Cryptocurrency Compliance

When dealing with cryptocurrency compliance, the practice of meeting legal, regulatory and policy requirements while using, trading or building on digital assets. Also known as crypto compliance, it helps businesses avoid fines and stay trustworthy.

Understanding cryptocurrency compliance starts with knowing the rules that shape the market. Every jurisdiction publishes its own set of crypto regulations, from licensing requirements for exchanges to reporting obligations for traders. These regulations dictate how you can advertise a token, who can hold an account, and what records you must keep. Missing a single filing can trigger penalties, so staying current is non‑negotiable.

One of the most powerful tools in a compliance toolkit is blockchain forensics, the analytical process of tracing transactions on public ledgers to detect illicit activity. Law‑enforcement agencies and compliance teams use it to spot money‑laundering patterns, sanction evasion, and fraud. When you run a wallet service or an exchange, integrating forensic tools means you can flag suspicious transfers before they become a legal headache.

Another pillar is the broader landscape of crypto regulations, the set of laws, guidelines and supervisory measures that govern digital asset activities in a given country. These rules affect everything from token issuance (security vs utility classification) to tax reporting. For example, the U.S. SEC’s focus on securities laws pushes projects to file registration statements, while the EU’s MiCA framework standardizes consumer protection across member states. Knowing which regulation applies to your operation lets you align policies early and avoid costly retrofits.

Compliance isn’t just about paperwork; it also shapes the technology you choose. non‑custodial wallets, wallet solutions where users retain full control of their private keys without a third‑party holding them have become a compliance-friendly option in high‑risk jurisdictions. Since the user holds the keys, the service provider sidesteps many custody regulations and reduces exposure to seizure. However, they still need to implement AML/KYC checks at onboarding and monitor on‑chain activity to stay compliant.

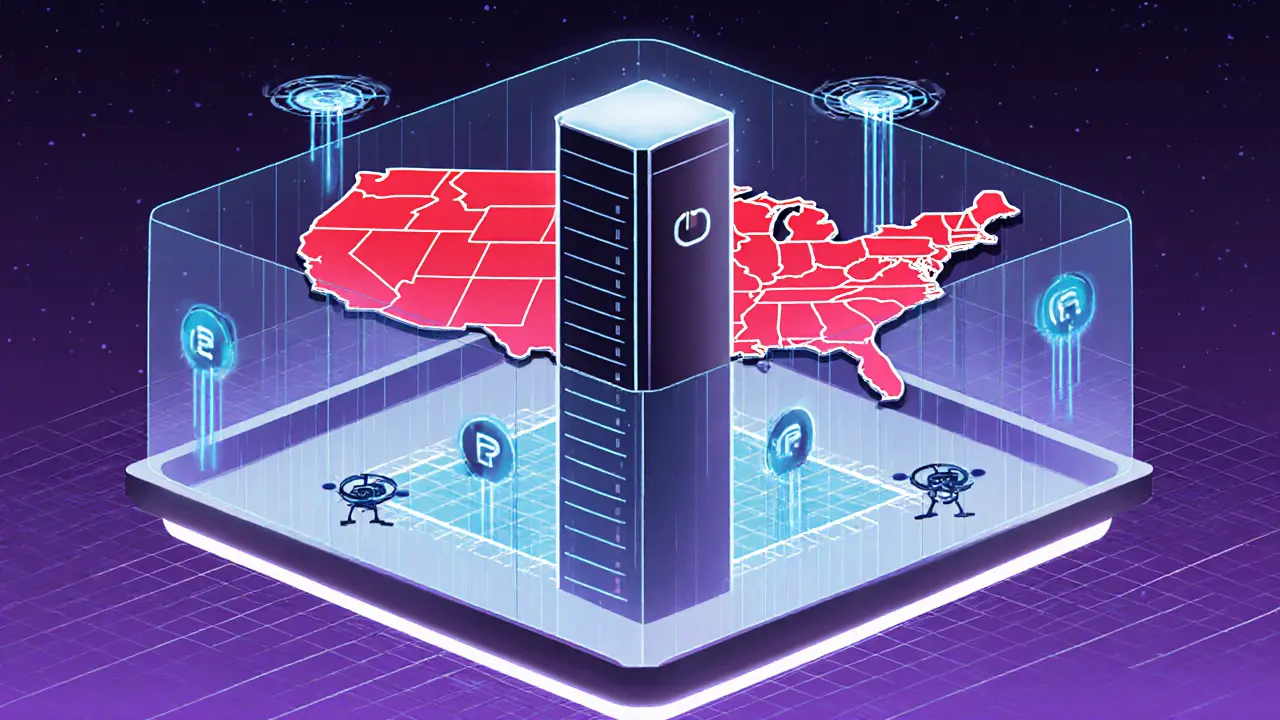

Bringing these pieces together, cryptocurrency compliance encompasses regulatory frameworks, requires blockchain forensics, and influences wallet design choices. It also drives the need for a clear jurisdiction strategy. Companies often pick crypto‑friendly jurisdictions that offer clear tax guidance, supportive banking relationships, and predictable legal environments. This strategic location decision can simplify licensing, lower operational costs, and provide a stable base for global expansion.

In practice, a solid compliance program looks like this: first, map the regulatory requirements of every market you touch; second, embed blockchain forensic tools to monitor transactions in real time; third, offer non‑custodial wallet options where appropriate; and fourth, locate your core operations in a jurisdiction that aligns with your business model. Following this roadmap helps you avoid surprises and builds trust with users, partners, and regulators alike.

Below you’ll find a curated collection of articles that dive deeper into each of these areas—from step‑by‑step airdrop claim guides that respect local laws, to country‑specific bans and how to work around them, to detailed exchange reviews that weigh security against regulatory compliance. Explore the pieces that match your current challenge and keep your crypto activities on the right side of the law.

Explore 2025 privacy coin regulations, focusing on Monero and Zcash restrictions, global compliance rules, and what the future holds for anonymous crypto.

MoreLearn how Bybit blocks US traders using geofencing and VPN detection, why the system can be bypassed, and what future upgrades might mean for crypto traders.

More