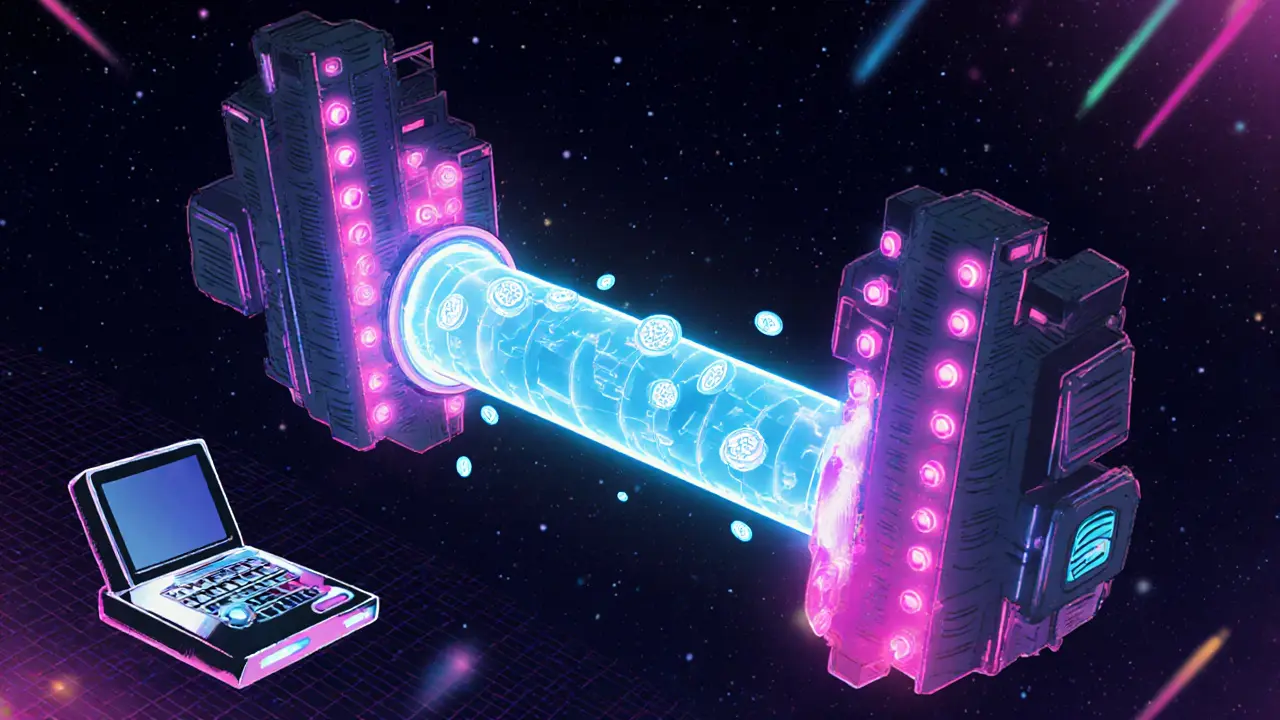

Blockchain Bridges: The Backbone of Cross‑Chain Crypto

When working with blockchain bridges, protocols that let assets move between separate blockchains. Also known as cross‑chain bridges, they enable secure, trust‑minimal transfers of tokens, data, and NFTs. For example, wrapped tokens, standardized versions of a native asset that live on a different chain, use bridges to lock the original and mint the counterpart. Many layer‑2 scaling solutions, off‑chain networks that boost transaction speed and lower fees, depend on bridges to move liquidity back and forth with the main chain. This creates a three‑way relationship: blockchain bridges enable cross‑chain interoperability, wrapped tokens rely on bridges for minting, and layer‑2 systems use bridges to keep assets synced with Layer‑1. The result is a fluid ecosystem where a token like Wrapped THETA can jump from its native network into Ethereum DeFi, or a user can shift USDC from Optimism back to Ethereum with a single click. Security teams often audit bridge contracts because a single vulnerability can expose billions of dollars, which is why tools like blockchain forensics are becoming standard practice for bridge operators.

From a trader’s perspective, bridges unlock arbitrage opportunities across chains, letting you buy low on one network and sell high on another without moving through a centralized exchange. Developers gain a powerful building block: they can deploy a smart contract on a cheap layer‑2, then use a bridge to expose its functionality to Ethereum’s massive user base. Regulators, on the other hand, see bridges as both a challenge and a chance—they can trace cross‑chain flows using on‑chain data mining, as highlighted in our guide on blockchain forensics, and apply AML checks across multiple ledgers. The diversity of use cases means that a single bridge can support DeFi protocols, NFT marketplaces, and gaming platforms like the ZooCW Mega Event airdrop, all while maintaining user sovereignty. Our collection of articles dives deep into these scenarios, from practical how‑to guides for claiming airdrops that rely on bridges, to in‑depth reviews of exchanges that integrate bridge technology for faster withdrawals.

Below you’ll find a curated set of posts that break down bridge mechanics, showcase real‑world examples, and give you actionable steps to leverage bridges in your own strategy. Whether you’re hunting a new airdrop, comparing exchange fees, or learning how non‑custodial wallets bypass restrictions using cross‑chain paths, the articles ahead provide the context and tools you need to navigate the rapidly evolving bridge landscape.Why Bridges Matter for Traders, Developers, and Regulators

Explore the key differences between trusted and trustless blockchain bridges, their security, speed, fees, and when each design is the right choice.

More