Staking vs Mining: Which Decentralized Validation Method Wins?

Oct, 29 2024

Oct, 29 2024

Staking vs Mining Calculator

Calculate Your Best Option

Compare potential returns, costs, and environmental impact of staking versus mining based on your inputs.

Staking Inputs

Mining Inputs

Comparison Results

Staking

Annual Return:

Payback Period:

Energy Usage:

Risk Level:

Mining

Annual Return:

Payback Period:

Energy Usage:

Risk Level:

Key Takeaways

Staking vs Mining Comparison

| Aspect | Staking | Mining |

|---|---|---|

| Energy Use | ||

| Hardware Needed | ||

| Initial Capital | ||

| Reward Predictability | ||

| Accessibility |

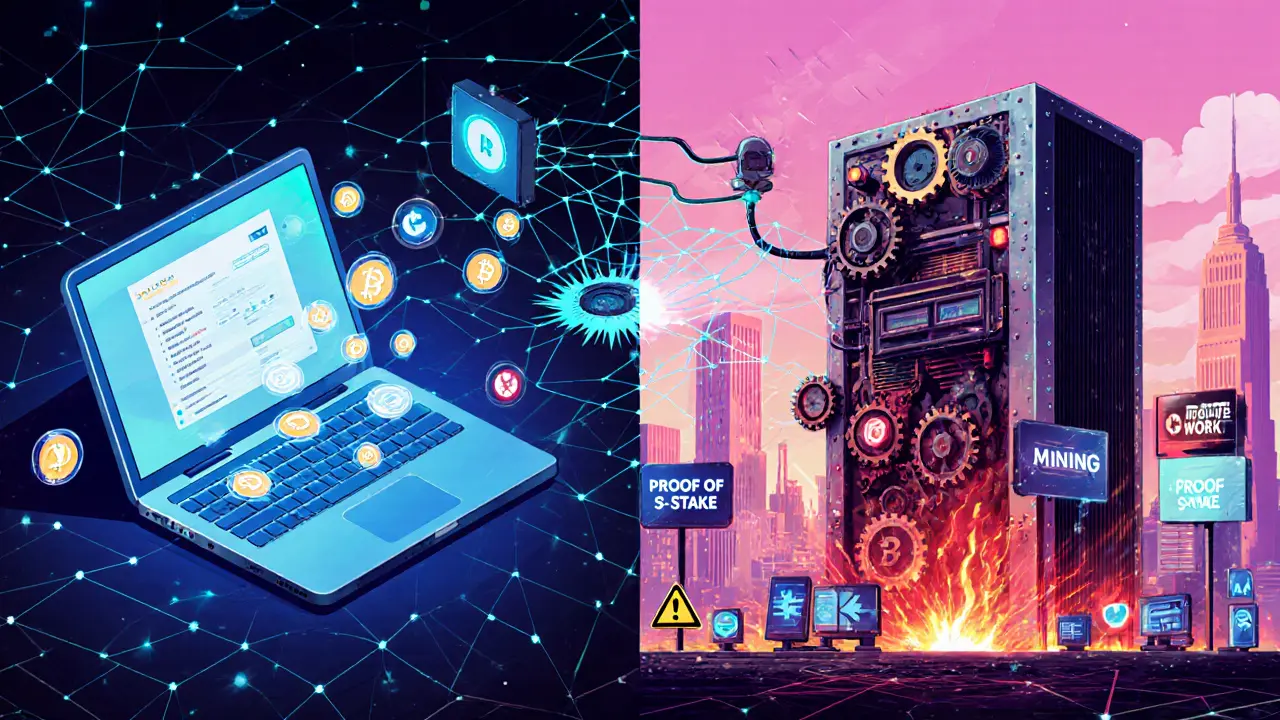

When you hear "decentralization" most people picture a network of computers working together, but the real battle is how those computers agree on what’s true. Two heavyweights dominate the scene: Staking is a Proof‑of‑Stake (PoS) process where token holders lock up assets to become validators and Mining is a Proof‑of‑Work (PoW) activity that uses computational power to solve cryptographic puzzles and add blocks. Both aim to keep the blockchain secure, yet they differ in energy use, hardware needs, rewards, and risk. If you’re weighing whether to become a validator or a miner, this deep‑dive gives you the numbers, the pitfalls, and the future outlook - no fluff, just the facts you need to decide.

How Staking Works

In a PoS system, validators stake a certain amount of the native cryptocurrency as collateral. Ethereum, the biggest PoS chain, requires 32 Ether to run a solo node, though most users join staking pools that accept much smaller deposits. Once the stake is locked, a selection algorithm picks validators to propose and attest to new blocks. The selection is weighted by the amount staked and, in many designs, by the validator’s past performance. Successful validation earns a reward paid in the same token, while misbehaviour can trigger slashing - a penalty that destroys a portion of the staked funds.

The technical load is light: a regular laptop or a low‑cost VPS with a stable internet connection can run a validator. Because the work is mostly bookkeeping, the electricity draw is comparable to a household appliance, not a data‑center.

How Mining Works

PoW mining flips the script. Miners compete to solve a hash puzzle that meets the network’s difficulty target. The first to find a valid solution adds the next block and receives a block reward plus transaction fees. The puzzle is deliberately hard, so miners invest in specialized equipment. For Bitcoin, the industry standard is ASIC (Application‑Specific Integrated Circuit) miners that can crunch billions of hashes per second. Some older chains still rely on graphics cards (GPU rigs), but the profitability gap has widened dramatically.

Mining’s biggest cost is energy. In 2023 Bitcoin’s global consumption topped 120 TWh - enough to power a mid‑size country. The hardware itself costs several thousand dollars, and it degrades quickly as difficulty climbs. Miners must constantly upgrade or risk becoming unprofitable.

Energy Consumption and Environmental Impact

Energy use is the clearest divider. When Ethereum shifted from PoW to PoS in 2022, its estimated consumption plummeted by more than 99 %. Bitcoin’s PoW model still accounts for roughly 0.6 % of global electricity demand, a figure that fuels regulatory scrutiny. Staking’s modest power draw makes it attractive to environmentally conscious investors and jurisdictions that penalize high‑energy operations.

Hardware and Setup Costs

Setting up a miner is a capital‑intensive venture. A modern ASIC miner can cost $2,000-$12,000, plus cooling, rack space, and a reliable power contract. Ongoing electricity bills can eclipse the hardware cost in high‑price regions. By contrast, staking can start with the price of the minimum stake. On Ethereum, 32 ETH is roughly $55,000 (as of Oct 2025), but fractional staking services let you begin with $50‑$100. The only hardware you need is a modest computer or even a cloud instance, which usually runs under $20 per month.

Reward Structures and Financial Risks

Mining rewards fluctuate with block subsidies and transaction fees. Bitcoin’s block reward halves roughly every four years, meaning miners increasingly rely on fees. The reward’s volatility ties directly to hash‑rate and electricity costs, so profitability can swing wildly.

Staking rewards are more predictable, expressed as an annual percentage yield (APY). Ethereum’s APY hovers around 4‑5 % for solo validators, while pooled services can push net returns to 6‑7 % after fees. However, staking locks up capital. If the token price drops sharply, you can’t sell the locked amount until the unbonding period ends (often 7‑21 days). Slashing adds another risk layer: a faulty validator can lose up to 5 % of its stake.

Accessibility and Participation Barriers

Anyone with a crypto wallet can stake a few dollars on platforms like Coinbase, Kraken, or Binance. The process is a few clicks, making staking the most democratized way to earn on a blockchain.

Mining demands technical know‑how, location with cheap electricity, and upfront capital. Many newcomers are deterred by the steep learning curve - from selecting the right hashboard to configuring cooling systems. Consequently, mining remains dominated by dedicated hobbyists and large‑scale farms.

Security Guarantees: Computational Power vs Economic Stake

PoW security grows with hash‑rate; an attacker would need > 51 % of the network’s computational power - a massive, costly undertaking. PoS security hinges on economic stake; an attacker must acquire > 51 % of the token supply, which would be prohibitively expensive for established assets like Bitcoin or Ether.

Critics argue PoS could lead to wealth‑centralization, as large holders can command validator power. Yet many PoS designs incorporate randomization and penalize inactive nodes, mitigating pure stake‑based dominance.

Future Outlook: Where Are Staking and Mining Heading?

Regulators worldwide are tightening around energy‑hungry mining operations. Some countries already limit mining permits unless renewable sources are used. The industry reacts by building solar‑powered farms in places like Texas and Kazakhstan.

Staking is on the rise. New chains launch directly with PoS, and legacy PoW projects are contemplating hybrid or full PoS transitions to stay competitive. Liquid‑staking solutions (e.g., Lido, Rocket Pool) are solving the liquidity lockup problem, letting users earn yields while still accessing a derivative token.

Both ecosystems will coexist: Bitcoin’s PoW remains the anchor for digital scarcity, while PoS powers the majority of DeFi, NFTs, and layer‑2 scaling solutions. Understanding each model’s trade‑offs helps you pick the right side of the decentralization debate.

Quick Takeaways

- Staking needs minimal hardware, uses far less energy, and is more beginner‑friendly.

- Mining offers higher potential upside but comes with big upfront costs, high electricity bills, and technical complexity.

- Both secure their networks differently - PoW with raw computational work, PoS with locked economic value.

- Environmental concerns and regulatory pressure favor staking, while mining adapts with renewable‑energy‑focused farms.

- Future growth leans toward PoS, yet PoW will persist for flagship assets like Bitcoin.

Staking vs Mining - Side‑by‑Side Comparison

| Aspect | Staking (PoS) | Mining (PoW) |

|---|---|---|

| Energy Use | Low - comparable to a home appliance | High - 120 TWh / yr for Bitcoin |

| Hardware Needed | Standard PC or VPS | ASICs / GPUs, cooling infrastructure |

| Initial Capital | Stake amount (e.g., 32 ETH ≈ $55k) or fractional pool | $2k‑$12k+ for ASIC + setup |

| Reward Predictability | APY 4‑7 % (depends on chain) | Variable - depends on block reward + fees |

| Risk Factors | Slashing, lock‑up period, token price exposure | Hardware failure, electricity cost spikes, 51 % attack risk |

| Accessibility | Anyone can stake via exchanges or pools | Requires technical skill and cheap power |

| Security Model | Economic stake deters attacks | Computational difficulty deters attacks |

Frequently Asked Questions

Can I stake without owning the full validator amount?

Yes. Most PoS chains support delegation or pool staking. You can lock as little as $10 on major exchanges and earn a share of the validator’s rewards.

Is mining still profitable in 2025?

Profitability depends on electricity price, hardware efficiency, and the coin’s market price. In regions with sub‑$0.05/kWh electricity, ASIC mining of Bitcoin can still break even, but margins are thin.

What is slashing and how often does it happen?

Slashing is a penalty that destroys part of a validator’s stake for misbehaving (e.g., double‑signing or prolonged downtime). It occurs rarely-usually under 1 % of validators per epoch on well‑maintained networks.

Do staking rewards count as taxable income?

In most jurisdictions, staking rewards are treated as ordinary income at the time you receive them, and capital gains apply when you later sell the tokens.

How does a 51 % attack differ between PoW and PoS?

In PoW, an attacker needs > 51 % of the network’s hash‑rate, requiring massive hardware and electricity. In PoS, the attacker must acquire > 51 % of the token supply, which is financially prohibitive for large, liquid assets.

Jason Roland

October 24, 2025 AT 00:36Staking is the future, no debate. I started with $50 on Coinbase and now I’m earning passive income while scrolling TikTok. Mining? Nah. I don’t want to hear my rig sound like a jet engine in my apartment. Plus, my electricity bill already hates me enough as it is.

Niki Burandt

October 24, 2025 AT 14:25Ugh, staking is just centralized control with fancy words. 😒 You think you're 'validating' but you're just trusting some exchange to do it for you. Meanwhile, miners are actually doing the work. PoW is the only real decentralization. Also, Bitcoin isn't going anywhere. 🤡

Chris Pratt

October 24, 2025 AT 16:03As someone who grew up in a country where electricity costs more than beer, I get why staking wins. In my home country, even a $20 VPS is a luxury. But I respect miners - they’re the OGs. PoW is like blacksmithing in the digital age. Both have their place. 🙏

Karen Donahue

October 25, 2025 AT 09:47Let’s be real - staking is a scam designed to make rich people richer. You need $55k just to be a solo validator? That’s not decentralization, that’s a gated club. And don’t even get me started on slashing - it’s just a fancy way for the protocol to steal your money if you blink wrong. Meanwhile, miners at least put real money into hardware and electricity - they’re building something tangible. This whole PoS thing feels like Wall Street repackaging debt as ‘yield’. 🤮

Bert Martin

October 25, 2025 AT 19:58Good breakdown. If you’re new, start with staking. No question. But if you’ve got the tech skills and cheap power, mining can still be a legit side hustle. Just don’t go all-in unless you’ve run the numbers for at least 18 months. And remember - hardware dies, but your ETH balance doesn’t. 🛠️💡

Ray Dalton

October 26, 2025 AT 02:00People forget that PoW isn’t just about energy - it’s about verifiable scarcity. Bitcoin’s security isn’t just economic, it’s physical. You can’t fake a hash. PoS is elegant, sure, but it’s all math and trust. I’m not saying mining’s perfect - I’ve got a rig that cost me $8k and now it’s a paperweight. But the fact that someone can mine in a basement in Paraguay and still contribute? That’s magic. PoS is the future. But PoW? It’s the foundation. 🤝

Peter Brask

October 26, 2025 AT 02:28STAKING IS A CENTRAL BANKING SCHEME DISGUISED AS DECENTRALIZATION. 😈 They want you to trust exchanges. They want you to lock your coins. They want to control who gets rewarded. Meanwhile, miners are the only ones actually holding the chain together with sweat and silicon. And don’t tell me about ‘slashing’ - that’s just a backdoor for the elite to punish small validators. Bitcoin is the only true blockchain. Everything else is a Ponzi with a whitepaper. 🚨