Proof of Stake: How Staking Shapes Modern Crypto

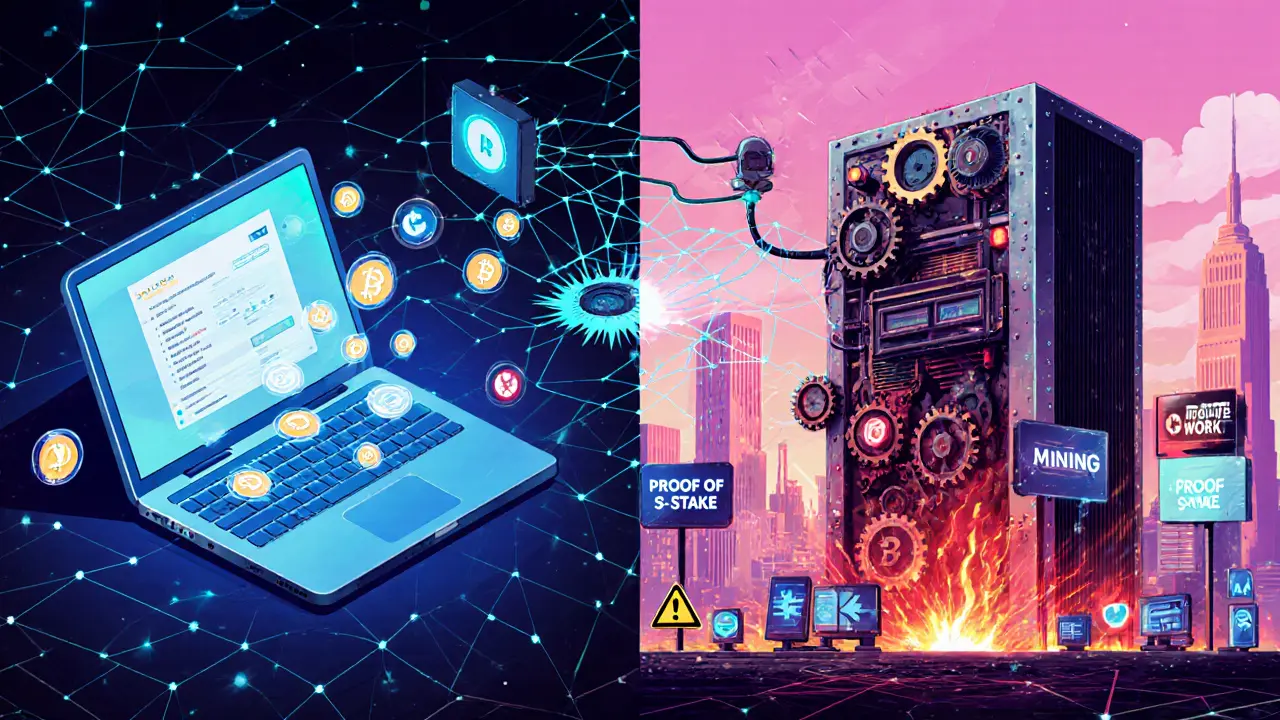

When diving into Proof of Stake, a consensus mechanism where participants lock up crypto to help secure the blockchain. Also known as PoS, it swaps energy‑hungry mining for staking rewards, periodic payouts that incentivize honest validation. Ethereum 2.0, the major upgrade that moved Ethereum from proof‑of‑work to proof‑of‑stake shows how PoS can boost throughput while cutting electricity use. In this model, validators, nodes that lock tokens and propose or attest blocks compete based on stake size rather than raw hash power. This shift means Proof of Stake directly influences network security, token economics, and user participation.

Key Concepts in Proof of Stake

Beyond basic staking, many projects adopt Delegated Proof of Stake, a variant where token holders vote for delegated validators who run the network. Delegation spreads voting power, lowers entry barriers, and creates a market for validator services. The security model relies on two core attributes: economic finality—the cost of losing your staked tokens if you act maliciously—and participation incentives—the reward schedule that balances short‑term returns with long‑term network health. Both attributes tie back to the central idea that the more you stake, the more you have to lose, which aligns interests across the ecosystem. This design also makes PoS attractive for layer‑2 solutions and emerging chains that need fast finality without the energy footprint of proof‑of‑work.

Understanding these mechanics helps you evaluate the dozens of exchange reviews, airdrop guides, and regulatory deep‑dives on this site. Whether you’re eyeing a new token launch or comparing fee structures, the PoS lens reveals how staking incentives shape liquidity, user onboarding, and compliance. Below you’ll find a curated mix of exchange analyses, airdrop walkthroughs, and market insights—all linked by the shared impact of Proof of Stake on today’s crypto landscape.

Explore the differences between staking and mining, covering energy use, hardware costs, rewards, risks, and future trends for blockchain validation.

More