Proof of Work: The Backbone of Crypto Security

When working with Proof of Work, a consensus method where miners solve computational puzzles to add new blocks. Also known as PoW, it powers most early cryptocurrencies and still fuels major networks today.

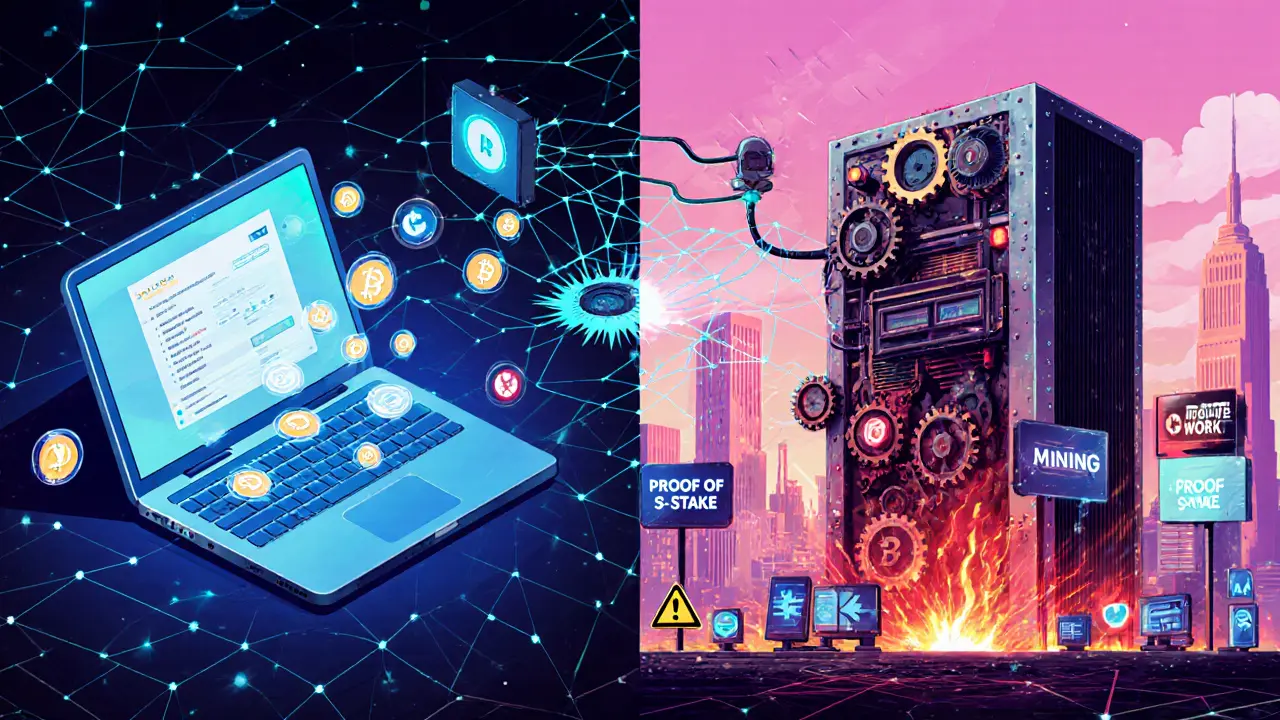

Proof of Work encompasses Mining, the process of using hardware to find hash solutions that meet difficulty targets, which in turn Blockchain, a distributed ledger that records transactions in immutable blocks can safely extend. The relationship is simple: miners compete, the winner adds a block, and the whole network agrees on the new state. This trio—Proof of Work, Mining, Blockchain—forms the core of cryptocurrency consensus.

Key Concepts Linked to Proof of Work

Understanding proof of work is key for anyone diving into crypto. The method requires significant computational power and electricity, making security costly for attackers. As a result, the higher the hash rate, the harder it is to rewrite history. This security model directly influences blockchain resilience against 51% attacks. Projects that prioritize decentralization often stick with PoW because the expense creates a natural barrier to central control.

Two giants illustrate PoW in action. Bitcoin, the first cryptocurrency, uses SHA‑256 hashing and enjoys the highest global hash rate. Its security guarantees stem from millions of miners worldwide, each contributing tiny slices of power. Meanwhile, Ethereum, originally ran on PoW with the Ethash algorithm before its planned shift to proof of stake demonstrated that PoW can support smart contract platforms with high transaction throughput. Both networks show how PoW scales from simple payments to complex decentralized applications.

Beyond the big names, PoW connects to several practical topics covered in our article collection. For example, the “Gas Fees vs Transaction Fees” guide explains why PoW blockchains often charge miners directly for processing, while the “Mastering On‑Chain Data Mining” piece shows how analysts extract PoW‑generated data for market insights. If you’re curious about how government authorities trace illicit activity, the “Blockchain Forensics for Crypto Sanctions Detection” post details how PoW’s transparent ledger aids investigations. Together, these pieces paint a full picture of PoW’s role in security, economics, and regulation.

Whether you’re a beginner trying to grasp why your Bitcoin wallet needs a miner’s fee, or an advanced trader comparing PoW versus proof of stake, the posts below give you step‑by‑step guidance, real‑world examples, and actionable tips. Dive in to explore airdrop strategies, exchange reviews, and jurisdiction advice—all linked by the common thread of proof of work and its impact on the crypto ecosystem.

Learn what hash rate is, how it’s measured, why it matters for blockchain security, and how major cryptocurrencies compare.

MoreExplore the differences between staking and mining, covering energy use, hardware costs, rewards, risks, and future trends for blockchain validation.

More