Cross‑Chain Interoperability: Unlocking Asset Flow Across Blockchains

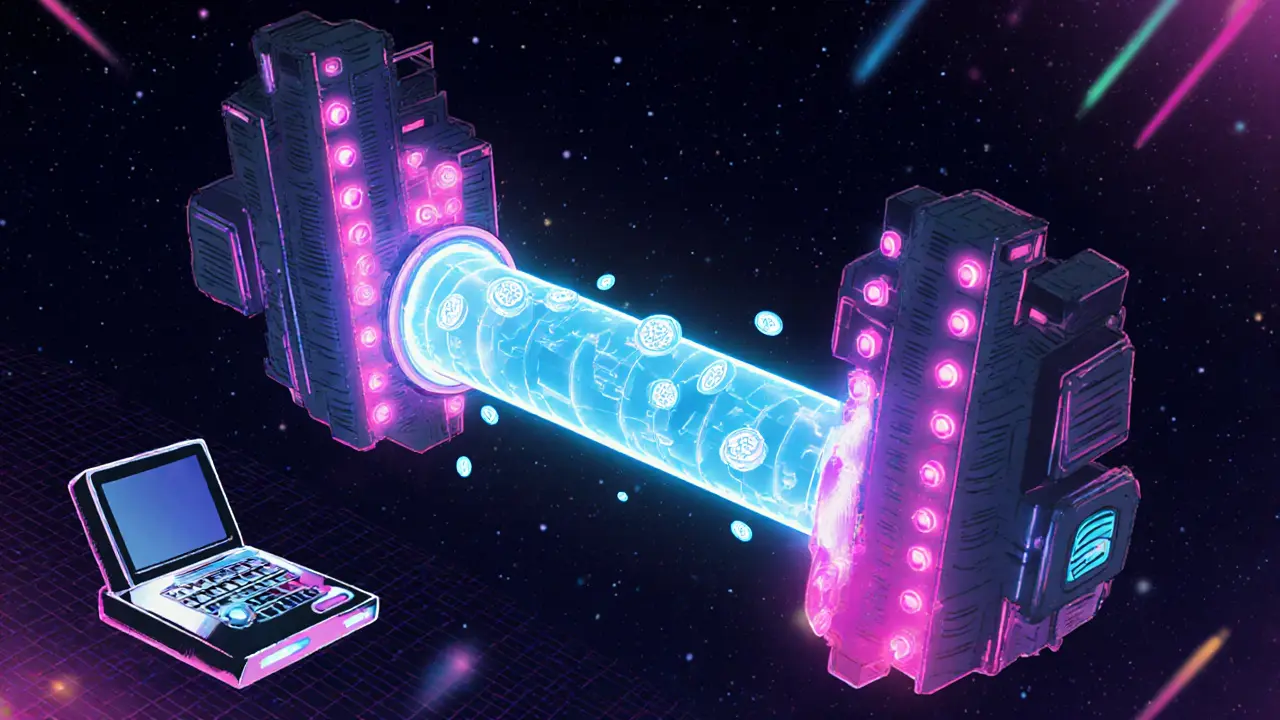

When working with cross‑chain interoperability, the ability for assets, data, and smart contracts to move seamlessly between separate blockchain networks. Also known as inter‑blockchain communication, it creates new use cases by linking ecosystems that would otherwise stay isolated. A key enabler is the blockchain bridge, software that locks assets on one chain and issues equivalent tokens on another. Another common pattern involves wrapped tokens, tokens that mirror the value of an asset from a different chain while staying on the host blockchain. Finally, decentralized exchanges, platforms that trade assets across chains without a central custodian rely on these mechanisms to offer true multi‑chain markets.

Why Cross‑Chain Interoperability Matters

At its core, cross‑chain interoperability solves the problem of siloed blockchains. By allowing tokens to travel, developers can combine the strengths of each network – low fees from one chain, high security from another, or specialized smart‑contract features from a third. This mix‑and‑match approach fuels DeFi products that borrow liquidity across ecosystems, lets NFT creators showcase artwork on multiple marketplaces, and powers gaming worlds that need fast, cheap transactions while still accessing high‑value assets. For example, a DePIN project can use a bridge to pull sensor data from a private ledger onto a public chain where investors trade tokenized infrastructure shares.

Interoperability protocols such as Polkadot, Cosmos, and Axelar provide the underlying messaging layer that makes bridges and wrapped tokens reliable. They define standard formats for cross‑chain messages, handle validator sets, and enforce security checks. Layer‑2 solutions like Optimism or Arbitrum also join the picture: they scale transactions on a base chain while still speaking the same language to other networks via shared roll‑up contracts. When a user swaps a token on Curve on Optimism and then moves the resulting stablecoin to a Binance Smart Chain DEX, the whole flow depends on a combination of bridge contracts, wrapped representations, and protocol‑level messaging.

Security is a constant concern. A faulty bridge can lock up millions, and wrapped tokens inherit risks from both the original and host chains. Audits, multi‑sig governance, and real‑time monitoring are essential. Tools that analyze on‑chain data, such as those covered in our guide on blockchain forensics, help users spot anomalous bridge activity before it spreads. Likewise, understanding how non‑custodial wallets bypass restrictions can protect assets when regulatory climates shift, as shown in our coverage of high‑risk jurisdictions.

The articles below dive into real‑world examples – from the SAKE airdrop that uses wrapped tokens to the Curve review on Optimism that highlights layer‑2 bridge performance. You'll find step‑by‑step guides, deep dives into protocol mechanics, and practical tips for staying safe while moving value across chains. Browse the collection to sharpen your cross‑chain strategy and stay ahead of the fast‑moving interoperability landscape.

Explore the key differences between trusted and trustless blockchain bridges, their security, speed, fees, and when each design is the right choice.

More