BEPSwap Crypto Exchange Review: The First BSC DEX That Disappeared

Oct, 29 2025

Oct, 29 2025

DeFi DEX Safety Score Calculator

Assess Your DEX's Safety

Based on the lessons from BEPSwap's failure, determine if a DEX is secure and truly decentralized. Answer these critical questions:

BEPSwap was the first decentralized exchange to launch on Binance Smart Chain in July 2019. At the time, DeFi was still in its infancy, and Ethereum gas fees were skyrocketing. Traders looking for faster, cheaper swaps flocked to BEPSwap. It promised no platform fees-just the bare minimum blockchain gas costs. But by November 2021, it vanished without warning. No announcement. No migration notice. Just silence. Today, users who left funds in its liquidity pools have no way to recover them. This isn’t just a story about a broken website. It’s a case study in how early DeFi projects failed-not because of hacking or fraud, but because they ignored the most basic rule: decentralization.

What BEPSwap Actually Was

BEPSwap wasn’t a centralized exchange like Binance or Coinbase. You didn’t deposit your crypto and trust a company to hold it. Instead, you connected your wallet-like Ledger, Binance Chain Wallet, or a Keystore file-and swapped tokens directly on-chain. That’s what made it a true DEX. All trades happened through smart contracts on Binance Smart Chain, not through a central server. It only supported BEP2 and BEP20 tokens, which meant its selection was tiny compared to today’s DEXs. At its peak, it listed around 20 to 30 tokens, mostly those tied to Binance’s ecosystem. No Solana, no Polygon, no cross-chain bridges. You were locked into BSC. That wasn’t a flaw at first-it was a feature. BSC was faster and cheaper than Ethereum. Transactions settled in 3 to 5 seconds, and gas fees hovered between $0.10 and $0.50. For users tired of paying $50 in Ethereum fees just to swap ETH for USDT, BEPSwap was a breath of fresh air.Why It Failed

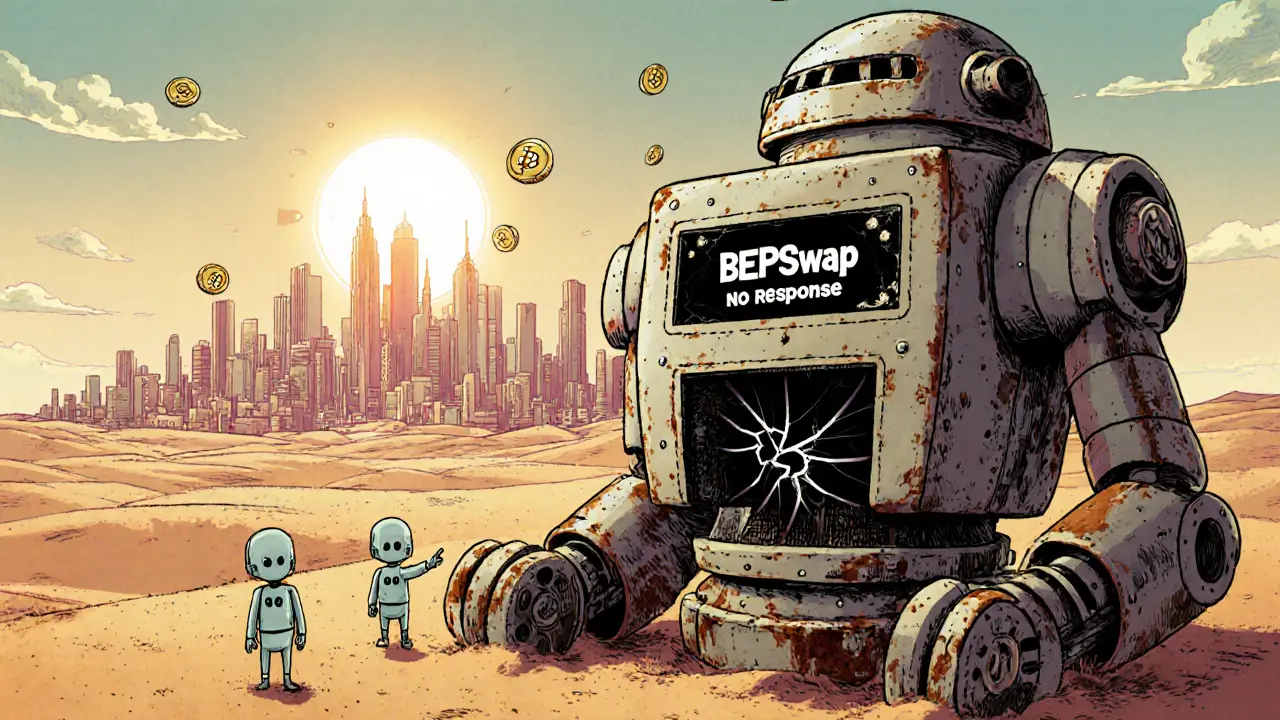

BEPSwap had one fatal flaw: it was controlled by BitMax.io and THORChain. No community governance. No token. No treasury. No way for users to vote on upgrades, fee changes, or recovery plans. When the team stopped responding, there was no backup. No emergency protocol. No fallback. Compare that to PancakeSwap, which launched a year later in September 2020. PancakeSwap had CAKE, a governance token. Holders could vote on proposals. There was a community treasury. Even if the core team disappeared, the protocol could keep running. BEPSwap had none of that. It was a centralized project dressed up as decentralized. Security was another issue. No public audit reports. No timelocks on contract changes. If the developers wanted to freeze funds or change how swaps worked, they could. And they never had to explain why. When users reported transaction failures during high traffic, the only response was silence. Telegram groups filled with panicked users asking for help. No replies.How It Compared to Other DEXs

| Feature | BEPSwap | PancakeSwap | Uniswap |

|---|---|---|---|

| Launch Date | July 2019 | September 2020 | May 2018 |

| Blockchain | Binance Smart Chain | Binance Smart Chain | Ethereum |

| Platform Fees | 0% | 0.25% (to liquidity providers) | 0.3% |

| Token Listings | 20-30 | 150+ | 1,000+ |

| TVL at Peak | $12.7M | $12B+ | $1.2B |

| Governance Token | None | CAKE | UNI |

| Still Operational? | No (since Nov 2021) | Yes | Yes |

BEPSwap was the first on BSC, but it didn’t build for the future. PancakeSwap didn’t just copy it-it improved everything. It added yield farming, lotteries, NFTs, and a token that gave users real power. BEPSwap didn’t innovate beyond basic swaps. It didn’t even have limit orders. You could only do market trades. If the price moved while your transaction was pending, you lost money. Slippage was common-sometimes over 4% during volatile markets.

User Experience: Clunky, Unreliable, Unsupported

Using BEPSwap wasn’t beginner-friendly. You had to manually add the BSC network to your wallet. Many users didn’t know how to set the RPC URL or chain ID. A 2020 survey found 68% of BEPSwap users struggled with setup. Once connected, the interface was basic. No mobile app. No tooltips. No video guides. The documentation was a single page of text. Transaction failures were frequent. If you set your gas price too low, your swap would get stuck for hours-or never confirm. There was no customer support. No email. No live chat. No Twitter replies after October 2021. Reddit threads from late 2021 are full of users asking, “Where did BEPSwap go?” One user, u/LostMyTokens, reported losing $3,200 in BEP20 tokens. No one responded.The Aftermath: What Happened to the Money?

When BEPSwap went offline, users didn’t just lose access to the website. They lost access to their funds locked in liquidity pools. Smart contracts still existed on-chain, but the backend services that made them usable were shut down. No one had the keys to unlock them. No one could call the functions to withdraw. This wasn’t a hack. It wasn’t a rug pull with a sudden withdrawal. It was neglect. The team simply stopped maintaining it. And because there was no governance structure, no one else could take over. The code was open, but without the supporting infrastructure, it was useless. Today, over 1,200 users are estimated to have funds trapped in BEPSwap’s pools. The total value is likely in the millions. But recovery is impossible. The project is officially dead. Cryptowisser, DeFi Safety, and other tracking platforms have all labeled it as such.

Why BEPSwap Still Matters

BEPSwap didn’t fail because it was bad tech. It failed because it was built like a startup, not a decentralized network. It proved BSC could support DeFi. It showed users that low fees and fast swaps were possible. But it also proved that without community ownership, even the first-mover advantage means nothing.Today, every major DEX has a governance token. Every protocol has a treasury. Every team knows that trust must be distributed, not concentrated. BEPSwap was a pioneer-but a cautionary one. It didn’t die because of competition. It died because it never gave its users a reason to stay.

What You Should Learn From BEPSwap

If you’re thinking about using a new DEX, ask yourself these questions:- Does it have a governance token? Can users vote on changes?

- Has it been audited by a reputable firm? Are the reports public?

- Is there a treasury? Who controls it?

- Is the team anonymous? Or are they accountable?

- Has the project been active for over a year? Or is it a flash-in-the-pan?

BEPSwap had none of these. And that’s why it’s gone. Don’t make the same mistake.

Is BEPSwap still operational?

No. BEPSwap became inaccessible on November 1, 2021, with no official announcement. It has not returned as of October 2025. All official channels, including its website and social media, are inactive.

Can I recover my funds from BEPSwap?

No. BEPSwap’s smart contracts still exist on the Binance Smart Chain, but the backend services needed to interact with them have been permanently shut down. There is no recovery mechanism, no team to contact, and no way to withdraw funds. Users who left assets in liquidity pools lost them permanently.

Was BEPSwap a scam?

It wasn’t a scam in the traditional sense-there was no evidence of intentional theft. But it was a poorly designed DeFi project. It lacked decentralization, governance, and long-term planning. Its collapse was predictable to anyone who understood DeFi fundamentals. It’s better described as a failed experiment.

How did BEPSwap compare to PancakeSwap?

BEPSwap was the first DEX on BSC, but PancakeSwap surpassed it quickly. PancakeSwap had a governance token (CAKE), yield farming, lotteries, and a strong community. BEPSwap had none of that. PancakeSwap’s TVL peaked at over $12 billion. BEPSwap’s peaked at $12.7 million. PancakeSwap is still running. BEPSwap is gone.

Did BEPSwap charge fees?

BEPSwap charged 0% platform fees. Users only paid the standard Binance Smart Chain gas fees, which were typically between $0.10 and $0.50 per transaction. This was one of its few advantages over Ethereum-based DEXs, which often had much higher fees.

Why did BEPSwap shut down?

BEPSwap shut down because it lacked decentralization. It was controlled by BitMax.io and THORChain with no community governance or token. When the team stopped maintaining it, no one else could take over. There was no treasury, no backup plan, and no way for users to vote on its future. It was a centralized project disguised as decentralized.

Was BEPSwap secure?

It followed basic DeFi security practices, relying on blockchain immutability and user-controlled keys. But it had no public audits, no timelocks on contract changes, and no emergency protocols. Security depended entirely on users managing their own wallets correctly. That made it risky for beginners.

What lessons does BEPSwap teach today’s crypto users?

Don’t trust projects that lack governance, transparency, or community ownership. A fast, cheap DEX means nothing if you can’t recover your funds when it disappears. Always check if a project has a token, a treasury, audited contracts, and an active, accountable team. First-mover advantage doesn’t guarantee survival-sustainability does.