Mining: The Core Engine Behind Crypto Networks

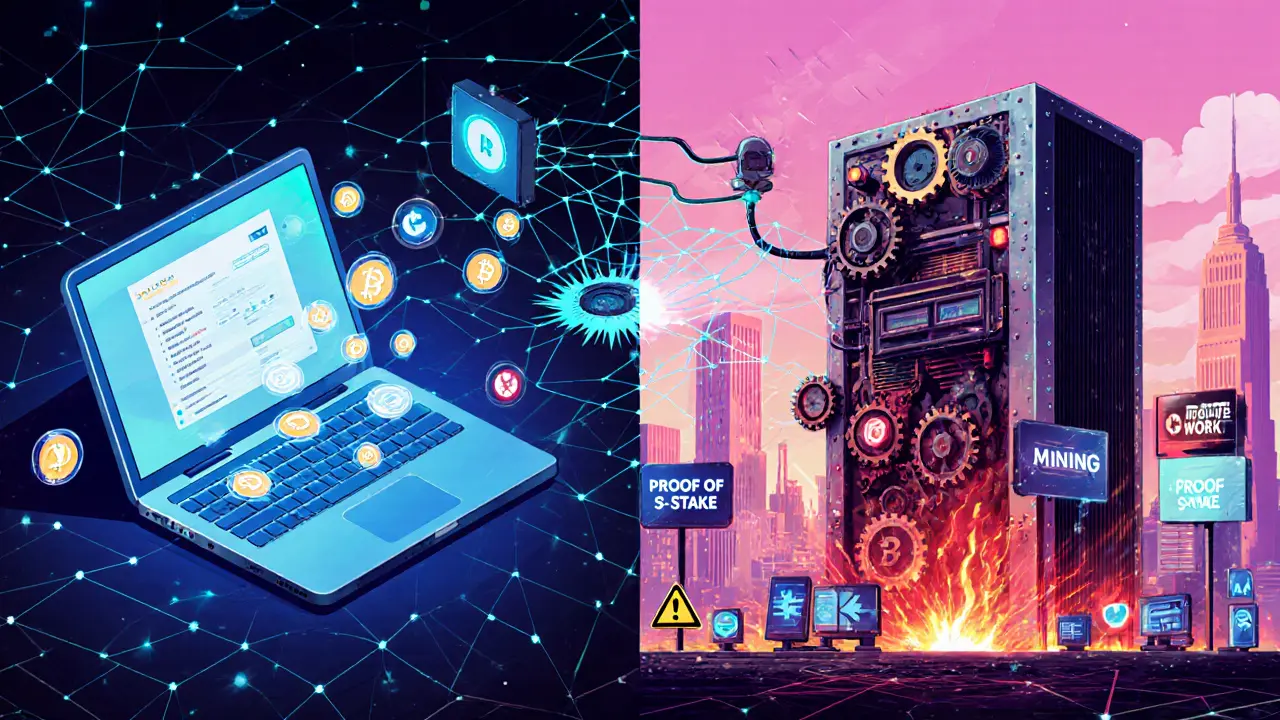

When talking about Mining, the process of validating transactions and creating new units of cryptocurrency by solving computational puzzles. Also known as crypto mining, it fuels network security and token issuance while offering participants a way to earn rewards.

One major offshoot is On-chain Data Mining, the extraction and analysis of transaction data directly from the blockchain. This technique lets analysts spot trends, detect fraud, and gauge market sentiment without relying on third‑party reports. Another cornerstone is Proof of Work, the consensus algorithm that requires miners to perform real computational work to add a block. Proof of Work defines the difficulty curve, secures the ledger, and creates the economic incentive that makes mining viable.

Why Mining Matters Across the Crypto Landscape

Mining encompasses on-chain data mining, which provides raw metrics for blockchain analytics. Those metrics feed into tools that track token velocity, wallet activity, and network health. Proof of Work requires specialized mining hardware—ASICs, GPUs, and increasingly efficient rigs—that transform electricity into hash power. The relationship between hardware efficiency and hash difficulty forms a feedback loop: as more powerful rigs join, the network raises the puzzle difficulty, pushing miners to upgrade or optimize.

Beyond raw security, mining creates tangible economic signals. When hash rates climb, it often signals confidence in a network's future and can push the price upward. Conversely, a sudden drop in hash power may hint at regulatory pressure or energy cost spikes. This cause‑and‑effect dynamic influences traders, investors, and developers alike, making mining a barometer for broader market health.

Practical miners need to navigate several layers: selecting the right consensus model, choosing hardware that balances cost and performance, and staying compliant with regional regulations. For example, some jurisdictions impose heavy taxes on mining profits, while others ban certain energy‑intensive setups outright. Understanding these policy nuances can save time and money, especially for those aiming to scale operations.

On the analytical side, on-chain data mining offers a playbook for anyone wanting deeper insights without a PhD in cryptography. Tools like blockchain explorers, open‑source parsers, and commercial analytics platforms let users pull transaction graphs, calculate average fees, and even model future supply curves. By combining raw mining data with these analytics, you get a full picture of network health and potential investment opportunities.

Security concerns also tie back to mining. A 51% attack—where a single entity controls the majority of hash power—can rewrite recent blocks, double‑spend tokens, and undermine trust. Hence, decentralizing hash power across many miners and locations is a core strategy for network resilience. Mining pools help smaller participants contribute hash power while sharing rewards, but they also concentrate power, creating a trade‑off every community must weigh.

All of these angles—hardware, consensus, analytics, regulation, and security—show why mining isn’t just a technical curiosity; it’s a multi‑faceted discipline that shapes the entire crypto ecosystem. Below you’ll find a curated set of articles that dive deeper into each of these aspects, from step‑by‑step guides on claiming airdrops tied to mining rewards to in‑depth reviews of tools for on‑chain data extraction. Whether you’re a hobbyist looking to set up a home rig or a professional analyst hunting for the next market signal, the collection below offers practical knowledge you can act on right away.

Learn what hash rate is, how it’s measured, why it matters for blockchain security, and how major cryptocurrencies compare.

MoreExplore the differences between staking and mining, covering energy use, hardware costs, rewards, risks, and future trends for blockchain validation.

More