US Traders: Navigating Crypto Regulation, Airdrops, and Exchange Choices

When working with US traders, individuals or institutions based in the United States who buy, sell, or hold digital assets. Also known as American crypto participants, they must stay aware of shifting legal landscapes. One key element they face is crypto regulation, the set of federal and state rules that define how digital currencies can be traded, taxed, and reported. Because regulations dictate which platforms are accessible, US traders often rely on detailed exchange reviews, comparisons of platforms covering fees, security, and compliance status. Additionally, many chase airdrops, free token distributions that reward eligible wallet holders as a way to boost portfolio returns without extra capital. Recent enforcement trends also highlight the role of blockchain forensics, techniques used by authorities to trace transactions and detect sanctions evasion. Together these factors shape how US traders plan, execute, and protect their crypto activities.

Why These Elements Matter for American Crypto Participants

US traders need to understand that crypto regulation directly influences which airdrops they can claim; some projects restrict rewards to residents of compliant jurisdictions. That relationship forms a semantic triple: "Crypto regulation influences airdrop eligibility for US traders." Exchange reviews become crucial because compliance status determines whether an American can legally open an account, so the triple "Exchange reviews guide US traders in meeting regulatory requirements" holds true. Blockchain forensics adds another layer: authorities use forensic tools to monitor suspicious trades, meaning "US traders must consider blockchain forensics when designing trading strategies." By aligning these three pillars—regulation, airdrops, and platform choice—traders can reduce legal risk, capture free token opportunities, and select safe exchanges. Practical steps include checking the SEC’s latest guidance, signing up for airdrop newsletters that filter by jurisdiction, and reading our in‑depth exchange reviews before depositing funds.

Below you’ll find a curated collection of articles that digs into each of these topics. From a step‑by‑step SAKE airdrop claim guide for SakePerp traders to a breakdown of the 2025 Trump crypto policy reversal, every piece offers actionable insights that US traders can apply right now. Dive in to see how regulation shapes market moves, how to maximize airdrop rewards, and which exchange platforms earn the highest safety scores for American users.

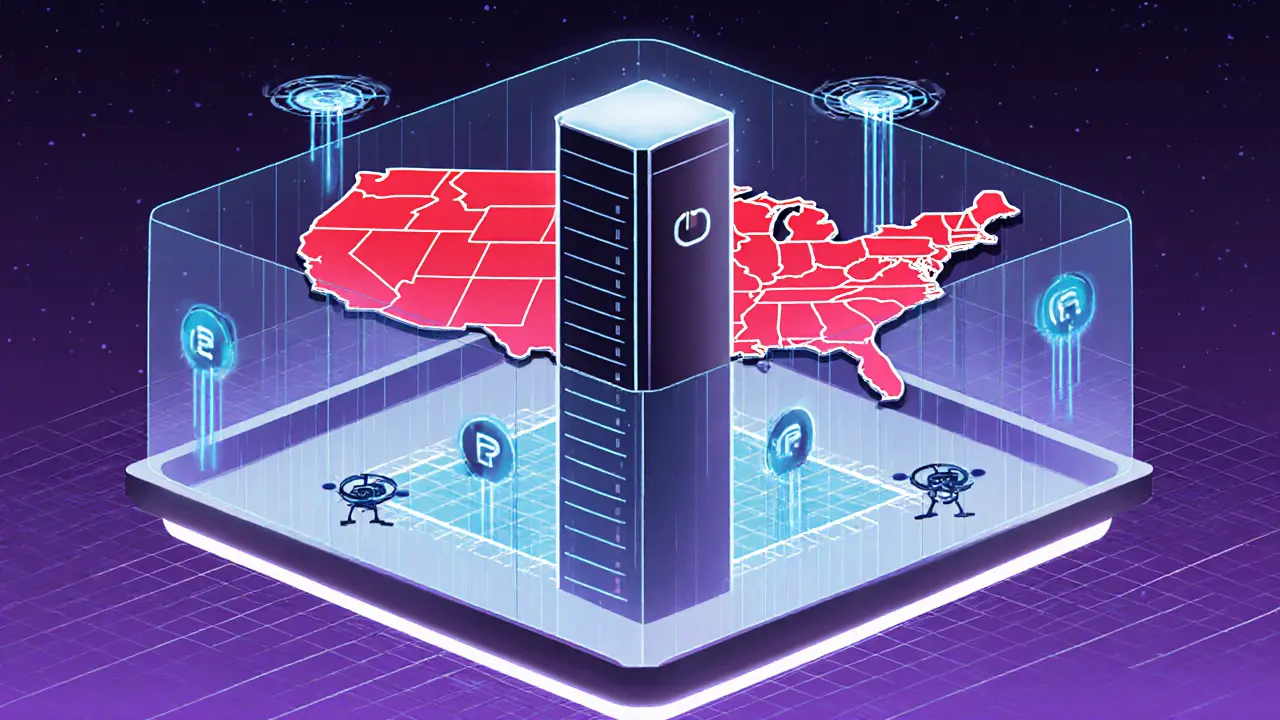

Learn how Bybit blocks US traders using geofencing and VPN detection, why the system can be bypassed, and what future upgrades might mean for crypto traders.

More