Trustless Bridge: Moving Assets Across Blockchains Without Custody

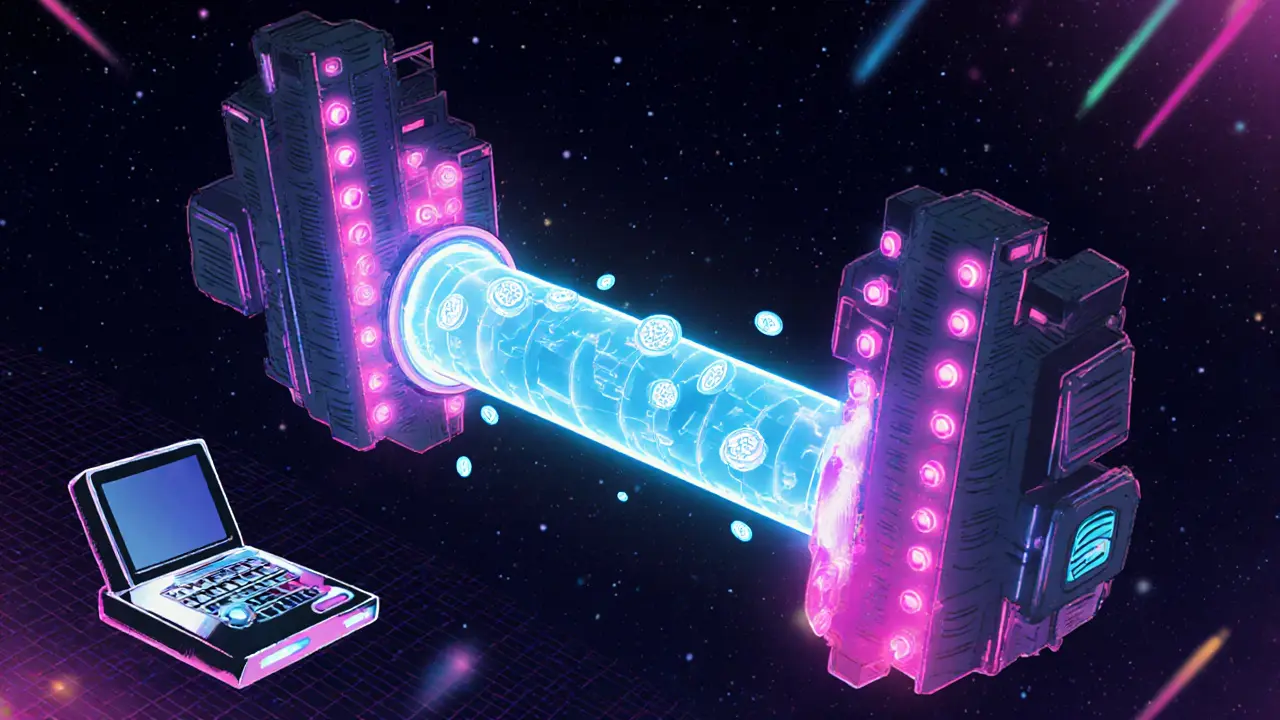

When working with Trustless Bridge, a system that moves assets between blockchains without custodial control. Also known as trustless cross‑chain bridge, it lets users send tokens from one chain to another while keeping private keys in their own wallets. Cross‑chain Interoperability, the ability of different blockchain networks to communicate and exchange value is the broader goal that trustless bridges serve. In simple terms, a trustless bridge acts like a tunnel: you lock assets on the source chain, a set of smart contracts mint or release equivalent tokens on the destination chain, and the original assets stay safely locked until you decide to move them back. This design removes the need for a third‑party custodian, which reduces counter‑party risk and aligns with the core decentralization ethos of crypto.

Behind the tunnel, Smart Contracts, self‑executing code that runs on the blockchain are the engine that enforces the lock‑mint‑burn cycle. They verify that the amount you lock matches the amount minted on the other side, and they trigger the reverse process when you initiate a return transfer. To keep the tunnel fluid, Liquidity Providers, users or protocols that supply the assets needed for fast swaps across chains stake capital into bridge pools. Their stakes earn fees, encouraging them to maintain healthy liquidity, which in turn lowers slippage for people moving value. Decentralized exchanges (DEXs) often integrate with bridges, allowing you to swap a bridged token for another asset without leaving the DEX interface. This synergy creates a seamless experience: you lock ETH on Ethereum, receive wrapped ETH (WETH) on Polygon, and instantly trade it on a Polygon‑based DEX, all while your private keys stay in your non‑custodial wallet.

Why Trustless Bridges Matter Today

With the rise of multi‑chain DeFi strategies, users are no longer satisfied with staying on a single network. Trustless bridges unlock the ability to chase the best yields, lowest fees, or newest features across ecosystems without handing over control of their assets. They also play a key role in airdrop distribution, where projects reward users who have moved assets between chains, and in blockchain forensics, where investigators trace cross‑chain flows to detect illicit activity. Non‑custodial wallet users especially appreciate bridges because they can stay compliant with regional regulations while still accessing global liquidity. As bridge technology matures, we see more robust fraud‑resistance mechanisms, automated verification of contract upgrades, and incentive models that align the interests of liquidity providers, developers, and end‑users. Below, you’ll find a curated list of articles that dive deeper into specific bridges, security best practices, on‑chain data mining techniques, and real‑world case studies that illustrate how trustless bridges are reshaping the crypto landscape.

Explore the key differences between trusted and trustless blockchain bridges, their security, speed, fees, and when each design is the right choice.

More