CELT Airdrop Details: What Really Happened with Celestial Token Distribution

Jan, 2 2026

Jan, 2 2026

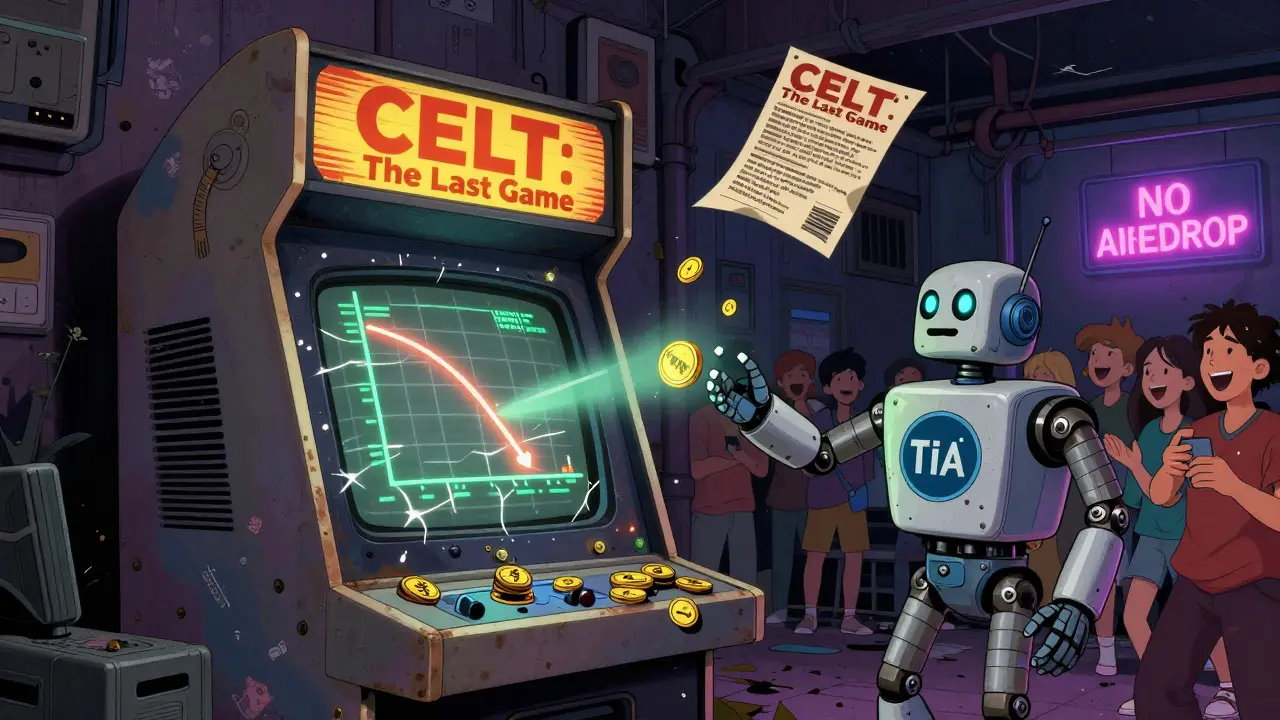

There’s no such thing as a CELT airdrop - at least not in the way most people expect. If you’re searching for free CELT tokens handed out to community members, you’re looking in the wrong place. Celestial (CELT) didn’t run a public airdrop. It didn’t reward early followers, social media participants, or Discord members. Instead, it did something far more common in the crypto world: it gave away nearly all its tokens to private investors before anyone else even knew the project existed.

Back in September 2021, Celestial completed its Token Generation Event. That’s crypto-speak for "we sold most of our tokens before the public even had a chance to buy." The total supply? 4.92 billion CELT tokens. The amount raised? $1.49 million across private sales, ICO, and IDO rounds. The pre-sale alone brought in $1.4 million - all at $0.002 per token. That might sound cheap now, but back then, it was enough to attract institutional backing from ZBS Capital, a venture firm with a history of investing in early-stage blockchain projects.

Here’s where things get messy. Of those 4.92 billion tokens, 700 million - or 14.21% - went directly to private and pre-sale investors. No lockup. No waiting. Just immediate access. The rest? Distributed in monthly chunks after launch. The first 20% of the remaining tokens was released right away. Then, every month for the next nine months, another 10% came out. That’s a slow drip, not a flood. And by the time all that was done, the public had almost no shot at getting CELT at anything close to its original price.

Fast forward to today - January 2026 - and CELT trades at $0.00003674. That’s a 98% drop from the $0.002 pre-sale price. Early investors who bought in at $0.002 saw a 7,111% return when the token briefly peaked. But those who bought later? They’re stuck watching the value evaporate. The market cap? Around $109,290. For a project with nearly 5 billion tokens, that’s a ghost town. Some block explorers even show 0 CELT in circulation, which doesn’t make sense unless the data is wrong or the token is locked up indefinitely.

Don’t confuse Celestial (CELT) with Celestia (TIA). They’re not the same project. Celestia is a modular blockchain that raised serious attention, did a real airdrop of 60 million TIA tokens, and now trades near $17. Projects building on Celestia - like AltLayer and Dymension - have since rewarded TIA stakers with their own airdrops. But Celestial? No such luck. There’s no active development team, no major partnerships, no roadmap updates. The website is quiet. The Twitter account hasn’t posted in months. The community is gone.

If you’re hoping to get CELT tokens now, your only real option is buying them on Bitget. You can trade them spot, use their swap tool, or even try futures contracts. But here’s the catch: there’s almost no liquidity. The order books are thin. You might pay a 10% premium just to get in, or you might not be able to sell when you want to. There’s no earn program, no staking rewards, no yield. It’s just a token sitting on an exchange, slowly fading from memory.

Why did this happen? Three reasons. First, the tokenomics were flawed. Four billion-plus tokens with a tiny market cap means each token is worth almost nothing. Second, the distribution was unfair. Private investors got 14% upfront with no restrictions. The public got scraps. Third, there was no real product. No utility. No clear use case beyond speculation. When the hype died, so did the price.

Some people still hold CELT, hoping for a miracle. Maybe a new team will take over. Maybe someone will revive the project. But that’s not how crypto works. Projects that vanish from public view rarely come back. And when they do, they usually rebrand - and the old token becomes worthless.

If you’re looking for airdrops, skip CELT. Look at projects with active communities, real tech, and public token distributions. Celestia’s ecosystem is still handing out rewards. New Layer 2s are launching with airdrops for early users. But Celestial? It’s a cautionary tale. Not a chance.

How CELT Tokens Were Actually Distributed

The distribution wasn’t random. It was planned - and heavily tilted toward insiders.

- 700 million CELT (14.21%) - Private and pre-sale investors (no lockup)

- 20% of remaining supply - Released immediately after launch

- 10% monthly for 9 months - Linear release of the rest

- Maximum supply cap - 5 billion CELT (4.92 billion already issued)

- Circulating supply - Reported as 0 by some trackers, suggesting delays or technical issues

This structure meant early buyers got 90% of the tokens within the first year. The public got almost nothing. No public sale. No community rewards. No incentives to build. Just a slow, controlled release that benefited a small group.

Why No One Talks About CELT Anymore

There are no updates. No blog posts. No GitHub commits. No team announcements. The project’s website is a static page with outdated links. The last tweet from their official account was in 2023. No one is building on it. No one is using it. No wallets are actively holding it.

Compare that to projects like Celestia or Arbitrum - they post weekly updates, host community calls, and reward users for participation. Celestial did none of that. It raised money, released tokens, and vanished.

Even the exchanges that listed CELT - like Bitget - don’t promote it. It’s buried under hundreds of other tokens. You won’t find it in their trending section. No trading competitions. No liquidity mining. It’s dead weight on the platform.

CELT vs. Celestia: Don’t Mix Them Up

People keep confusing Celestial (CELT) with Celestia (TIA). They’re not related. Celestia is a real, active blockchain focused on data availability. It launched in 2023. It did a massive airdrop. It’s used by projects like Manta Network and AltLayer. TIA trades at $17. Its ecosystem is growing.

Celestial (CELT)? It’s a forgotten token with no utility, no team, and no future. The names are similar. The logos look alike. But that’s where the similarity ends.

If you’re chasing airdrops, focus on Celestia stakers. They’ve already received rewards from AltLayer and Dymension. Manta Network is rumored to be next. But none of that touches CELT. Not even close.

Can You Still Buy CELT? Should You?

You can buy CELT on Bitget. That’s it. No other major exchange lists it. You can trade it spot, use margin, or even try futures. But here’s what you’re really buying:

- A token with 98% less value than its original price

- A project with no active development

- No staking, no yield, no utility

- Potential illiquidity - you might not be able to sell when you want

There’s no upside left. The token’s peak was years ago. The market has moved on. Buying CELT now isn’t an investment - it’s speculation on a dead project. And in crypto, speculation on dead projects rarely ends well.

What You Should Do Instead

If you want real airdrops, stop chasing CELT. Look at active ecosystems:

- Stake TIA on Celestia to qualify for future airdrops from projects like AltLayer or Manta Network

- Use Layer 2s like Arbitrum or zkSync and complete simple tasks - many have ongoing airdrops

- Try new DeFi protocols that reward early users with token distributions

- Follow projects with active GitHub repos, weekly updates, and community calls

Real airdrops come from real projects. Not from tokens that vanished into the void.