Monero & Zcash Regulations 2025: Key Restrictions on Privacy Coins

Aug, 17 2025

Aug, 17 2025

FATF Travel Rule Compliance Checker

Check if your transaction meets FATF Travel Rule requirements for Monero or Zcash transactions in 2025

By 2025, privacy‑focused cryptocurrencies handle over $250 billion in daily trades, yet regulators worldwide are tightening the screws. If you own or trade privacy coin regulations have become a daily headline, it’s time to understand exactly what’s happening to Monero and Zcash.

What are privacy coins?

Privacy coins are digital assets that hide the sender, receiver, and amount of a transaction. They use advanced cryptography to make the blockchain unreadable to anyone without the right keys. Two of the biggest names are Monero - a coin that forces privacy on every single transaction - and a proof‑of‑work token that lets users choose between fully hidden (shielded) and public (transparent) transfers. The latter is known as Zcash. Both aim to protect financial privacy, but their technical choices shape how regulators treat them.

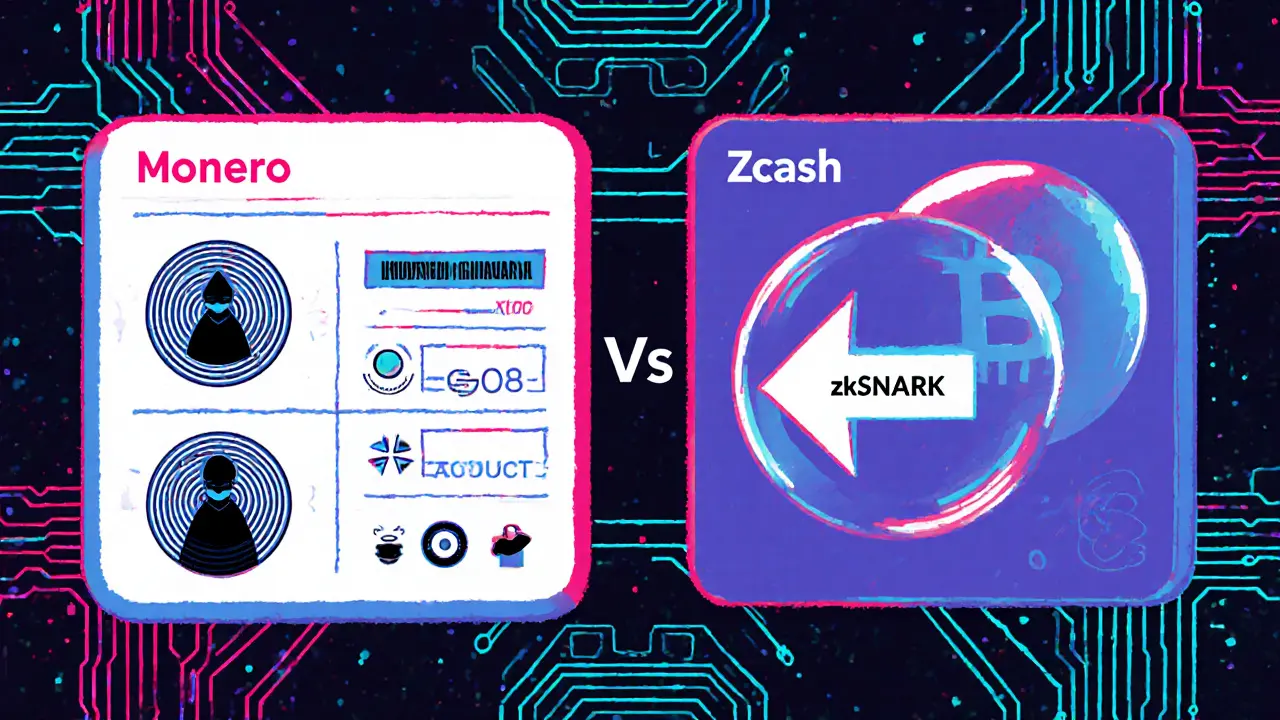

Monero vs. Zcash: How the tech works

Monero builds privacy into its core. Every transaction mixes the sender’s output with a group of decoys using ring signatures, hides the destination with stealth addresses, and obscures the amount via RingCT. Because these features are mandatory, a user can never accidentally broadcast a transparent transaction.

Zcash takes a different route. It uses zk‑SNARKs (zero‑knowledge succinct non‑interactive arguments of knowledge) to create shielded transactions that prove validity without revealing details. Users can also send transparent transactions that look just like Bitcoin, which gives exchanges a compliance doorway. This optional privacy is why regulators view Zcash as a “hybrid” rather than a pure anonymity tool.

Global regulatory landscape in 2025

The Financial Action Task Force (FATF) extended its Travel Rule to cover privacy‑coin transfers, meaning 57 % of Monero and Zcash trades now need to report sender and receiver data to a designated compliance entity. The European Union’s Markets in Crypto‑Assets (MiCA) regulation forces exchanges to delist or heavily scrutinize any token that can’t meet transparency requirements. As a result, Binance and Kraken removed both Monero and Zcash from their regulated platforms in early 2025, pushing a surge of peer‑to‑peer (P2P) activity in regions with weaker oversight.

Countries such as Singapore and Switzerland have responded with sandbox programs that allow developers to test privacy‑coin features under regulatory supervision. Meanwhile, traditional financial hubs like the United Kingdom and the United States are moving toward outright bans on privacy‑coin listings on regulated exchanges.

Regulatory impact: Monero vs. Zcash

| Aspect | Monero (XMR) | Zcash (ZEC) |

|---|---|---|

| Mandatory privacy | Yes - every transaction is private | No - users choose private or transparent |

| FATF Travel Rule compliance | Complex - requires on‑chain adapters or off‑chain reporting | Easier - transparent transactions satisfy reporting |

| Exchange delistings (2025) | Binance, Kraken, Coinbase (all) | Binance, Kraken (partial), some regional exchanges kept shielded listings |

| Adoption trend | Stable - strong privacy community | 8 % address decline due to KYC pressure |

| Regulatory classification | Often labeled “Anonymity‑Enhanced Cryptocurrency (AEC)” | Listed as “privacy‑optional token” in many jurisdictions |

In plain words, Monero faces a harsher regulatory environment because its built‑in privacy leaves fewer hooks for compliance teams. Zcash can pivot to transparent transactions when needed, which keeps it marginally more exchange‑friendly.

Regional approaches and market dynamics

Singapore’s Monetary Authority launched a “Privacy‑Coin Sandbox” that allows vetted firms to offer Monero‑based services if they integrate KYC checkpoints at the gateway level. Switzerland’s FINMA follows a similar model, issuing "crypto‑friendly" licences that require periodic audit trails for any privacy‑coin activity.

Conversely, the United States’ Treasury Office has circulated a draft rule that would treat non‑transparent privacy coins as high‑risk AML assets, demanding real‑time transaction monitoring. This pressure has nudged a significant chunk of Monero and Zcash trading toward P2P platforms in Latin America and Africa, where economic instability fuels demand for untraceable value transfers.

Compliance challenges and emerging tech solutions

Developers are experimenting with hybrid zero‑knowledge proofs that could let regulators audit specific transaction attributes without exposing the whole history. Zcash’s upcoming “Orchard” upgrade aims to lower computational costs for shielded transactions, potentially making large‑scale compliance integrations feasible.

Monero researchers are also working on “view‑keys” that would allow a trusted third party (such as a regulator) to decrypt a transaction under a court order, but the community debates whether this undermines the coin’s core philosophy.

Both approaches require more CPU cycles and larger block sizes, which could slow network performance. Until these solutions mature, most exchanges prefer to stay clear of privacy‑coin listings altogether.

What the restrictions mean for everyday users

If you’re a regular trader, expect to see more KYC prompts on any platform that still lists these coins. On P2P marketplaces, you’ll likely need to verify your identity with a phone number or social media profile, even though the transaction itself remains hidden.

For developers building wallets or apps, the FATF Travel Rule now demands that you embed reporting modules capable of flagging Monero or Zcash transfers that exceed $1,000. Failure to do so can result in sanctions or removal from the sandbox.

Looking ahead: 2026 and beyond

Analysts predict three possible paths:

- Full integration: Privacy coins adopt mainstream AML layers while preserving most anonymity, thanks to mature zero‑knowledge tools.

- Regulatory carve‑outs: Certain jurisdictions create “privacy‑coin zones” with limited reporting, attracting innovative projects.

- Suppression: Global regulators force a ban on non‑transparent coins, pushing the community toward decentralized, off‑chain solutions.

The next year will likely clarify which direction dominates. Keep an eye on FATF guidance updates and the EU’s final MiCA enforcement schedule - those will set the baseline for what you can legally hold and move.

Is Monero completely illegal in any country?

No single country has outright banned Monero, but many regulated exchanges in the U.S., EU, and Japan have removed it from their listings, effectively limiting legal access for residents who rely on those platforms.

Can I use Zcash’s shielded mode on a compliant exchange?

Only a handful of niche exchanges allow shielded ZEC transfers, and they require users to submit additional KYC documentation before enabling the privacy feature.

What does the FATF Travel Rule mean for privacy‑coin users?

It obliges entities that handle Monero or Zcash to capture and share sender/receiver details for transactions above a set threshold, effectively turning anonymous swaps into reportable events.

Are there any privacy‑coin sandboxes where I can develop legally?

Singapore’s MAS and Switzerland’s FINMA both run sandbox programs that permit privacy‑coin projects to test under strict supervision, provided they embed KYC/AML checkpoints.

Will future upgrades make Monero or Zcash more compliant?

Both communities are researching selective disclosure and view‑key solutions, but wide adoption will depend on regulatory acceptance and the ability to keep performance costs low.

harrison houghton

October 24, 2025 AT 00:12They call it privacy. I call it criminal convenience. If you can't prove where your money came from or where it's going, you're not a financial innovator-you're a ghost in the machine. And ghosts don't pay taxes.

DINESH YADAV

October 24, 2025 AT 22:57Western countries fear what they can't control. India doesn't ban privacy coins-we adapt. If the US wants to turn crypto into a bank form, let them. We'll keep using what works.

rachel terry

October 25, 2025 AT 07:35Monero is just Bitcoin with a hoodie and a bad attitude

And Zcash? Oh sweetie, you think choosing to be transparent makes you a good citizen? That's not compliance, that's performance art

Susan Bari

October 26, 2025 AT 02:50Let me be the first to say it-privacy coins are the last gasp of libertarian fantasy

And now the adults are finally picking up the broom

Sean Hawkins

October 26, 2025 AT 13:49There's a technical nuance here that's being ignored: Zcash’s zk-SNARKs can be made compliant with regulatory APIs without sacrificing privacy entirely. The issue isn't the tech-it's the lack of standardized interfaces. Most exchanges don't even try to integrate because it's expensive and untested. But the framework exists. It's not about banning-it's about building bridges.

Marlie Ledesma

October 27, 2025 AT 05:53I just feel bad for people who use these coins to protect themselves from abusive governments or corrupt banks. It's not about crime-it's about survival.

Daisy Family

October 27, 2025 AT 17:15Monero? More like Monero-why-are-you-even-trying lol

Paul Kotze

October 27, 2025 AT 20:21Here in South Africa, P2P Monero trading is booming. People use it to send money across borders without waiting 3 days for a bank wire or paying 15% in fees. If regulators want to stop this, they need to offer something better-not just shut it down.

Jason Roland

October 28, 2025 AT 13:47What if we stopped seeing privacy coins as enemies and started seeing them as stress tests for the financial system? If we can't build compliance into privacy, maybe the system is broken-not the tech.

Niki Burandt

October 29, 2025 AT 07:58Monero = crypto's secret society 😏💸

Zcash = the guy who wears a suit to the rave but still dances like a maniac 🕺🧩

Chris Pratt

October 30, 2025 AT 03:24My cousin in Nigeria uses Zcash to pay his daughter’s tuition in the US without the bank freezing the transfer. That’s not money laundering-that’s family. Maybe regulators should care about people, not just protocols.

Karen Donahue

October 30, 2025 AT 14:29Let’s be real-this whole thing is just a power grab by banks and governments who can’t stand the idea that ordinary people might have control over their own money. And now they’re using AML as an excuse to crush innovation because they’re too lazy to actually understand it. And I’m supposed to feel bad for them? No. No no no. The fact that they can’t keep up with technology doesn’t mean the technology is the problem. It means they’re obsolete. And if you’re going to ban something because it’s hard to control, you’re not protecting society-you’re protecting your own irrelevance.

Bert Martin

October 30, 2025 AT 22:11If you're trading privacy coins, just know the risks. Use hardware wallets. Avoid centralized exchanges. And don't panic when your balance drops-it's not the market, it's the regulatory noise. This too shall pass.

Ray Dalton

October 31, 2025 AT 19:27People forget that Zcash’s transparent mode is literally just Bitcoin with a different name. So why are they banning both? It’s like banning a car because it has tinted windows-even though you can roll them down. The regulation doesn’t fit the tech.

Peter Brask

November 1, 2025 AT 14:31They're coming for us next. You think this is about money? Nah. It's about control. The Fed wants to know what you bought, who you paid, and when you slept. Privacy coins are the last firewall. Once they're gone, we're all just data points in a corporate surveillance state. 🚨👁️🗨️

Trent Mercer

November 1, 2025 AT 16:05Monero is like a locked diary. Zcash is a diary with a lock you can choose to leave open. So why are both getting tossed in the trash? Because the people with the keys don't want anyone else to read anything.

Kyle Waitkunas

November 2, 2025 AT 04:41They’re not banning privacy coins because they’re dangerous-they’re banning them because they’re honest. They expose how broken the banking system is. And when people realize they can send money without permission, without fees, without surveillance… what then? The whole house of cards collapses. So they’re burning the library before anyone reads the books. And you? You’re just sitting there, clicking ‘agree’ to their TOS like a good little sheep. 😭

vonley smith

November 2, 2025 AT 05:44Hey, if you're still holding XMR or ZEC, don't stress. This is just the market adjusting. Keep your keys safe, use P2P, and remember-this isn't the end. It's just the beginning of the real crypto era.

harrison houghton

November 2, 2025 AT 22:07So you think P2P is the answer? Cool. Then explain why 87% of those transactions are linked to ransomware or darknet markets. Don't give me the 'but it's for Venezuela' speech-statistics don't lie.

Paul Kotze

November 3, 2025 AT 05:5787%? That’s a scare tactic. In South Africa, 90% of P2P Monero is for rent, groceries, or school fees. The darknet stats are inflated by media and regulators who need a villain. Real people are using this to survive-not to steal.

Sean Hawkins

November 3, 2025 AT 18:02Exactly. The FATF reports themselves admit that less than 1% of all privacy coin volume is tied to illicit activity. The rest is financial sovereignty. We’re criminalizing human rights because it’s easier than reforming the system.

Jason Roland

November 4, 2025 AT 05:59And that’s why we need to stop fighting each other and start building the next layer-privacy with accountability. Not surveillance. Not bans. Solutions.

harrison houghton

November 4, 2025 AT 19:08Build what? A backdoor? That’s not privacy-that’s surrender.

Ray Dalton

November 5, 2025 AT 08:06Or you could build a system where regulators get zero-knowledge proofs of compliance-no keys, no exposure. Just proof that a transaction meets criteria without seeing the details. That’s not surrender. That’s evolution.

Susan Bari

November 5, 2025 AT 12:14Evolution? More like giving up the soul of crypto to become the thing we swore to overthrow.

Bert Martin

November 5, 2025 AT 13:08Maybe the soul isn’t in the tech-it’s in the people who use it. And if we can’t protect the users, we’ve already lost.

Kyle Waitkunas

November 5, 2025 AT 20:55They’ll never let us win. They never do. But we don’t need to win-we just need to keep existing.