Governance Attacks and Token Voting Vulnerabilities in DeFi Protocols

Jan, 23 2026

Jan, 23 2026

When you think of blockchain security, you probably imagine hackers breaking into wallets or stealing private keys. But the real danger in DeFi isn’t always about stealing money-it’s about governing it. In 2022, a hacker used a $1 billion flash loan to buy enough BEAN tokens to vote themselves $77 million out of Beanstalk’s liquidity pool. No password cracked. No smart contract exploited. Just a vote that changed everything.

How a Single Vote Can Steal Millions

Token-based governance sounds fair: the more tokens you hold, the more say you have. But in practice, it turns voting into an auction. If you can borrow a billion dollars for a few seconds-using a flash loan-you can buy enough governance tokens to control a DAO’s decisions. And once you’ve voted, you repay the loan and walk away with the profits. It’s legal. It’s in the code. And it’s happened more than once.The Beanstalk attack wasn’t a fluke. In July 2023, a group called the Golden Boys pushed through Compound Proposal 289, redirecting $24 million from Compound’s treasury to their own protocol. This wasn’t their first try. Two earlier attempts failed. But they kept coming back. Why? Because the system let them. There was no delay between voting and execution. No minimum quorum. No oversight. Just a simple yes-or-no vote, open to anyone with enough tokens.

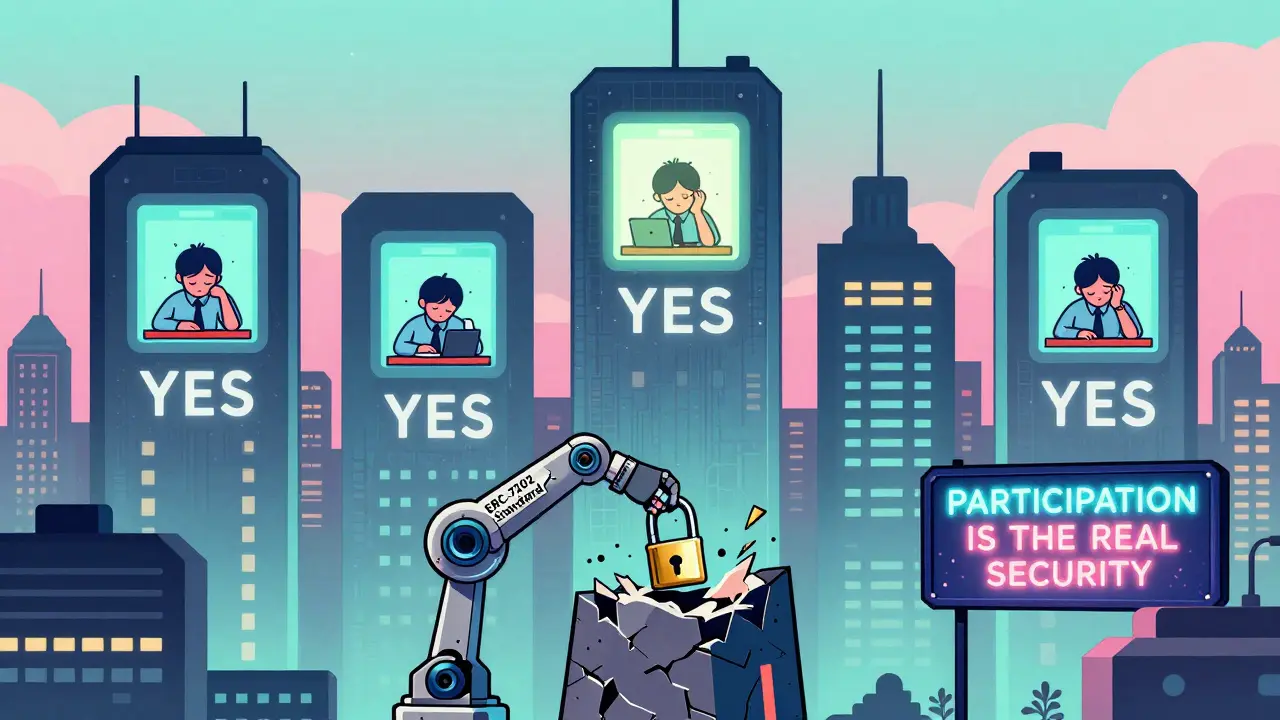

The Real Problem: Low Participation, High Concentration

Here’s the kicker: most people don’t vote. A study from the University Complutense of Madrid found that half of all DAOs have fewer than ten active voters. Even in larger DAOs with thousands of members, fewer than 30% of proposals get any real participation. Meanwhile, less than 1% of token holders control over half the voting power.This isn’t a bug-it’s a feature of how token distribution works. Early investors, venture funds, and whales hold the majority. Regular users? They’re left out. And when participation is this low, it doesn’t take much to swing a vote. In some cases, buying just $50,000 worth of tokens was enough to control a proposal. That’s cheaper than a used car.

Common Attack Vectors You Can’t Ignore

There are several ways attackers exploit this system:- Voting manipulation: Buy or borrow tokens to control votes. Used in Beanstalk and Swerve.

- Proposal hijacking: Submit a proposal that looks normal but secretly gives the attacker control. Tornado Cash was hit this way-attackers replaced the original contract with one that locked up $1 million in TORN tokens.

- Sybil attacks: Create hundreds of fake accounts to inflate voting power. Works best when turnout is low.

- Multi-chain exploits: In January 2026, Cream Finance was attacked because voting rules differed between Ethereum and BNB Chain. The attacker exploited the gap to pass a malicious proposal.

These aren’t theoretical. They’re real, repeated, and getting smarter. Even protocols with strong reputations-like Compound and Aave-are vulnerable. And the bigger the TVL (total value locked), the bigger the reward for attackers.

What’s Being Done to Fix It

The industry isn’t sitting still. Since 2022, 68% of the top 50 DeFi protocols have added time locks-meaning votes can’t execute immediately. Some require a 48-hour delay between voting and execution. Others use off-chain voting tools like Snapshot to prevent last-minute token buys from affecting results.Compound responded to the Golden Boys attack by threatening to use its centralized multisig to remove voting power from the attacker’s wallet-or even fork the protocol and issue a new token that excluded bad actors. It worked. The proposal was reversed. But it also showed the truth: even the most "decentralized" systems still need a backdoor.

MakerDAO uses delegated voting. Users can assign their vote to someone they trust. It increases participation, but now you’re trusting someone else. That’s not decentralization-it’s delegation.

And then there’s the Ethereum Foundation’s ERC-7202 standard, finalized in November 2025. It’s the first official attempt to codify safe governance. It requires:

- Minimum 48-hour voting periods

- Execution delays after voting

- Prohibitions on voting with newly acquired tokens

But adoption is slow. Smaller protocols don’t have the resources to implement these changes. And even if they do, attackers adapt. The system is always one step behind.

The Trade-Off: Security vs. Decentralization

Every fix introduces a cost. Time locks slow down decisions. Multi-sig safeguards mean centralization. Delegated voting means trust. Minimum quorums (like Compound’s 4% rule) make it harder for bad actors to win-but also harder for legitimate proposals to pass.Some argue this is the price of security. Others say it defeats the whole point of DAOs. If you need a central authority to step in every time something goes wrong, are you really decentralized?

Security researcher samczsun put it bluntly: "We're seeing the same vulnerabilities exploited repeatedly because economic security isn't prioritized in governance design." The code is perfect. The rules are clear. But the incentives are broken.

Why This Matters Beyond DeFi

Governance attacks aren’t just a DeFi problem. They’re a warning for any system that tries to replace human decision-making with token-based voting. Imagine a city council where anyone can buy a vote. Or a corporation where shareholders can rent their voting power. That’s what we’ve built.Regulators are watching. In 2024, the SEC charged the Beanstalk hacker with securities fraud-not for stealing funds, but for manipulating governance. That’s a new legal frontier. If governance tokens are securities, then vote-buying isn’t just a hack-it’s insider trading.

And yet, DAOs keep growing. There are over 10,000 now, managing $18.7 billion in assets. But only 3.2% of token holders ever vote. The rest are spectators. And that’s the real vulnerability: apathy.

What You Can Do

If you hold governance tokens:- Vote-even if it’s just once. Low turnout is the attacker’s best friend.

- Use delegated voting if available. Find a delegate with a track record.

- Read proposals before voting. Don’t rely on summaries. Look for hidden contract addresses or fee redirects.

- Support protocols that use time locks, multi-sig backups, and off-chain snapshots.

- Don’t assume decentralization means safety. It just means the rules are written in code, not in courtrooms.

For protocol teams: don’t wait for an attack to happen. Audit your governance design like you audit your code. Ask: "Can someone buy control of this system in under an hour?" If yes, fix it.

Is Token Voting Broken?

Some say yes. Others say it’s just early. Vitalik Buterin believes quadratic voting and reputation systems will fix it. But OpenZeppelin’s 2025 assessment says: "Current token-based governance models remain fundamentally vulnerable without significant architectural changes."The truth is somewhere in between. Token voting isn’t broken-it’s incomplete. It works great when everyone participates. It collapses when only a few do. And right now, most people aren’t even trying.

Until we solve the participation problem, governance attacks will keep happening. Not because the tech is weak. But because the incentives are misaligned.

What is a governance attack in DeFi?

A governance attack happens when someone gains control of a DAO’s voting system-usually by buying or borrowing governance tokens-and uses that power to approve malicious proposals, like stealing funds or redirecting fees. These attacks exploit the design of token-based voting, not software bugs.

How did the Beanstalk attack work?

In April 2022, an attacker used a $1 billion flash loan to buy enough BEAN tokens to control the DAO’s vote. They then passed a proposal that transferred $77 million from the protocol’s liquidity pool to their own wallet. Because there was no delay between voting and execution, the attack completed in a single block.

Can flash loans be blocked to prevent governance attacks?

Not directly. Flash loans are a core feature of DeFi and can’t be removed without breaking the system. Instead, protocols prevent abuse by adding time locks-so tokens bought in a flash loan can’t be used to vote immediately. This makes flash loan attacks too slow and expensive to be profitable.

Why don’t more people vote in DAOs?

Most token holders don’t understand governance, find it too complex, or think their vote won’t matter. Studies show over half of DAOs have fewer than ten active voters. Even in large DAOs, participation rates are below 30%. Low turnout makes it easy for a single actor to swing a vote.

Are centralized backups in DAOs a betrayal of decentralization?

Not necessarily. Most DAOs still rely on multisig wallets for emergency fixes-like what Compound did after the Golden Boys attack. This isn’t a failure; it’s a safety net. Full decentralization without security is just chaos. The goal isn’t to remove all central points, but to make them rare, transparent, and last-resort.

What’s the future of DAO governance?

The future lies in layered systems: time locks, delegated voting, reputation-based weights, and off-chain snapshots. ERC-7202 is a step forward, but adoption is uneven. The real challenge isn’t technology-it’s participation. Until users care enough to vote, governance will remain vulnerable to anyone with enough money.