How Blockchain Cuts Out Middlemen: A Deep Dive into Disintermediation

Jan, 11 2025

Jan, 11 2025

Disintermediation Cost Calculator

Calculate Your Savings

Estimate cost savings when replacing traditional intermediaries with blockchain technology. Enter your transaction details and select your industry to see potential savings.

How This Works

Blockchain disintermediation reduces transaction costs by eliminating middlemen. Based on industry data from the article, we calculate potential savings when replacing traditional intermediaries with blockchain solutions.

Note: Savings percentages are based on the industry-specific data provided in the article.

When people talk about Blockchain is a distributed ledger technology that records transactions across a network of computers without a central authority, the idea of cutting out the middleman often comes up. blockchain disintermediation promises lower costs, faster settlement, and direct peer‑to‑peer interaction, but the reality varies by industry and implementation.

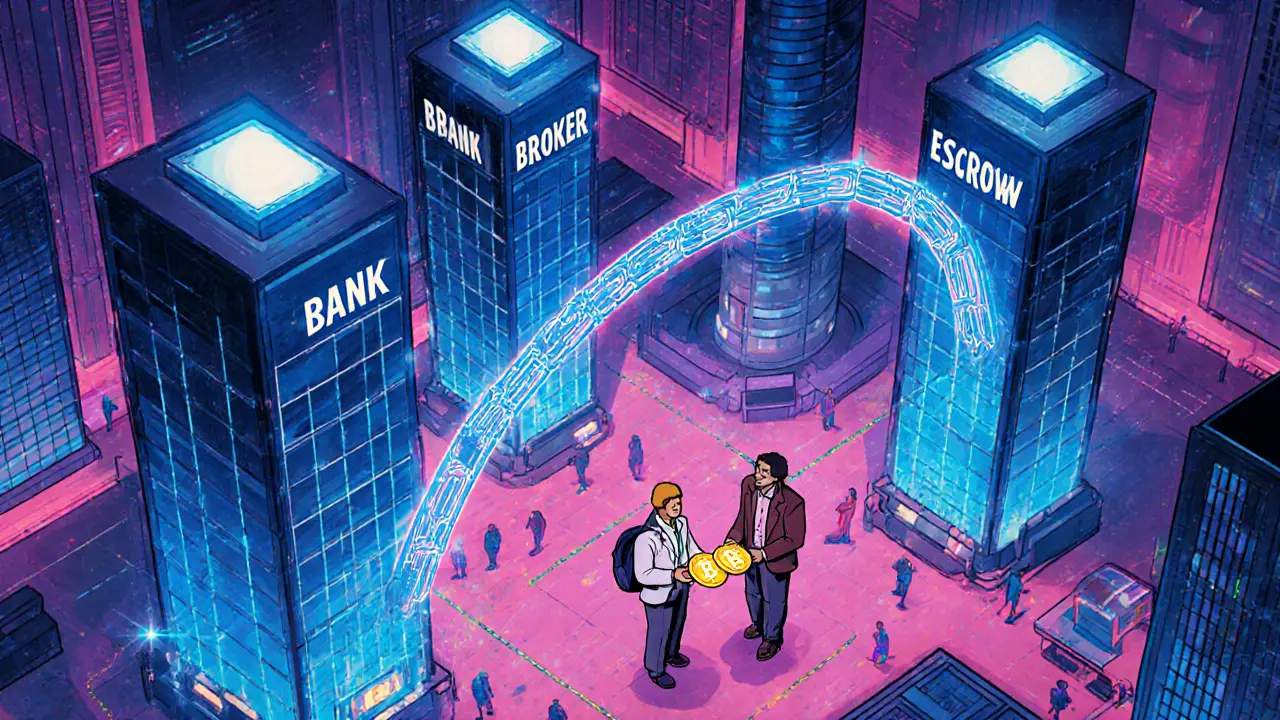

What does “disintermediation” really mean?

In traditional commerce, a trusted third party - a bank, broker, escrow service, or ad network - validates, records, or settles a transaction. Disintermediation removes that layer by letting the participants trust the code and the consensus protocol instead of a single institution.

Two technical pillars make this possible:

- Proof‑of‑Work is a consensus method where miners solve cryptographic puzzles to add blocks, as first used by Bitcoin.

- Proof‑of‑Stake lets validators lock up coins as collateral, a model adopted by Ethereum after the Merge.

Both mechanisms create an immutable ledger that anyone can read, eliminating the need for a central gatekeeper.

Smart contracts: code that replaces paperwork

Enter Smart contracts are self‑executing agreements where the terms are written in code and triggered automatically when predefined conditions are met. They run on virtual machines - the Ethereum Virtual Machine (EVM) - and can enforce escrow, royalty splits, or multi‑party approvals without a lawyer.

Because the contract lives on the blockchain, it inherits the same security and transparency as the underlying ledger. This is why sectors with high trust costs (finance, supply chain, media) see the biggest headline savings.

Industries where middlemen are vanishing

Below are four verticals that have already built functional, blockchain‑based alternatives.

- Cross‑border payments: Traditional wires travel through 3‑5 banks, costing 6‑7% of the amount and taking days. Platforms like Ripple and permissioned solutions such as Hedera Hashgraph settle in seconds with fees under 1%.

- Supply‑chain provenance: Companies replace paper bills of lading with immutable asset tokens, cutting documentation time by up to 50%.

- Digital advertising: Blockchain marketplaces let advertisers buy inventory directly from publishers, bypassing Google or Facebook’s 20‑35% take.

- Music royalties: Artists register tracks on a smart‑contract platform, receiving payouts within 24 hours instead of the 6‑18 month lag of legacy collection societies.

Benefits versus drawbacks

Every technology has trade‑offs. The table below summarizes the main pluses and minuses compared with the status‑quo.

| Sector | Typical Intermediaries | Cost Reduction | Speed Gain | Blockchain Alternative | Key Challenge |

|---|---|---|---|---|---|

| Payments | Correspondent banks, clearing houses | 15‑40% | Days → Minutes | Ripple, Hedera, Stellar | Regulatory clarity |

| Supply Chain | Logistics brokers, customs agents | 20‑35% | Weeks → Hours | IBM Food Trust, VeChain | On‑chain data quality |

| Advertising | Ad networks, DSPs | 30‑45% | Hours → Seconds | AdEx, Brave Ads | User adoption |

| Music royalties | Collecting societies, distributors | 50‑70% | Months → Days | Tune.fm, Audius | Legal jurisdiction |

How to start a disintermediation project

For businesses ready to experiment, follow this practical roadmap.

- Identify a high‑trust‑cost process. Look for steps that require three or more parties and charge >15% of the transaction value.

- Choose the right blockchain layer. Public networks (Bitcoin, Ethereum) offer maximal openness but limited throughput; permissioned ledgers (Hyperledger Fabric, Hedera) give you control and higher TPS.

- Design a smart contract prototype. Keep the logic simple - escrow, split‑payment, or conditional release. Test on a testnet before moving to mainnet.

- Integrate with existing systems via APIs. Services like Chainlink provide off‑chain data feeds (price, IoT sensor readings) needed for contract triggers.

- Plan for key management. Use hardware wallets or multi‑sig solutions; remember that 3.7 million ETH have been lost due to forgotten passwords.

- Run a pilot with a limited transaction volume. Measure cost, speed, and error rate, then iterate.

Typical learning curves are 80‑120 hours for non‑technical staff. Many firms partner with platforms like Kaleido to offload the heavy lifting.

Future outlook: From pure disintermediation to “re‑configured” intermediation

Analysts now agree that middlemen won’t disappear entirely. Instead, they will evolve into validators, data aggregators, or compliance‑as‑a‑service layers. By 2027, roughly 10% of global GDP is expected to be stored on blockchain, yet traditional firms will still handle customer support and regulatory reporting.

Key trends to watch:

- Layer‑2 scaling: Solutions like Polygon and Optimism aim to push Ethereum’s throughput beyond 7,000 TPS, making micro‑transactions viable.

- Standardisation: ISO/TC 307 standards are being adopted across finance and supply chain, easing cross‑network integration.

- Regulatory convergence: The EU’s MiCA framework provides a template that other regions are beginning to mirror, reducing legal uncertainty.

Businesses that treat blockchain as a complementary trust layer rather than a wholesale replacement will capture most of the projected $1.5 trillion savings by 2027.

Quick checklist for blockchain‑enabled disintermediation

- Clear use‑case with measurable trust cost.

- Appropriate blockchain type (public vs. permissioned).

- Simple, auditable smart contract code.

- Robust key‑management strategy.

- Compliance plan aligned with local regulations.

- Pilot metrics: cost, time, error rate, user satisfaction.

Frequently Asked Questions

Can blockchain completely eliminate banks?

No. Banks still provide deposit insurance, customer service, and regulatory compliance. Blockchain can replace the settlement layer, reducing fees and speed, but the full banking relationship usually remains.

What’s the biggest barrier to adoption?

Regulatory uncertainty and the need for new skills. Companies must train staff, manage cryptographic keys, and ensure they comply with evolving laws.

How secure are smart contracts?

They are as secure as the code written. Bugs can lead to hacks (e.g., the 2016 DAO attack). Audits, formal verification, and bug‑bounty programs are essential.

Do I need a cryptocurrency to use blockchain?

Not always. Permissioned ledgers can operate with internal tokens or even fiat‑backed stablecoins, eliminating the need for public crypto for many enterprise use cases.

What’s the environmental impact?

Proof‑of‑Work chains consume significant energy, but Proof‑of‑Stake and permissioned models reduce consumption by over 99% compared with Bitcoin’s 150 TWh/year.

Niki Burandt

October 24, 2025 AT 13:27Okay but like… have you seen how many ‘blockchain solutions’ are just a MySQL database with a fancy frontend? 😅 I’ve worked in fintech for 8 years and 90% of these ‘disintermediation’ projects are just rebranding legacy middleware. The tech is cool, but the hype? Pure vaporware. Still, I’m rooting for it-maybe one day we’ll get real change. 🤞

Chris Pratt

October 25, 2025 AT 11:20Love how you broke this down. As someone who’s lived in 5 countries, I’ve seen how messy cross-border payments are-especially in Southeast Asia. Seeing Ripple actually work in real pilot programs? Huge win. Not magic, but way better than SWIFT. 👏

Karen Donahue

October 25, 2025 AT 19:22Let’s be real-this whole ‘blockchain eliminates middlemen’ narrative is a scam pushed by crypto bros who want to avoid taxes and regulation. Who’s gonna help grandma understand how to recover her private key when she forgets it? Who’s gonna mediate when a smart contract fails because the weather API was down? The middleman isn’t the problem-the lack of human accountability is. And now we’re trusting code written by 19-year-old devs who think ‘solidity’ is a type of cheese. 😒

Bert Martin

October 25, 2025 AT 23:50Great overview. For anyone thinking of diving in-start small. I helped a local coffee shop use a simple escrow smart contract for pre-orders. No crypto needed, just a stablecoin wallet. They cut their processing fees by 70% and customers loved the transparency. It’s not revolutionary… but it’s real. Keep it simple.

Ray Dalton

October 26, 2025 AT 08:11One thing people overlook: blockchain doesn’t eliminate trust-it redistributes it. Instead of trusting a bank, you’re trusting the protocol, the code, the miners/validators, the developers, and the community. That’s not less trust-it’s just different. And honestly? Sometimes it’s worse. But when it works? It’s beautiful. Also, check out Hyperledger Fabric if you’re in enterprise. Way more practical than Ethereum for supply chains.

Trent Mercer

October 27, 2025 AT 08:07Oh wow, you actually think ‘Tune.fm’ is replacing ASCAP? Cute. The music industry runs on contracts written in legalese, not Solidity. Artists don’t care about ‘24-hour payouts’-they care about being paid at all. And guess what? Most still get ripped off by labels even on-chain. This isn’t liberation-it’s rebranding exploitation with a blockchain sticker. 🤡

Kyle Waitkunas

October 27, 2025 AT 14:48THIS IS A GOVERNMENT AND BANKS PLOT TO CONTROL YOU!!! 🚨 They LET you think blockchain is ‘decentralized’-but all the major ‘solutions’ like Ripple and Hedera? CENTRALIZED! They’re owned by VENTURE CAPITALISTS who work with the FED! The ‘Ethereum Merge’? A LIE! Proof-of-Stake is just a new way to lock you in! They want you to think you’re free… while they monitor every transaction through the blockchain ledger! I’ve seen the documents! The Illuminati own the miners! 🕵️♂️💣

vonley smith

October 28, 2025 AT 12:28Biggest mistake people make? Thinking blockchain = crypto. Nah. It’s just a fancy way to log stuff without a middleman. I built a little tool for my cousin’s carpentry shop to track wood shipments. No crypto. Just a private chain. Saved them 3 days on paperwork. Simple. Doesn’t need to be sexy. Just works.

Melodye Drake

October 29, 2025 AT 05:42It’s so refreshing to see someone actually understand the difference between public and permissioned ledgers. Most of these ‘blockchain experts’ on Twitter think Bitcoin is the only option. But let’s be honest-any enterprise that doesn’t use Hyperledger or Corda is just doing it for the buzz. And the environmental argument? Poof. PoS killed that. Still, I’m skeptical about user adoption. People don’t want to manage keys. They want Apple Pay.

paul boland

October 29, 2025 AT 10:31Y’all Americans think you invented this tech. Ireland’s been doing secure, distributed ledgers since the 1800s-land deeds, church records, everything. Blockchain? Just the latest fad. And you’re still stuck on ‘disintermediation’? We’ve had smart contracts in our legal system for centuries-called ‘deeds.’ You’re not innovating. You’re just repackaging history with crypto jargon. 🇮🇪

harrison houghton

October 29, 2025 AT 19:36What is a middleman? A human being who, through the burden of responsibility, mediates between two parties who cannot trust each other. Blockchain does not eliminate this burden-it transfers it to the algorithm. And algorithms cannot bear moral responsibility. Therefore, blockchain does not disintermediate-it re-externalizes the human cost. We are not replacing the intermediary. We are replacing the soul with a machine. And machines… do not feel guilt.

Niki Burandt

October 30, 2025 AT 16:07Wait, so you’re telling me the guy who runs the coffee shop’s blockchain system is the same guy who used to do the payroll? 😂 I’ve seen this. Someone gets excited, sets up a wallet, loses the seed phrase, and now the whole team is waiting for ‘the blockchain to fix it.’ We’re not replacing middlemen-we’re replacing them with confused interns. 🤦♀️