Bitcoin Mining Hardware: What Works, What Doesn't, and Where to Start

When you buy Bitcoin mining hardware, specialized machines built to solve complex math problems and earn Bitcoin rewards. Also known as ASIC miners, these devices are the backbone of Bitcoin’s security network—but most people buy them without knowing if they’ll ever turn a profit. It’s not like buying a GPU for gaming. This is industrial-grade equipment that runs 24/7, eats electricity like a small appliance, and needs serious cooling. If you’re thinking about jumping in, you need to know what separates the machines that make money from the ones that just sit there and waste power.

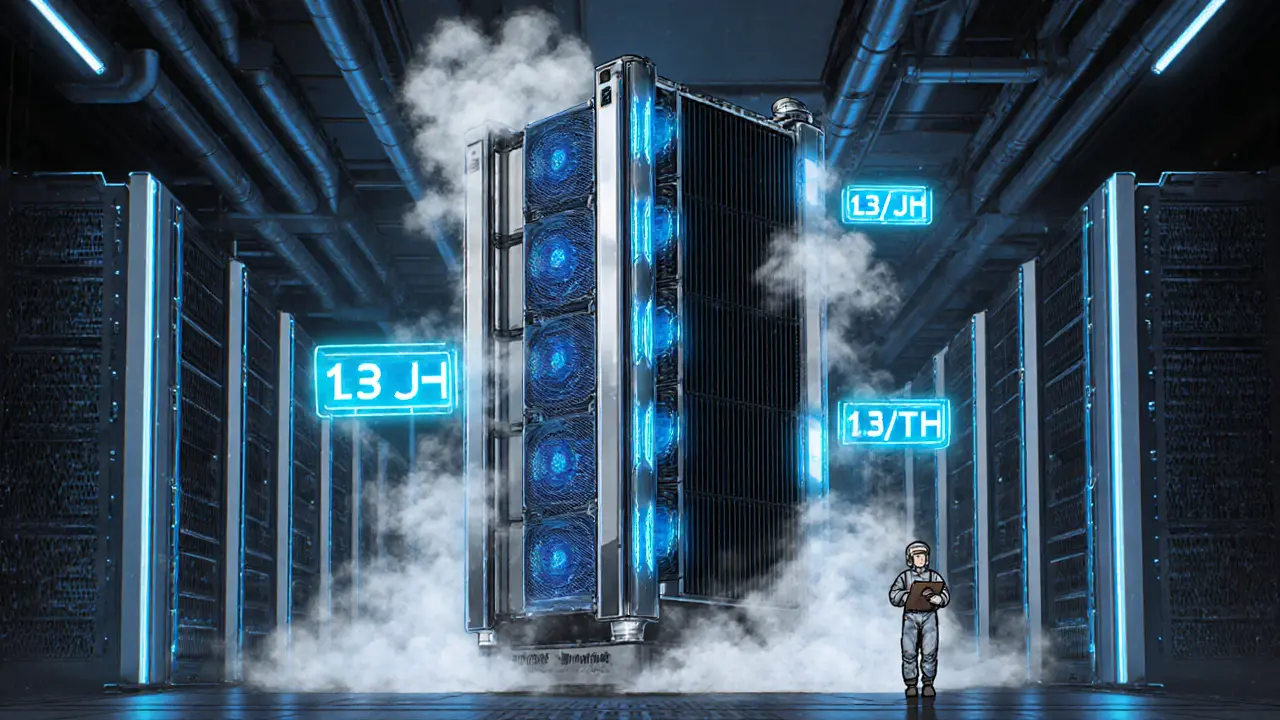

Hash rate, the speed at which a miner solves Bitcoin’s cryptographic puzzles. Also known as mining power, it’s measured in terahashes per second (TH/s). A high hash rate means more chances to earn Bitcoin, but only if your electricity cost is low enough. In 2025, anything under 100 TH/s is barely worth running unless you’re using free solar power. The top miners today—like the Antminer S21 or the WhatsMiner M50—hit 200+ TH/s and pull around 3,000 watts. That’s a lot of juice. And that’s where mining profitability, the real test of whether your hardware pays for itself. Also known as return on investment, it’s not just about the coin price—it’s about how much you spend on power, cooling, and maintenance over time. Many miners break even after 18 months. Others never do. The difference? Location, efficiency, and timing.

You can’t ignore crypto mining rigs, the full setups that include miners, power supplies, cooling fans, and sometimes custom frames. Also known as mining farms, these are what serious operators run in warehouses or repurposed garages. But for most people, a single ASIC miner is enough to test the waters. Just remember: if your local electricity costs more than $0.12 per kWh, you’re already behind. And if you’re in a place with blackouts, humidity, or no ventilation, you’re not mining—you’re just burning cash. The hardware hasn’t changed much in the last five years. What’s changed is the competition. Every new miner pushes the network difficulty higher. That means older machines—like the Antminer S9—are now museum pieces. Even mid-range models from 2022 are struggling to stay profitable. The only way to win now is to start with the latest, most efficient hardware and run it in the cheapest power environment you can find.

There’s no magic formula. No secret trick. Just cold math: divide your daily Bitcoin earnings by your daily electricity cost. If the number is below one, you’re losing. If it’s above one, you’re playing the game. And if you’re still not sure? Look at the real results from people who’ve done it. The posts below show exactly what’s working, what’s failed, and why some miners walk away while others keep scaling up.

Discover the best Bitcoin mining hardware in 2025, including top ASICs like the Antminer S21e XP Hyd and Whatsminer M66S++. Learn what makes mining profitable, the real cost of hydro-cooled systems, and whether mining is still worth it.

More