Best ASIC 2025: What Actually Works and What to Avoid

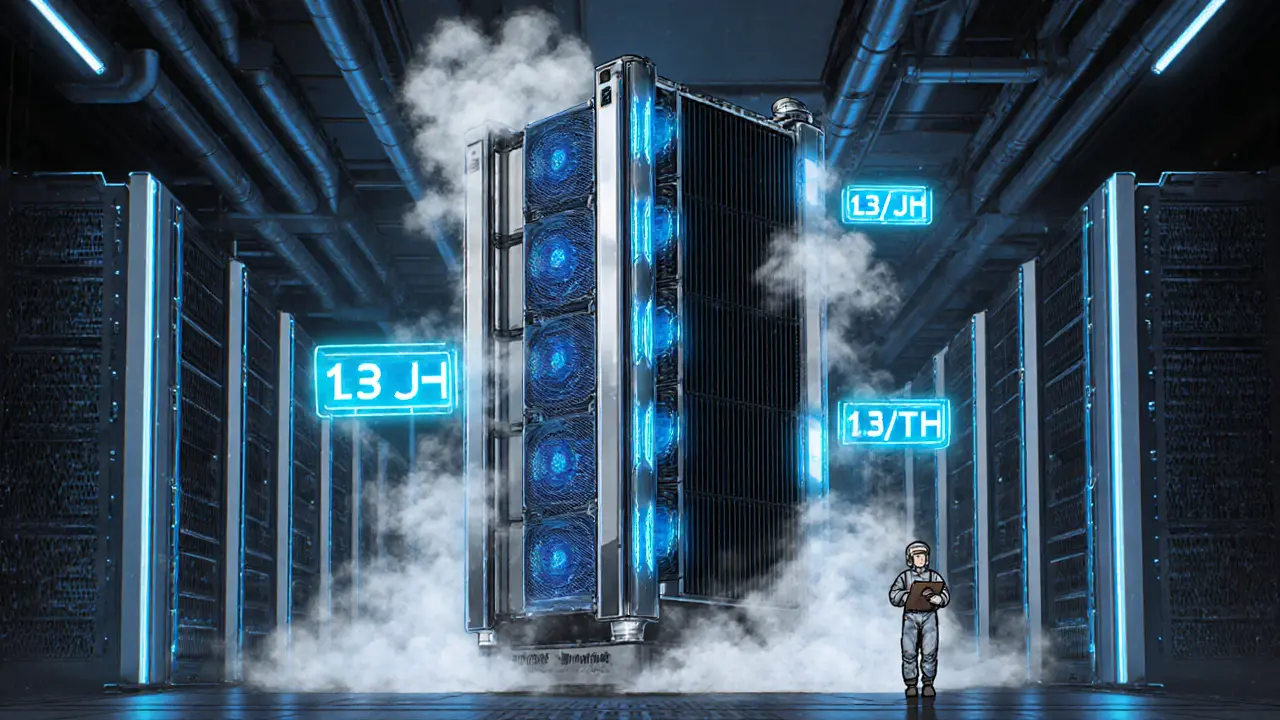

When people ask for the best ASIC 2025, a specialized hardware device built to mine Bitcoin and other proof-of-work cryptocurrencies by solving complex cryptographic puzzles. Also known as application-specific integrated circuit miner, it's the only hardware that can compete profitably in today’s Bitcoin network. They’re not looking for specs on a screen—they want to know which machine won’t eat their electricity bill and still turn a profit. The truth? Most ‘top ASIC’ lists from 2023 are already outdated. The Bitcoin network’s hash rate hit 800 exahashes per second in early 2025, and only miners with efficiency under 20 J/TH are still viable. If your ASIC uses more than 3,000 watts for less than 110 TH/s, you’re losing money before you even turn it on.

It’s not just about raw power. The hash rate, the speed at which a miner solves cryptographic problems to validate Bitcoin transactions. Also known as mining speed, it’s the core metric that determines your chances of earning rewards needs to match the network’s difficulty, which resets every two weeks. A miner that was top-tier last year might now be outpaced by newer models from MicroBT or Bitmain. The Antminer S21 and WhatsMiner M56S++ are the only two ASICs that still deliver consistent returns in 2025, thanks to their 22 J/TH efficiency and 200+ TH/s output. Everything else? Either too old, too noisy, or too power-hungry. And don’t get fooled by sellers claiming ‘new stock’ of discontinued models like the S19 Pro—those are often refurbished units with worn-out chips.

Then there’s the crypto mining profitability, the net income from running a mining rig after subtracting electricity, hardware, and maintenance costs. Also known as mining ROI, it’s what separates hobbyists from serious operators. Even the best ASIC won’t help if you’re paying $0.15 per kWh. In places like Texas or Kazakhstan, where power is under $0.06, miners break even in under 12 months. In Europe or California? You’re better off buying Bitcoin outright. Profitability isn’t just about the machine—it’s about location, cooling, and how long you’re willing to wait. And forget about mining altcoins like Ethereum or Litecoin anymore. Bitcoin is the only proof-of-work coin left with enough market cap to support serious ASIC mining.

What you’ll find in the posts below isn’t a list of ‘top 10 ASICs.’ It’s a collection of real-world tests, failure stories, and hidden costs from people who actually ran these machines. You’ll see why some miners died after six months, how one guy lost $18,000 on a fake ‘new model,’ and what the latest firmware updates actually do to your hash rate. No marketing fluff. No sponsored reviews. Just what works, what doesn’t, and why most people get burned before they even understand the basics of power draw or pool fees.

Discover the best Bitcoin mining hardware in 2025, including top ASICs like the Antminer S21e XP Hyd and Whatsminer M66S++. Learn what makes mining profitable, the real cost of hydro-cooled systems, and whether mining is still worth it.

More