DePIN Explained: Decentralized Physical Infrastructure Networks in Cryptocurrency

Jul, 20 2025

Jul, 20 2025

DePIN Earnings Calculator

This calculator estimates potential earnings based on typical DePIN network parameters. Actual earnings vary based on:

- Network demand and token price volatility

- Location-specific coverage requirements

- Hardware quality and uptime

- Token supply and distribution policies

Estimated Monthly Earnings

Based on: Typical DePIN network parameters (PRN: $45-$120/month per device, DRN: $200-$500/week per device)

Key Takeaways

- DePIN (Decentralized Physical Infrastructure Networks) lets anyone earn crypto by providing real‑world resources like wireless coverage or compute power.

- Two main flavors exist: Physical Resource Networks (PRNs) for location‑bound assets and Digital Resource Networks (DRNs) for location‑agnostic services.

- Helium (wireless hotspots) and Render Network (GPU rendering) are the flagship projects that showcase how token rewards replace traditional fees.

- Benefits include lower deployment costs, faster rollout in underserved areas, and new passive‑income streams.

- Challenges still loom-regulatory uncertainty, technical onboarding hurdles, and the need for critical mass to become profitable.

DePIN (Decentralized Physical Infrastructure Networks) is a blockchain‑based model that tokenizes the provision of tangible services. It bridges the gap between crypto’s digital world and the physical assets that power everyday life, letting participants earn cryptocurrency for things like running a Wi‑Fi hotspot, sharing spare GPU cycles, or hosting a solar micro‑grid.

What Exactly Is DePIN?

In a traditional setup, a single company builds a tower, a data center, or an energy substation, then charges users for access. DePIN flips that script: anyone with the right hardware can join a public ledger, prove they’re delivering a service, and automatically receive tokens via smart contracts.

The idea emerged around 2021‑2022 when developers realized that blockchain’s trust‑less settlement could be applied to real‑world resources. Early pilots like the Helium Network (launched in 2019) proved the concept, and by 2023 the sector’s market cap topped $3.2 billion.

Technical Architecture Behind DePIN

Three components work together:

- Off‑chain network: Users, hardware providers, and service consumers interact through a marketplace web app or mobile UI.

- Blockchain layer: A public ledger records every service proof, token transfer, and governance vote. Most projects run on high‑throughput chains like Solana, Ethereum, or Polygon.

- Protocol rules: Smart contracts enforce eligibility, calculate rewards, and trigger payments when predefined conditions (e.g., signal strength, compute output) are met.

These layers ensure transparency, immutability, and automated payouts without a central authority.

Network Types: Physical vs. Digital Resources

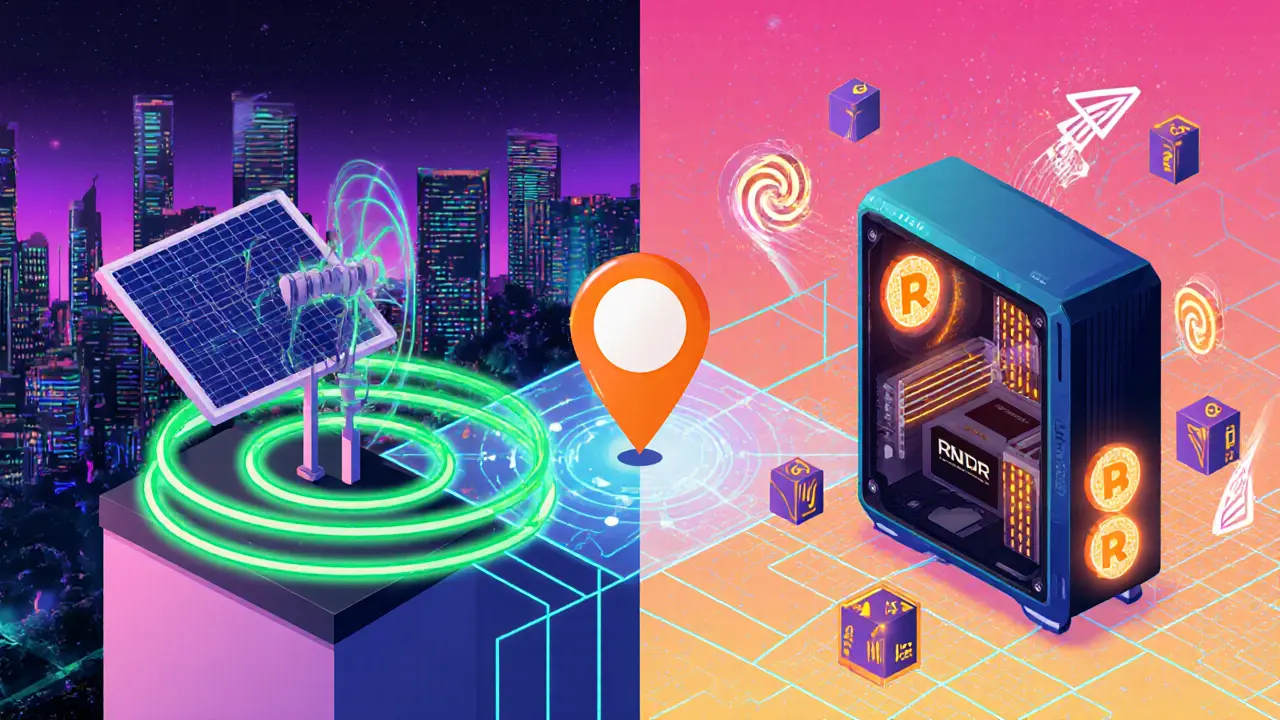

Physical Resource Networks (PRNs) are location‑bound. Think of a Helium hotspot that provides LoRaWAN coverage in a suburban backyard or a solar micro‑grid feeding a neighborhood. The service is tied to a geographic point, so the protocol often includes a proof‑of‑coverage mechanism.

Digital Resource Networks (DRNs) are location‑agnostic. Render Network, for example, lets owners of spare GPUs rent out rendering power to creators worldwide. Because the resource isn’t fixed to a place, the protocol focuses on proof‑of‑compute and secure data verification.

| Aspect | Physical Resource Networks (PRN) | Digital Resource Networks (DRN) |

|---|---|---|

| Typical Assets | Hotspots, solar panels, EV chargers | GPU rigs, storage nodes, bandwidth providers |

| Location Dependency | Yes - service tied to a fixed spot | No - resources are virtual |

| Key Protocol | Proof‑of‑Coverage / Proof‑of‑Location | Proof‑of‑Compute / Proof‑of‑Storage |

| Regulatory Touchpoints | Telecom, energy, local zoning | Data privacy, export controls |

| Typical Token Incentive | HNT, IOTX, ENERGY | RNDR, FILE, STOR |

Flagship Projects that Define the Space

Helium Network started as a decentralized wireless provider. Operators buy a LoRaWAN‑compatible hotspot for $300‑$500, set it up, and earn HNT tokens for proving they’ve covered a geographic area. As of Q3 2023, more than 950 k hotspots were live worldwide, delivering sub‑dollar connectivity in rural regions.

Render Network focuses on GPU rendering. Participants install an RTX 3080‑class card, run the Render client, and receive RNDR tokens when their hardware completes a rendering task. The network claims 40‑60 % lower pricing than major cloud providers while maintaining 99.9 % uptime.

Both projects migrated to high‑speed chains-Helium to Solana in 2023, boosting throughput from 5 TPS to over 65 000 TPS; Render stays on Ethereum but leverages layer‑2 rollups for scalability.

Economic Incentives: How Tokens Keep the Network Alive

Tokenomics differ per network, but the core idea is simple: reward providers proportionally to the value they add. In Helium, the reward formula weighs signal strength, coverage overlap, and data traffic. In Render, the reward is based on compute cycles and successful proof verification.

Participants typically see monthly earnings ranging from $45 - $120 for a single hotspot, while GPU providers can make $200 - $500 per week depending on demand. However, earnings are volatile-token prices can swing 30‑80 % in a quarter, which means participants must weigh hardware costs against market risk.

Benefits Over Traditional Infrastructure

- Cost reduction: Deploying a Helium hotspot costs under $500 versus $1‑2 million for a cellular tower.

- Speed to market: Communities can launch coverage within weeks instead of years.

- Resilience: Distributed nodes eliminate single points of failure, delivering up to 99.95 % uptime in mature networks.

- Passive income: Asset owners monetize otherwise idle hardware.

Kraken’s 2023 analysis showed a 35‑50 % cost drop and a 60‑75 % faster rollout for DePIN projects compared to centralized rivals.

Challenges and Risks

Despite the upside, the space faces headwinds:

- Regulatory gray zones: 78 % of jurisdictions lack clear rules for token‑rewarded infrastructure, creating compliance uncertainty.

- Technical onboarding: 65 % of potential participants find the setup “steep,” especially for DRNs that require smart‑contract interaction.

- Economic sustainability: Token rewards can dry up if token price collapses, as seen in the Puerto Rico solar DePIN failure where token value dropped 82 %.

- Network effect threshold: A PRN needs a critical mass of hotspots in a region before rewards become worthwhile.

Experts like Vitalik Buterin warn that coordination problems may demand new governance layers beyond simple token incentives.

Adoption Landscape in 2025

By late 2024, the sector’s total market cap crossed $12 billion, with more than 1.2 million active participants. Fortune 500 firms are piloting DePIN pilots-telecoms testing decentralized cell‑site sharing, utilities experimenting with micro‑grid token rewards.

Geographically, North America leads (42 % of participants), followed by Southeast Asia (29 %) and Europe (18 %). Singapore and Switzerland have introduced clear regulatory sandboxes, while the U.S. FCC remains in “observation” mode.

How to Get Started as a Participant

1. Choose a network type. If you have a spare rooftop, a PRN like Helium is easiest; if you own a workstation with a powerful GPU, consider a DRN like Render.

2. Buy compatible hardware. LoRaWAN hotspot devices range $300‑$500; GPU rigs start around $2,000 for a suitable card.

3. Set up the node. Follow the project’s official guide-Helium reports 2‑5 hours for basic hotspot configuration.

4. Create a wallet. Most networks accept MetaMask (Ethereum) or Phantom (Solana). Secure the seed phrase.

5. Stake or register your asset. The protocol may require a small token deposit to prove commitment.

6. Monitor performance. Use the project’s dashboard to track coverage, reward accrual, and hardware health.

7. Stay informed. Join Discord or Reddit communities-many troubleshooting guides exist for common hiccups like location‑verification failures.

Future Outlook: What’s Next for DePIN?

Roadmaps point to three big trends:

- Interoperability alliances: The DePIN Alliance, backed by Chainlink and Filecoin, is standardizing cross‑chain proof protocols, allowing a hotspot on Solana to earn rewards on an Ethereum‑based marketplace.

- New verticals: Decentralized EV‑charging stations, satellite‑backed internet, and community‑owned water treatment plants are slated for 2024‑2025 launches.

- Institutional scaling: As token economics mature, expect hybrid models where traditional firms issue security‑token‑backed infrastructure shares, blending DePIN’s openness with regulatory compliance.

Analysts at the World Economic Forum caution that mainstream adoption could be delayed 3‑5 years due to policy hurdles, but the Blockchain Research Institute projects $100 billion in annual value creation by 2030 through cost savings and new markets.

Frequently Asked Questions

What does DePIN stand for?

DePIN is short for Decentralized Physical Infrastructure Networks, a model that lets anyone earn crypto by providing real‑world services such as connectivity, compute power, or energy.

How is a DePIN different from a traditional network?

Traditional networks are owned and operated by a single entity that charges fees. DePIN distributes ownership to a community of hardware owners, records every service on a blockchain, and automatically pays rewards through smart contracts.

Do I need programming skills to join a DePIN?

For PRNs like Helium, basic hardware setup is enough-no coding required. For DRNs such as Render, understanding how to install a client and manage a wallet is helpful but not strictly programming.

What are the main risks?

Key risks include token price volatility, regulatory uncertainty, the need for a minimum number of participants to earn meaningful rewards, and potential hardware failure.

Can businesses use DePIN for their own infrastructure?

Yes. Many telecoms and utilities are running pilot DePIN projects to reduce CAPEX, improve coverage, and test token‑based incentive models before full rollout.