Blockchain Validation: How It Works and Why It Matters

Blockchain Validation, the process that checks every transaction against the protocol’s rules before it’s added to the ledger. Also known as consensus verification, it guarantees that the chain stays trustworthy. Blockchain validation isn’t just a buzzword; it’s the foundation of any secure network. When you hear terms like on‑chain data mining, the extraction and analysis of raw transaction data to spot patterns and anomalies, think of it as the eyes that spot rogue entries before they slip in. Likewise, blockchain forensics, the investigative toolkit used by regulators and auditors to trace illicit flows builds on validation by flagging breaches after they happen. If you’re moving assets across networks, the choice between a trusted bridge, a cross‑chain connector that relies on a centralized authority for speed and simplicity and a trustless alternative can affect how quickly a validation error is caught. Even concepts like disintermediation, the removal of middlemen using smart contracts and decentralized ledgers tie back to validation because every automated contract still needs to be verified before execution. Together, these pieces form a safety net: solid validation, smart data mining, forensic oversight, the right bridge choice, and a middle‑man‑free design all work side‑by‑side to keep the blockchain honest.

Why These Pieces Matter for Real‑World Projects

Understanding validation is one thing; applying it is another. Developers build consensus engines that automate the validation step, but they also rely on on‑chain data mining tools like GraphQL APIs and custom scripts to monitor health in real time. Security teams use blockchain forensics, software that parses transaction graphs, flags sanctioned addresses, and generates audit trails to stay compliant with ever‑changing regulations. When you connect two blockchains, picking a trusted bridge, often means faster finality but introduces a single point of failure, so many projects now blend trusted and trustless models to hedge risk. At the same time, businesses looking to cut costs and increase transparency lean on disintermediation, features that replace banks, brokers, or content platforms with self‑executing contracts. Each of these choices circles back to validation: if a contract can’t be validated, the whole system collapses. Below you’ll find a curated set of guides, reviews, and deep dives that show how these concepts play out in real crypto projects, giving you actionable insights to strengthen your own blockchain strategy.

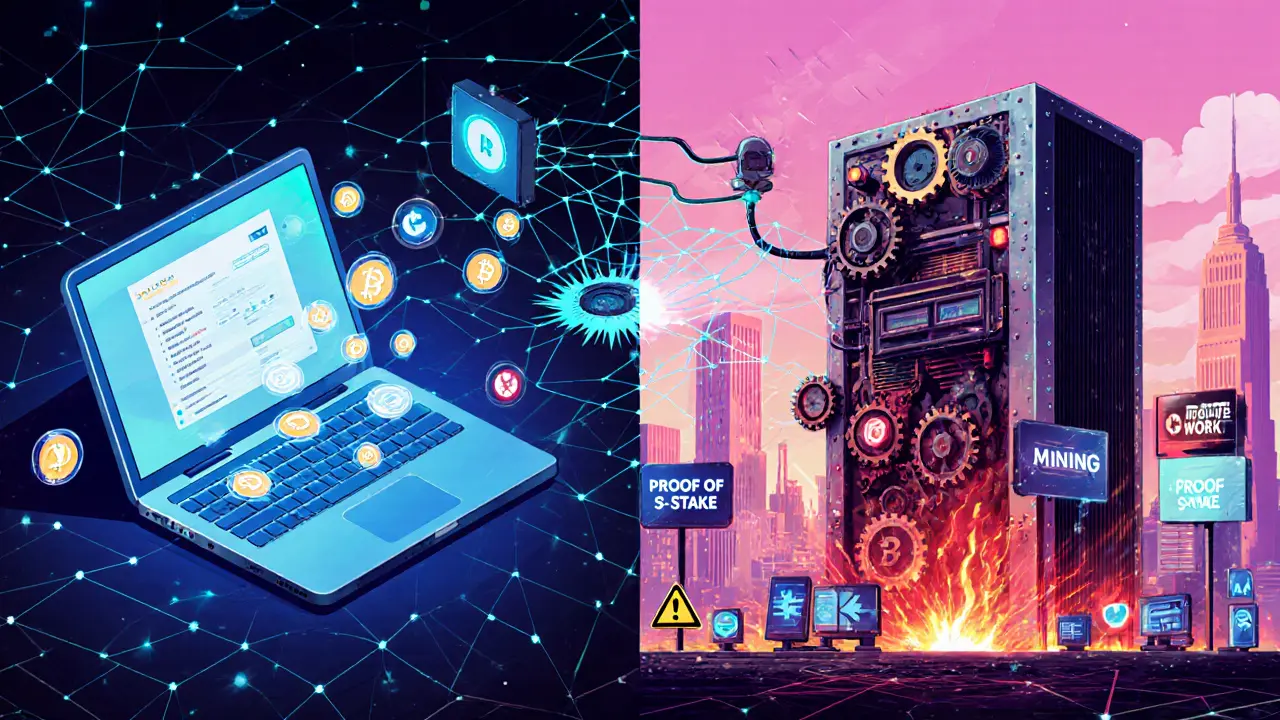

Explore the differences between staking and mining, covering energy use, hardware costs, rewards, risks, and future trends for blockchain validation.

More