Digitra.com Crypto Exchange Review: Zero Fees, Trade-to-Earn, and the DGTA Token Reality

Feb, 1 2026

Feb, 1 2026

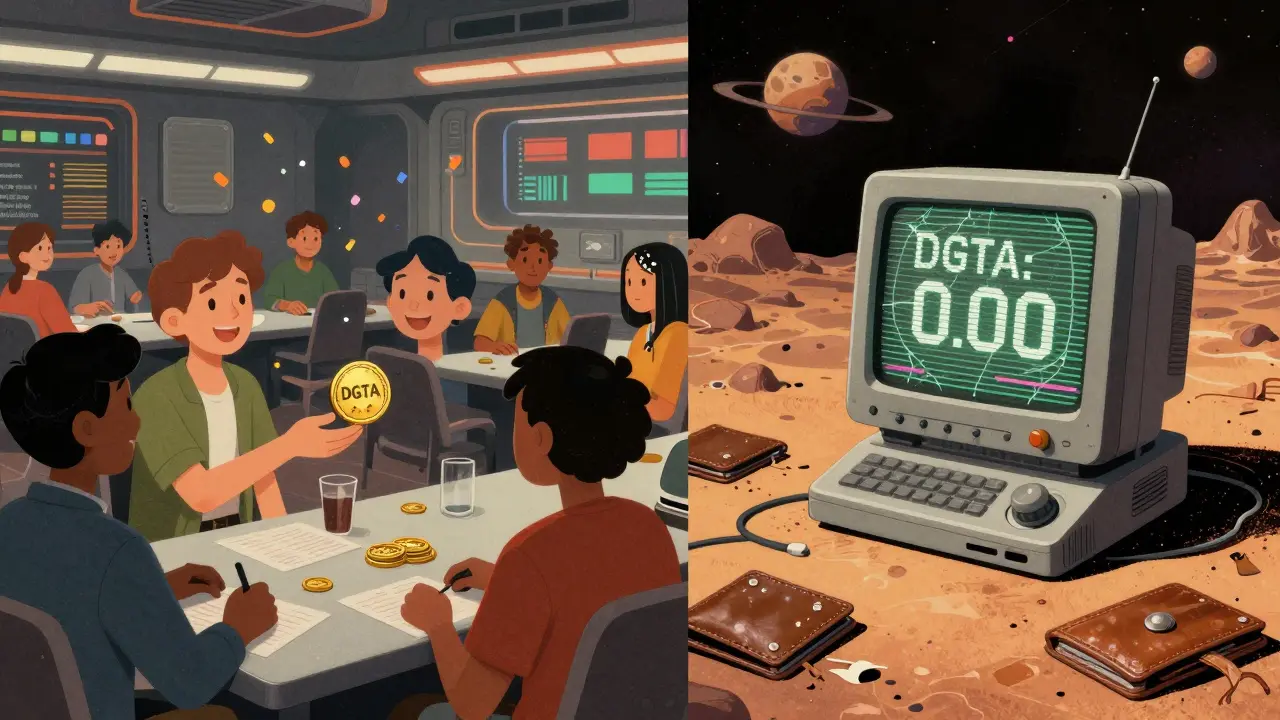

Most crypto exchanges charge you just to trade. Digitra.com says it doesn’t. Instead, it pays you - in its own token, DGTA. Sounds too good to be true? Let’s cut through the marketing and see what’s really going on with this platform that claims to use Nasdaq’s trading engine and reward you for doing what you’d do anyway.

How Digitra.com Works (And Why It’s Different)

Digitra.com didn’t start as a flashy app for beginners. It began in 2021 as an OTC desk for big players, built by Rodrigo Batista - the same guy who grew Mercado Bitcoin into South America’s biggest crypto exchange. That’s not a small detail. He’s seen how crypto exchanges succeed and fail. When Digitra launched its retail platform in 2022, it made one radical choice: eliminate trading fees entirely. Instead of charging 0.1% like Binance or 0.6% like Coinbase, Digitra gives you back value. Every time you trade, you earn DGTA tokens. That’s the core of their ‘Trade-to-Earn’ model. They don’t make money off your trades. They make money off the token itself - and they need you to trade more to make the token valuable. The platform runs on Nasdaq’s Universal Matching Service. That’s not marketing fluff. Nasdaq’s system powers major stock exchanges. It’s fast, secure, and built for high-volume trading. Most crypto exchanges use custom or cheaper tech. Digitra is one of the first to bring institutional-grade matching to retail traders. That matters if you’re placing orders quickly or trading large amounts.The DGTA Token: Rewards, Risks, and the Big Question

The DGTA token is the engine of Digitra’s entire system. Total supply: 300 million. Here’s how it’s distributed:- 11% for new user bonuses

- 10% for daily Trade-to-Earn airdrops

- 20% for marketing and liquidity

- 20% for the team

- 10% for ecosystem growth

- 30% held in long-term reserve

Security and Compliance: What’s Behind the Scenes

Digitra uses Fireblocks for asset custody. That’s a solid choice. Fireblocks is trusted by institutions like JPMorgan and Coinbase. It’s not just cold storage - it’s multi-party computation (MPC) security with insurance coverage. If something goes wrong, your assets are covered. They also use Veriff for identity checks. That’s standard KYC. You’ll need your ID, a selfie, and proof of address. No surprises there. The app is on Google Play and has over 100,000 downloads. The rating is 4.3 stars - decent, but not outstanding. The reviews are split: some love the simplicity and rewards. Others are deeply suspicious. The company is based in Brazil and backed by 4Equity Fund, which invested $1 million specifically to promote DGTA. Ricardo Villela, a major shareholder in Itaú Bank (Brazil’s largest private bank), is also involved. That adds credibility - but doesn’t guarantee safety. Plenty of well-backed projects have failed.

What You Can Actually Do on Digitra.com

The platform supports both crypto and fiat deposits. You can wire transfer money from your bank, which is the cheapest way to fund your account. They offer over 100 altcoins, including popular ones like Ethereum, Solana, Polkadot, and Cardano. The interface is clean, mobile-friendly, and designed for quick trades. You can also join the referral program. Invite someone, and both of you get DGTA tokens. Or become a Liquidity Provider. If you place limit orders that add to the market (instead of taking liquidity), you earn extra rewards. That’s smart - it helps the market stay healthy. The mobile app works smoothly. No major crashes reported. The onboarding process takes less than 15 minutes if your documents are clear. If you’re in Brazil or Latin America, the experience is even smoother - local payment methods, Portuguese support, and faster withdrawals.Who Is This For? And Who Should Stay Away?

If you’re a trader who wants to minimize costs and you’re okay with holding a token that only exists on one platform, Digitra could be worth a small stake. The daily DGTA rewards add up. If you trade $500 a week, you could earn $10-$20 worth of DGTA per week. That’s not life-changing, but it’s extra income with no extra effort. But if you’re looking for a safe place to store your crypto, or if you want to buy a token you can easily sell later - avoid DGTA. Don’t invest in it expecting price growth. It’s not a crypto asset. It’s a loyalty program in token form. Think of it like airline miles. You earn them by flying. But you can’t cash them out for real money. You can only use them on the airline’s website. Digitra’s DGTA is the same. It’s not an investment. It’s a perk.

The Bottom Line: A Clever Model With a Dangerous Flaw

Digitra.com isn’t a scam. It’s built by someone who knows what he’s doing. The tech stack is top-tier. The security is strong. The rewards are real. But the entire model depends on one thing: you believing that DGTA has long-term value - even though you can’t trade it anywhere else. If Digitra gets listed on Binance or Kraken next year? Everything changes. The token could surge. The platform could explode. But if they never list it elsewhere? DGTA could slowly lose value as users realize they’re stuck with it. For now, treat Digitra like a high-yield savings account for traders. Use it to trade, earn rewards, and keep your main crypto elsewhere. Don’t put your life savings into DGTA. Don’t even put 10% of it there. But if you’re already trading and want to earn something back? It’s one of the few exchanges that actually gives you something for it.Frequently Asked Questions

Is Digitra.com safe to use?

Digitra.com uses Fireblocks for custody and Nasdaq’s matching engine, both industry-standard systems. Their security infrastructure is stronger than most retail exchanges. However, safety also depends on your own actions. Always enable 2FA, never share your keys, and keep your main holdings off the platform. The biggest risk isn’t hacking - it’s the DGTA token’s lack of liquidity.

Can I withdraw DGTA tokens to another wallet?

Yes, you can withdraw DGTA to any wallet that supports the token’s blockchain (likely BSC or ERC-20). But once it’s outside Digitra, you won’t be able to sell it anywhere else. No major exchange lists DGTA. You’re stuck holding it unless Digitra lists it on another platform.

How do I earn DGTA tokens?

You earn DGTA through three main ways: 1) Trading - every trade earns you a share of the daily 15,000 DGTA airdrop. 2) Referrals - invite friends and get tokens for both you and them. 3) Liquidity provision - placing limit orders adds to market depth and earns bonus rewards. No deposits or staking required.

Is the Trade-to-Earn program sustainable?

It’s sustainable only if the DGTA token’s value holds up. Digitra needs users to keep trading to generate revenue from other sources (like fiat deposits, staking, or future services) to fund the rewards. If trading volume drops, they’ll have to cut rewards. If DGTA crashes, users will leave. It’s a loop - and the whole thing depends on belief.

Should I use Digitra.com instead of Binance or Coinbase?

Use Digitra if you want to earn rewards while trading and don’t mind holding DGTA. But don’t use it as your main exchange. Keep your Bitcoin, Ethereum, and other major assets on Binance, Coinbase, or a hardware wallet. Digitra is a side tool - not a replacement. It’s great for small trades and earning extra tokens, but not for storing or trading large amounts.