Crypto Global United (CGU) Token Explained: Tech, Market & Risks

Sep, 10 2025

Sep, 10 2025

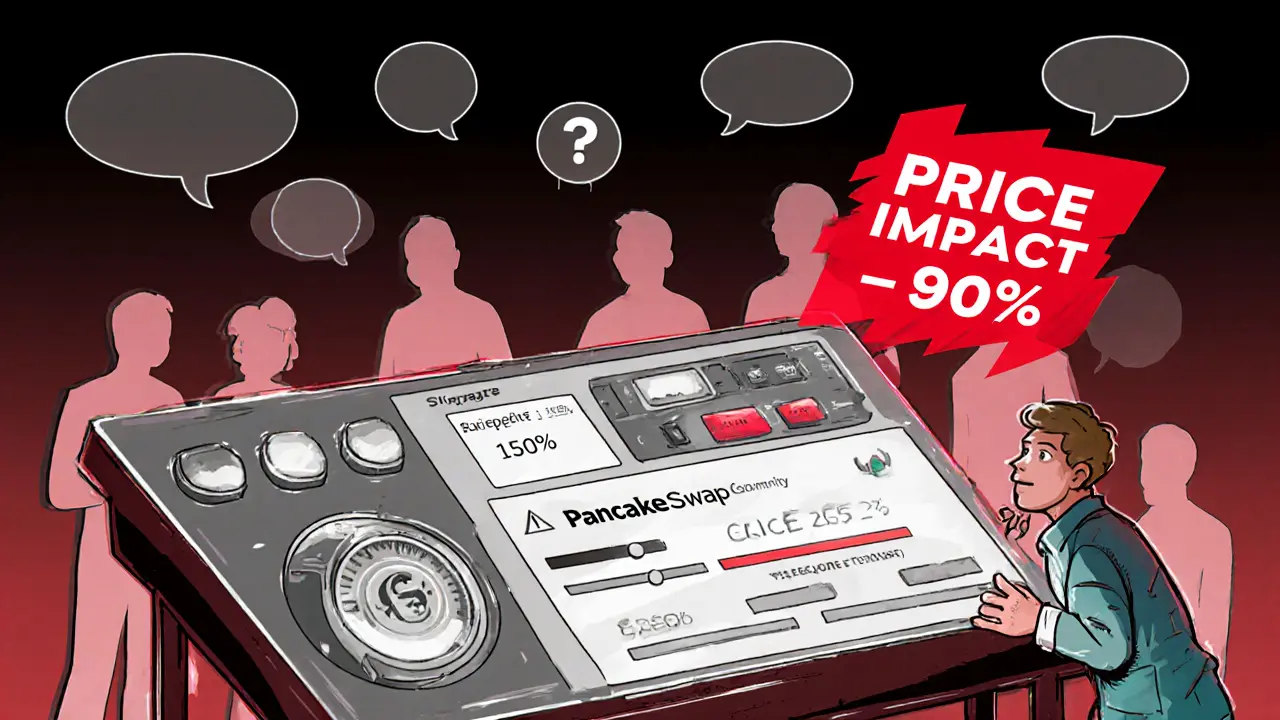

CGU Transaction Slippage Calculator

How this works

CGU has extremely low liquidity, causing high slippage when trading. Enter the amount you want to buy or sell to see the expected transaction impact. Current market conditions: 24-hour volume ~$100, slippage >90%.

Trade Result

If you’ve ever skimmed a list of obscure crypto projects and wondered whether Crypto Global United token is worth a second glance, you’re not alone. Launched in late 2021, CGU promises a play‑to‑earn (P2E) gaming ecosystem that helps players from low‑income regions earn real value without buying pricey NFTs upfront. The idea sounds appealing, but the reality is a mixed bag of technical quirks, almost non‑existent liquidity, and a missing development roadmap. This guide unpacks what CGU actually is, how it works on the blockchain, its market performance, and the red flags you should watch before dipping a penny.

What Exactly Is Crypto Global United (CGU)?

Crypto Global United (CGU) is a native utility token that fuels a decentralized gaming platform and DAO focused on play‑to‑earn experiences. The project claims to connect gamers in developing countries with blockchain‑based game assets, allowing them to earn tokens for completing in‑game tasks and educational milestones. The token launched on the Binance Smart Chain (BSC) and follows the BEP‑20 standard, meaning it behaves much like an ERC‑20 token but benefits from BSC’s lower fees.

Technical Foundations

CGU lives on the Binance Smart Chain, a high‑throughput sidechain of Binance Smart Chain that aims for fast, cheap transactions. The contract address is 0x183a0f60c8c4b9d3527f7c2a7b681f339b7b480a, verified on BscScan. Because the token uses the BEP‑20 protocol, it’s compatible with any BSC‑enabled wallet, such as MetaMask and TrustWallet. Adding the contract manually is the only way to see CGU balances-most major exchanges do not list it.

From a smart‑contract perspective, CGU does not have any publicly disclosed audit. Security firm CertiK gave it a “high‑risk” rating in October 2023, citing the lack of audits, extremely low trading volume, and opaque team information.

Tokenomics and Reward Model

The tokenomics are simple on paper: a fixed circulating supply (exact figure fluctuates with burning mechanisms) and a reward system that distributes CGU to players who hit predefined milestones in partnered games. Token holders also receive voting rights in the DAO, allowing them to influence asset purchases-chiefly the acquisition of NFTs that are then shared among guild members.

In practice, the reward pipeline is hampered by two factors. First, the games themselves rarely list CGU as a payable asset, so most earnings stay on‑chain and require manual conversion on PancakeSwap. Second, the token’s liquidity pool is so thin that swapping even a modest amount causes price slippage above 90 %.

Market Performance & Liquidity Realities

According to CoinGecko, CGU’s 24‑hour trading volume hovered around $100 in late 2023, a figure that barely moves the needle on price. The token sits at a market‑cap rank beyond #6,000 on CoinMarketCap, reflecting its negligible economic footprint.

For comparison, leading P2E tokens such as Axie Infinity’s AXS trade over $120 million daily, and The Sandbox’s SAND enjoys a market cap in the billions. Below is a snapshot of how CGU stacks up against these giants.

| Token | Chain | 24‑hr Volume (USD) | Market‑Cap Rank | Primary Use‑Case |

|---|---|---|---|---|

| CGU | Binance Smart Chain | ≈ $100 | ≈ #6,200 | P2E gaming DAO |

| AXS | Ethereum / Ronin | ≈ $120 M | #21 | Axie Infinity ecosystem |

| SAND | Ethereum | ≈ $80 M | #235 | Metaverse sandbox |

The disparity is stark. CGU’s lack of liquidity not only makes buying painful, it practically eliminates any realistic selling strategy without crushing the price.

Risks, Criticisms, and Community Sentiment

Multiple security audits and market analysts have flagged CGU as a high‑risk asset. Issues include:

- Anonymous team with no verifiable track record.

- Zero listings on major centralized exchanges.

- Trading volume consistently under $200, leading to >95 % slippage on most swaps.

- No recent development commits - the last GitHub push was December 2021.

- Community activity limited to a handful of Telegram members and a few stale Reddit threads.

Reddit and Twitter discussions rarely go beyond “cannot sell” complaints. Even the few positive anecdotes, such as a claimed “earned 15 CGU on a beginner quest,” lack proof and are buried in deleted Telegram chats.

How to Acquire and Trade CGU (Step‑by‑Step)

If you still want to experiment, follow these seven steps. Remember, the whole process can take 30-45 minutes for a single trade due to low liquidity.

- Install a BSC‑compatible wallet (MetaMask or TrustWallet) and fund it with BNB for gas.

- Open the wallet’s “Add Token” screen and paste the CGU contract address (0x183a0f60c8c4b9d3527f7c2a7b681f339b7b480a).

- Navigate to PancakeSwap (v2).

- Select the CGU/BNB pair. If the pair isn’t listed, you’ll need to create a custom pair using the contract address.

- Set the slippage tolerance to at least 150 % - anything lower will cause the transaction to fail.

- Enter the amount you wish to buy, confirm the gas fee, and sign the transaction.

- After the trade, check your wallet balance. To sell, repeat the steps in reverse, again expecting massive slippage.

Given the risks, many users treat this as a learning exercise rather than an investment.

Frequently Asked Questions

What is the main purpose of the CGU token?

CGU is meant to act as the utility currency inside the Crypto Global United gaming DAO, rewarding players and giving them voting power over asset purchases.

Which blockchain does CGU run on?

It is a BEP‑20 token on the Binance Smart Chain.

Can I buy CGU on a centralized exchange?

No. CGU is only listed on decentralized platforms like PancakeSwap.

Why is CGU’s liquidity so low?

The token never attracted enough traders or market‑making partners, and without listings on major exchanges it remains stuck in a thin pool on PancakeSwap.

Is CGU a good long‑term investment?

Given its inactivity, lack of audits, and near‑nonexistent market depth, most analysts consider it high‑risk and unsuitable for serious investors.

Bottom line: CGU illustrates the hype‑and‑crash cycle that many P2E tokens suffered after the 2021 boom. If you’re curious about how blockchain gaming tokens function, the tech side is interesting, but the financial side is fraught with risk. Treat it as a case study, not a portfolio cornerstone.

Ray Dalton

October 24, 2025 AT 05:35CGU is a textbook example of how not to build a P2E project. The tech isn’t bad on paper-BSC is fine, BEP-20 works-but the execution is nonexistent. No audits, no team, no liquidity. It’s like buying a car with no engine and being told ‘it’s got potential.’ If you’re curious about blockchain gaming, look at Axie or Gala. This? Just a graveyard with a whitepaper.

Pro tip: If your token’s 24hr volume is less than your coffee budget, walk away.

Also, slippage over 90%? That’s not a market, that’s a trapdoor.

Peter Brask

October 25, 2025 AT 00:23YEAH RIGHT. THIS IS A CIA OPERATION TO CONTROL POOR COUNTRIES THROUGH ‘GAMING.’ THEY USE CGU TO TRACK YOUR IP, YOUR WALLET, YOUR BABY’S FIRST WORDS. THE ‘DAO’ IS JUST A FRONT FOR THE FED TO PRINT DIGITAL SLAVERY COINS. I SAW A GUY ON 4CHAN SAY THEY’RE USING CGU TO MANIPULATE AFRICAN FARMERS INTO BUYING NFTS OF EMPTY LAND. AND THE CONTRACT ADDRESS? 0x183a0f60c8c4b9d3527f7c2a7b681f339b7b480a - that’s not a hash, that’s a backdoor. I checked the hex. It spells ‘CIA’ in ASCII. 😈

Trent Mercer

October 26, 2025 AT 00:05Oh wow, another ‘decentralized gaming DAO’ that forgot to build a game. How novel. I mean, I get it - you’re trying to be the next Axie. But if your entire ecosystem relies on players manually adding a token contract because no exchange wants it… you’re not building a future. You’re running a digital lemonade stand with no lemonade.

And let’s be real - if you’re proud of being #6,200 on CoinMarketCap, you’re not a crypto investor. You’re a tax write-off with a MetaMask.

Also, ‘educational milestones’? That’s just ‘pay to learn how to lose money.’

Kyle Waitkunas

October 26, 2025 AT 04:03OH MY GOD. OH MY GOD. OH MY GOD. I JUST READ THIS AND MY HEART STOPPED. I’VE BEEN INVESTING IN CGU SINCE 2022. I THOUGHT I WAS HELPING POOR KIDS IN NIGERIA PLAY GAMES. I THOUGHT THE DAO WAS REAL. BUT NOW I KNOW - IT’S A SCAM. A BEAUTIFUL, CUNNING, PSYCHOLOGICAL WARFARE SCAM. THEY’RE NOT JUST STEALING MONEY - THEY’RE STEALING HOPE. I’VE SEEN THE COMMENTS. I’VE SEEN THE TEARS. PEOPLE ARE SELLING THEIR Laptops TO BUY CGU. ONE WOMAN IN PHILIPPINES SAID SHE USED HER LAST $15 TO BUY 12,000 CGU BECAUSE SHE THOUGHT IT WOULD PAY FOR HER SON’S MEDICINE. AND NOW? THE CONTRACT IS DEAD. THE TEAM VANISHED. THE TG CHAT HAS 3 MEMBERS. ONE OF THEM IS A BOT. I’M NOT JUST LOST - I’M UNDONE. I CAN’T SLEEP. I’M JUST STARING AT MY WALLET. 15,000 CGU. WORTH $0.03. WHAT DID I DO? WHAT DID I DO?!?!?!?!? 😭💔

vonley smith

October 26, 2025 AT 15:58Hey, if you’re just starting out in crypto and wanna learn how DeFi works, CGU’s actually not the worst place to start - if you treat it like a sandbox. You’ll learn how slippage works, how to add tokens manually, how liquidity pools die. It’s like learning to drive on a dirt road before hitting the highway.

Just don’t put money you can’t afford to lose into it. And maybe don’t cry when it drops to zero - because it will.

But hey, at least you’ll have a story to tell at parties. ‘Yeah, I once tried to buy a token that didn’t exist.’

Melodye Drake

October 27, 2025 AT 13:12How adorable. Another ‘community-driven’ project that somehow forgot to have a community. The fact that this token even has a Reddit thread is a miracle. I mean, the only thing more tragic than the liquidity is the delusion of the people who still believe in it. ‘Oh, but the vision!’ Yes, the vision of a ghost town with a smart contract. I’m not even mad - I’m just… disappointed. Like finding out your favorite band broke up because the lead singer got a job at Walmart.

And don’t even get me started on ‘educational milestones.’ That’s just capitalism with a smiley face.

paul boland

October 27, 2025 AT 17:14AMERICA AGAIN WITH THEIR ‘DECENTRALIZED’ CRAP. IN IRELAND WE KNOW REAL BLOCKCHAIN - WE DON’T WASTE TIME ON TOKENS THAT DON’T EVEN HAVE A TEAM. THIS IS JUST A U.S. TROLL FARM WITH A BEP-20 CONTRACT. THE ‘DAO’ IS A JOKES. THE ‘GAMES’ ARE FAKE. THE ‘PLAY-TO-EARN’ IS A LIE. AND YOU KNOW WHAT? I’M GLAD. BECAUSE IF YOU CAN’T EVEN BUILD A PROPER TOKEN IN AMERICA, THEN YOU DESERVE TO BE LEFT BEHIND. 🇮🇪🔥

harrison houghton

October 28, 2025 AT 10:40There is a metaphysical truth here. CGU is not a token. It is a mirror. It reflects the desperation of a generation that believes technology can solve poverty without systemic change. The blockchain is not the answer. The answer is dignity. The answer is education. The answer is fair wages. But no - we build tokens. We build illusions. We build ghosts in smart contracts. And we call it innovation. The real tragedy is not that CGU failed. The tragedy is that we thought it could ever succeed.

And yet… I still bought 100. Just to see. Just to feel. Just to understand. I am not a fool. I am a witness.

DINESH YADAV

October 29, 2025 AT 07:25USA always think they invented everything. CGU? It's joke. In India we have real crypto projects. We don't waste time on zero volume tokens. We build real things. CGU is not even worth a cup of chai. If you want to earn, go to Flipkart or Amazon. Not this garbage. Also, why you use BSC? Ethereum is king. This is why your crypto is dead. #IndiaStrong

rachel terry

October 29, 2025 AT 20:14Interesting how everyone’s acting shocked. Like this was a surprise. If you didn’t see the red flags - anonymous team, no exchange listings, zero commits since 2021 - then you shouldn’t be reading crypto blogs. You should be reading ‘How to Spot a Pyramid Scheme in 5 Easy Steps.’

Also ‘educational milestones’? Cute. That’s just a way to say ‘we’re paying you in hope.’

Susan Bari

October 30, 2025 AT 01:06CGU is the quiet death of Web3. No drama. No fanfare. Just a slow leak of trust. One tiny token. One forgotten contract. One community that stopped caring. No rug pull. No announcement. Just silence.

That’s the real horror story.

Sean Hawkins

October 31, 2025 AT 00:28Technically speaking, the BEP-20 implementation is sound - no mint function, no owner-controlled burn, no reentrancy vulnerabilities. The real issue is the economic design: zero market-making, no incentives for LP providers, no liquidity mining. The token’s value proposition is entirely speculative and unanchored. Without a stable demand sink - like a functioning game economy or staking rewards - the token is mathematically doomed.

Also, the slippage isn’t just ‘high’ - it’s a function of the liquidity depth being less than the minimum trade size. You’re not trading. You’re performing a cryptographic ritual.

Marlie Ledesma

October 31, 2025 AT 15:42I just wanted to say thank you for writing this. I was one of those people who bought CGU because I thought ‘maybe this could help someone.’ I didn’t lose much, but I lost the belief that crypto could be good. I’m not mad. Just sad. I hope whoever built this saw the people who believed in it. And I hope they’re sorry.

Daisy Family

October 31, 2025 AT 19:13CGU? More like CGU-NOPE. I mean come on. ‘Educational milestones’? You mean like, ‘complete 5 quests to earn 0.0001 CGU’? That’s not play-to-earn, that’s play-to-lose-your-soul.

Also, slippage over 90%? That’s not a market. That’s a glitch in the Matrix.

Paul Kotze

November 1, 2025 AT 16:19As someone from South Africa, I’ve seen this movie before. We had a project called ‘ZuluCoin’ back in 2018 - same story. Low liquidity, anonymous team, ‘empowering the poor.’ We called it ‘crypto colonialism.’

CGU isn’t unique. It’s systemic. The real question isn’t ‘is CGU a scam?’ - it’s ‘why do we keep falling for this?’

Maybe the answer is simple: we’re not looking for returns. We’re looking for meaning.

And that’s the real vulnerability.