Race Attack and Finney Attack Explained: How Double-Spending Works on Blockchain

Feb, 2 2026

Feb, 2 2026

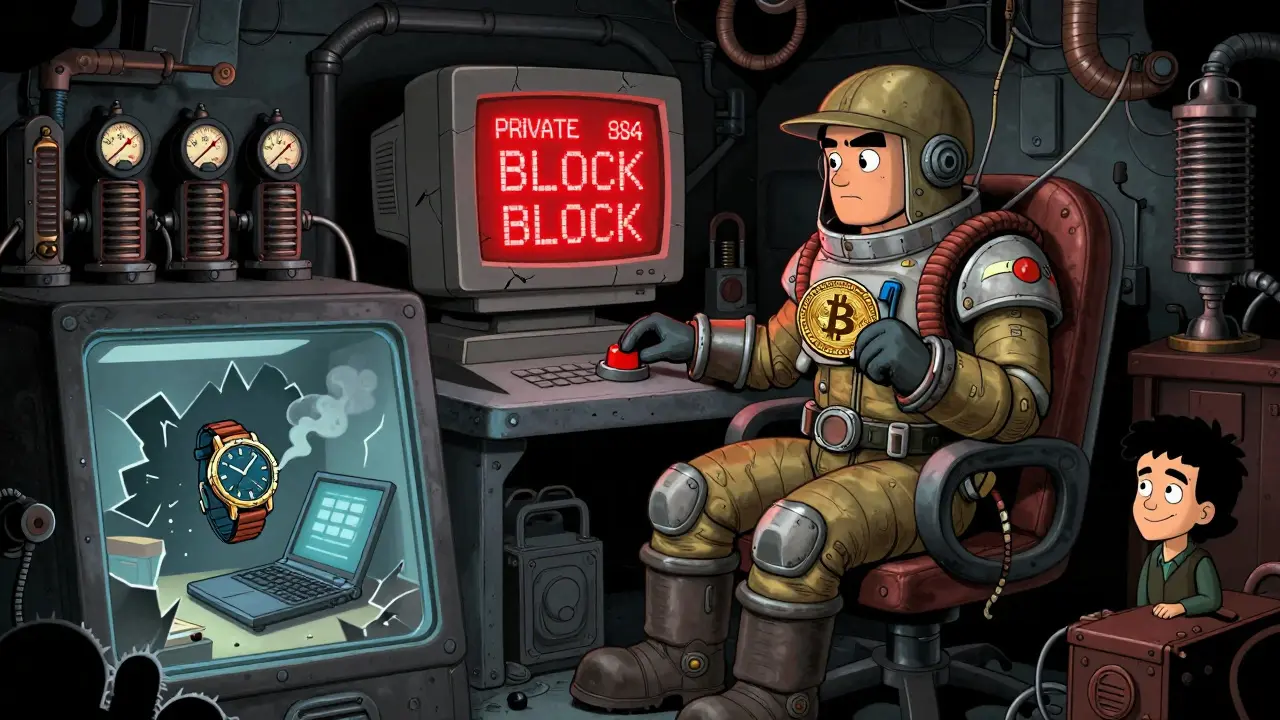

Imagine buying a $5,000 laptop with Bitcoin. You send the payment. The merchant sees the transaction pop up on their screen - no confirmations needed - and hands you the box. You walk out. Five minutes later, the transaction vanishes. The merchant never got paid. The laptop is gone. This isn’t a movie. This is how race attacks and finney attacks work - two real, documented ways hackers steal from merchants who accept Bitcoin without waiting for confirmations.

What Is a Race Attack?

A race attack happens when someone sends two versions of the same Bitcoin transaction at the same time. One goes to the merchant. The other goes to the rest of the Bitcoin network, spending the same coins back to the attacker’s own wallet. The goal? Trick the merchant into thinking they got paid, while the network confirms the theft. Here’s how it plays out:- The attacker has 1 BTC in wallet A.

- They send 1 BTC to the merchant’s wallet (Transaction 1).

- Simultaneously, they send that same 1 BTC back to their own wallet B (Transaction 2).

- They make sure Transaction 2 reaches the Bitcoin network faster than Transaction 1.

- The merchant, seeing Transaction 1 on their screen, assumes it’s real and ships the product.

- Within minutes, Transaction 2 gets included in a block. Transaction 1 gets rejected as a double-spend.

What Is a Finney Attack?

The Finney attack is sneakier. It doesn’t rely on network speed. It relies on mining power. Named after Hal Finney - one of Bitcoin’s first contributors and a miner himself - this attack requires the attacker to be a miner. Not just any miner. Someone with enough hash power to mine blocks occasionally. Here’s the sequence:- The attacker mines a block in private. Inside that block is a transaction: 1 BTC from wallet A to wallet B (both owned by the attacker).

- They don’t broadcast it yet.

- They use wallet A to buy something from a merchant who accepts zero-confirmation transactions.

- Once the merchant delivers the goods, the attacker broadcasts their pre-mined block.

- The block includes the transaction sending the coins to wallet B - not the merchant.

- The merchant’s transaction is erased from the blockchain. The attacker keeps the product and the coins.

How Are These Attacks Different?

At first glance, both attacks look like double-spending. But they’re built on different mechanics.| Feature | Race Attack | Finney Attack |

|---|---|---|

| Who can execute it? | Any Bitcoin user | Only miners with significant hash power |

| Resource needed? | Basic wallet + internet | Mining hardware + 450+ PH/s hash rate |

| Success rate? | 30-85% (depends on node setup) | Up to 100% if block is mined |

| Time window? | Seconds to minutes | Seconds - must mine before merchant confirms |

| Network dependency? | High - exploits propagation delays | Low - attacker controls the block |

| Common target? | Low-value, fast-turnover goods | High-value, immediate-delivery items |

Why Do These Attacks Still Matter in 2026?

You might think: “Bitcoin’s bigger now. These attacks are dead.” They’re not. Yes, the network is stronger. More nodes. Faster propagation. BIP 125 (Replace-By-Fee) made it harder to swap transactions after they’re broadcast. Bitcoin Core’s 2022 update prioritized “first-seen” transactions across 80% of nodes. And BIP 321, released in December 2025, introduced “transaction pinning” - making race attacks nearly impossible. But here’s the problem: not everyone uses these updates. Merchants who accept crypto for small purchases - coffee, digital goods, subscriptions - still rely on zero-confirmation transactions. Why? Because waiting 10 minutes for one confirmation kills customer experience. A 2025 BitPay survey found merchants lose $2.30 in sales for every transaction delayed by extra confirmations. And for high-value sales? The risk is real. Ledger Academy’s 2025 analysis showed that for transactions over $10,000, the expected loss from double-spending attacks is $84.30 per $1,000 processed. That’s an 8.4% risk. No legitimate business accepts that. Meanwhile, smaller altcoins - coins with market caps under $100 million - are still wide open. 73% of them, according to CryptoRank’s 2026 report, have no defenses against race or finney attacks. Their networks are too small. Their nodes too few. Their protocols too outdated.How to Protect Yourself as a Merchant

If you accept Bitcoin, here’s what you need to do - right now:- Never accept zero-confirmation transactions for anything over $100. This is the golden rule. Even $500 should require at least one confirmation.

- Use BTCPay Server. It’s free, open-source, and built with security in mind. Its “0-conf risk scoring” analyzes transaction patterns and flags suspicious activity - reducing false positives by 63%.

- Connect to 8-12 trusted outbound nodes. Don’t rely on random peers. Use known, well-connected nodes. Coinbase Commerce data shows 76% of enterprise merchants do this.

- Use transaction acceleration tools. Services like Blocknative’s Notify API reduce the race attack window from 30+ seconds to under 5.

- Require 3+ confirmations for transactions over $5,000. 92% of merchants already do this. Don’t be the exception.