How Liquidation Engine Mechanics Work in Crypto and DeFi

Nov, 24 2025

Nov, 24 2025

Liquidation Price Calculator

Calculate Your Liquidation Price

When you trade crypto with leverage, you’re betting more than you own. That’s powerful - but dangerous. If the market moves against you, your position can vanish in seconds. That’s not magic. It’s a liquidation engine at work. These automated systems are the silent enforcers of risk in crypto markets. They don’t care if you’re a beginner or a pro. They don’t pause for news or emotions. They just act - and when they do, your position gets closed, your collateral gets seized, and your losses are locked in.

What Exactly Is a Liquidation Engine?

A liquidation engine is an automated system that closes leveraged positions when they become too risky. Think of it like a safety valve on a pressure cooker. If the pressure gets too high, the valve opens to prevent an explosion. In crypto, the pressure is your collateral. If the value of what you put up as security drops too low, the engine steps in to prevent the whole system from collapsing. This isn’t just for exchanges like BitMEX or Binance. It’s everywhere in DeFi. When you borrow USDC against your ETH on a protocol like Fathom or Dolomite, the liquidation engine watches your collateral-to-debt ratio 24/7. If your ETH price drops and your loan becomes under-collateralized, the engine triggers. It doesn’t ask you. It doesn’t warn you twice. It just executes.How Do Liquidation Triggers Work?

Every platform has its own rules, but they all follow the same basic math. You deposit collateral. You borrow against it. The system gives you a liquidation threshold - usually between 80% and 90% of your collateral’s value. Let’s say you deposit 1 ETH (worth $3,000) and borrow $2,400 in USDC. That’s 80% loan-to-value. Most platforms set the liquidation trigger at 85% LTV. That means if your ETH drops to $2,824, your position becomes eligible for liquidation. Why? Because $2,400 is now 85% of $2,824. You’re barely covered. Some platforms use a maintenance margin instead. For example, with 10x leverage, you can lose 10% before liquidation. So if you go long BTC at $60,000 with 10x, your liquidation price is $54,000. One bad candlestick, and you’re out. The math is simple. The timing? Not always.Centralized vs. DeFi: Two Very Different Systems

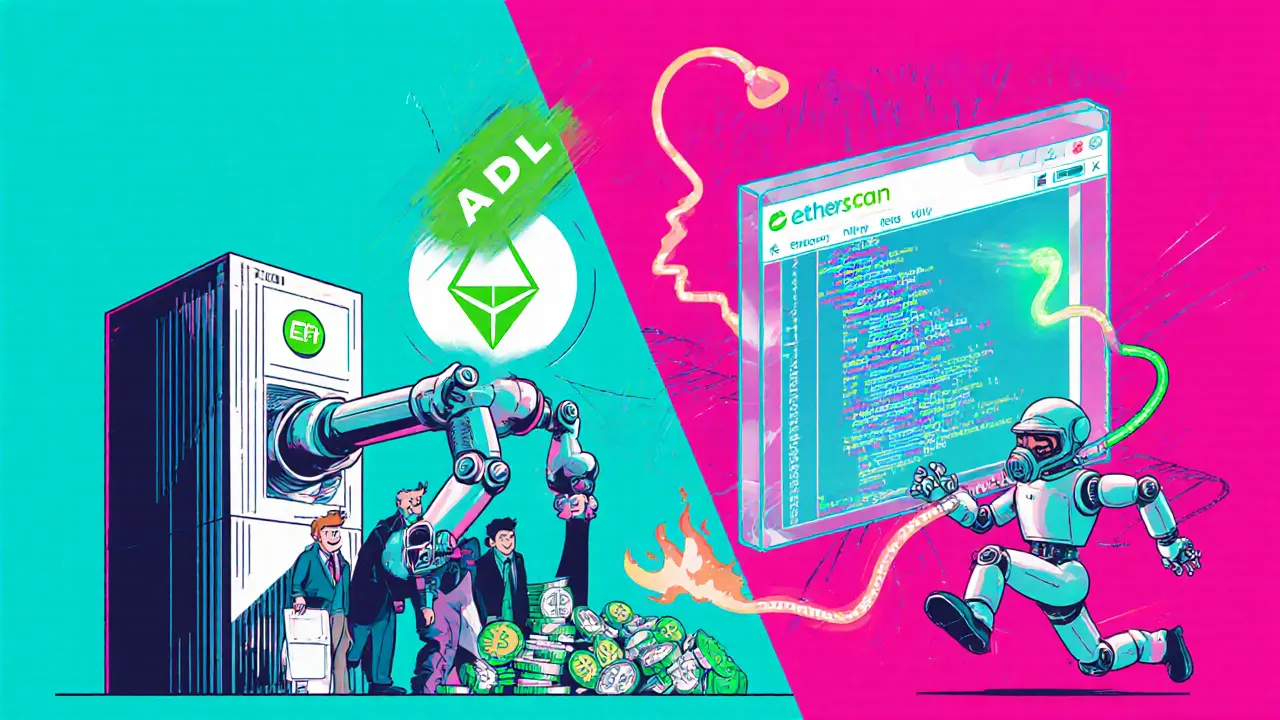

Not all liquidation engines are built the same. There are two main flavors: centralized exchange engines and DeFi smart contract engines. On centralized exchanges like BitMEX or Bibox, the engine runs on the exchange’s servers. It’s fast. It’s efficient. And it’s opaque. When your position gets liquidated, the system tries to close it at the current market price. If there’s not enough buyers or sellers - say, during a flash crash - it triggers Auto-Deleveraging (ADL). That means your losses get passed to other traders who were profitable. You didn’t lose to the market. You lost to another trader’s win. On DeFi platforms like Fathom or Demex, liquidation is handled by smart contracts. Anyone can trigger it - you, a bot, or a third-party liquidator. You don’t trust the exchange. You trust the code. The rules are public. The liquidation price is calculable. You can even see it on Etherscan. But there’s a catch. DeFi liquidations need someone to pay for the gas fee to execute the transaction. If the market is crashing and gas prices spike, liquidators might wait. That delay can mean your position gets wiped anyway - but slower, and sometimes at a worse price.

Auto-Deleveraging: The Hidden Risk

Auto-Deleveraging is the most controversial part of centralized liquidation engines. It’s not a bug. It’s a feature. But it’s a feature that can feel like a betrayal. When BitMEX or Bybit can’t close your position at a fair price, they don’t just eat the loss. They look at their most profitable traders - the ones who are still winning - and reduce their profits to cover your loss. The system picks traders in order of highest profit, highest leverage, and earliest entry. You might not know who you’re taking money from. But someone else is paying for your mistake. DeFi protocols avoid ADL by design. Instead of shifting losses to others, they rely on over-collateralization and liquidator incentives. If your position is under-collateralized, a liquidator steps in, takes your collateral, pays off your debt, and keeps a cut as a reward. It’s fairer. But it’s slower. And if no one wants to liquidate, your position just sits there - until the price drops further and the system forces a liquidation anyway.Why Liquidation Engines Exist

You might think these systems are cruel. But they’re necessary. Imagine a world without liquidation engines. Someone borrows $100,000 worth of ETH with only $5,000 as collateral. ETH crashes 50%. Now the loan is worth $50,000, but the collateral is only $2,500. The platform is insolvent. Everyone who lent money loses. That’s not a market. That’s a Ponzi. Liquidation engines prevent that. They protect lenders. They protect the protocol. They keep the system solvent. Without them, DeFi wouldn’t work. Exchanges would collapse under bad debt. The real question isn’t whether they should exist. It’s whether they’re fair.

What Traders Get Wrong

Most people lose money in leveraged trading not because they’re bad at predicting prices. They lose because they don’t understand liquidation mechanics. They think: “I’m safe as long as the price doesn’t hit my liquidation level.” But that’s not true. Liquidation prices aren’t fixed. They change with volatility, funding rates, and platform-specific rules. A 10x position on BitMEX might liquidate at 9% move. On another exchange, it might be 12%. On a DeFi protocol, it might be 15% - but only if a liquidator acts fast enough. They ignore margin buffers. The minimum requirement isn’t a target. It’s a cliff edge. Smart traders keep 20-30% extra collateral. That gives them breathing room. If ETH drops 5%, they don’t panic. They don’t get liquidated. They wait. They don’t check the price oracle. In DeFi, if the oracle is manipulated - say, by a flash loan attack - your liquidation price can be faked. You think you’re safe. The system thinks you’re not. You get wiped. That’s happened on multiple protocols.How to Avoid Getting Liquidated

Here’s what works in real life:- Know your platform’s exact liquidation formula. Don’t guess. Check the docs.

- Use a margin buffer. Never trade at the edge. Keep 20-30% extra collateral.

- Monitor funding rates. High positive funding can drain your position even if the price doesn’t move.

- For DeFi: track gas prices. If you’re using a protocol that needs external liquidators, make sure you’re not relying on them during a crash.

- Use stop-losses - not just for entry, but as a backup to your liquidation trigger.

- Never use max leverage. 5x is dangerous. 10x is gambling. 20x is asking to be liquidated.

The Future of Liquidation Engines

The best protocols are evolving. Dolomite’s virtual liquidity model lets one asset back multiple loans at once, reducing slippage. Newer ADL systems prioritize traders with lower profits first, not the biggest winners. Price oracles are becoming more decentralized - using multiple data sources to avoid manipulation. The next big shift? Hybrid systems. Imagine a DeFi protocol that runs liquidations on a fast layer-2 chain, with full on-chain transparency. You get the speed of a centralized exchange and the fairness of a smart contract. For now, the choice is simple: speed or transparency. Centralized exchanges give you speed. DeFi gives you control. But both rely on the same core idea: when risk gets too high, the system cuts you loose. You can’t beat the engine. But you can learn to play within its rules.What triggers a liquidation in crypto trading?

A liquidation is triggered when your collateral value falls below the platform’s maintenance margin requirement. For example, if you’re using 10x leverage, a 10% price move against your position typically triggers liquidation. Exact thresholds vary by platform - some use loan-to-value ratios (like 85%), others use fixed percentage drops. Always check your platform’s specific rules.

What is Auto-Deleveraging (ADL) in crypto?

Auto-Deleveraging (ADL) is a mechanism used by centralized exchanges like BitMEX and Bybit when there isn’t enough market liquidity to close a losing position at a fair price. Instead of taking the loss themselves, the exchange reduces the profits of the most profitable traders to cover the loss. It’s a way to protect the platform’s solvency - but it means you can lose even if you’re winning elsewhere.

Can you avoid liquidation in DeFi?

Yes - but not by ignoring the rules. You can avoid liquidation by keeping extra collateral (a margin buffer), using lower leverage, monitoring price oracles for manipulation, and ensuring you have enough gas to allow liquidators to act if needed. Unlike centralized exchanges, DeFi doesn’t auto-liquidate instantly - it relies on external actors. So timing and gas fees matter.

Why do some liquidations happen at worse prices than expected?

This happens during high volatility or low liquidity. On centralized exchanges, the engine tries to close your position at the market price - but if there’s a flash crash, the price slippage can be massive. On DeFi, if liquidators delay due to high gas fees, the price may drop further before the position is closed. In both cases, you’re subject to market conditions beyond your control.

Is DeFi liquidation safer than centralized exchange liquidation?

It’s more transparent, but not always safer. DeFi liquidations use public smart contracts, so you can verify the rules and liquidation price. But they depend on external liquidators and gas prices, which can cause delays. Centralized exchanges are faster and more reliable in execution, but use opaque systems like ADL that can force losses onto profitable traders. Safety depends on what you value: speed or fairness.

How do I calculate my liquidation price?

Use this formula: Liquidation Price = (Loan Amount / Collateral Amount) × (1 / (1 - Liquidation Ratio)). For example, if you deposited 1 ETH ($3,000) and borrowed $2,400, with a liquidation ratio of 85%, your liquidation price is ($2,400 / $3,000) × (1 / (1 - 0.85)) = $5,333.33. Most platforms have built-in calculators - but always double-check the math yourself.

What platforms have the most reliable liquidation engines?

For speed and reliability, BitMEX and Bybit have mature systems with strong liquidity. For transparency and fairness, DeFi protocols like Fathom and Dolomite offer clear, on-chain rules and avoid ADL. Newer platforms like Demex offer full decentralization but require active liquidator participation, which can be unreliable during crashes. Choose based on your risk tolerance and trading style.