Tax Incentive Removal for Crypto Mining in Norway: What Actually Happened

Nov, 13 2025

Nov, 13 2025

Norway Crypto Mining Tax Calculator

Calculate your tax liability for crypto mining in Norway based on the 22% income tax rate. Norway treats mining rewards as regular business income, with deductions for legitimate expenses.

Note: In Norway, mining rewards are taxed at the time of receipt at the current NOK value. You can deduct legitimate business expenses including electricity costs, hardware depreciation, and cooling systems.

Tax Calculation Summary

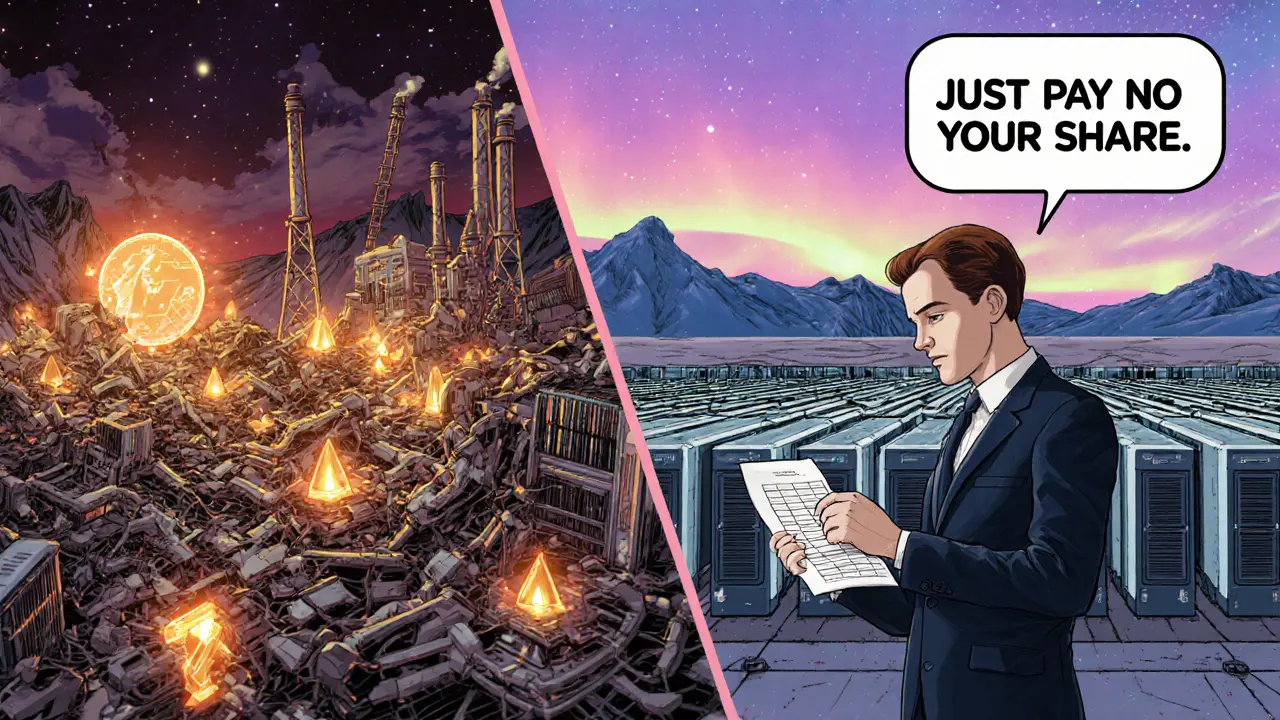

There’s a rumor going around that Norway removed tax incentives for crypto mining. If you’re a miner, an investor, or just someone tracking global crypto policy, you’ve probably heard it. But here’s the truth: Norway never had tax incentives for crypto mining to begin with. So nothing was removed. What changed isn’t a policy reversal-it’s a misunderstanding.

How Norway Taxes Crypto Mining Right Now

Norway treats crypto mining like any other business activity. If you mine Bitcoin, Ethereum, or any other coin, the rewards you earn are taxed as income. The rate? A flat 22%. That’s it. No discounts. No exemptions. No special breaks.

When you mine a coin, you don’t wait until you sell it to pay taxes. You pay when you receive it. The Norwegian Tax Administration (Skatteetaten) requires you to record the Norwegian Krone (NOK) value of each coin at the exact moment it hits your wallet. If you mine 0.1 BTC when it’s worth 50,000 NOK, you owe tax on 50,000 NOK of income-even if the price drops to 30,000 NOK the next day.

But here’s the fair part: you can deduct your real costs. That includes electricity bills, cooling systems, hardware depreciation, and even software licenses. Equipment like ASIC miners can be depreciated at 30% per year. So if you spent 1 million NOK on mining rigs, you can deduct 300,000 NOK in the first year, then 210,000 NOK the next, and so on. That’s not a subsidy-it’s standard business accounting.

Why People Thought There Were Incentives

Norway’s crypto mining scene grew fast in the late 2010s. Why? Because of cheap, clean energy-not tax breaks.

The country generates over 98% of its electricity from hydropower. That means power is abundant and inexpensive. Miners flocked to places like Bodø and Tromsø, where electricity costs as low as 0.03 NOK per kWh. That’s less than half the average in Germany or the U.S. Miners didn’t need tax incentives-they needed power, and Norway had it.

Some early miners assumed low energy prices meant government support. Others saw news about crypto-friendly policies and assumed that included tax breaks. But Norway’s stance has always been: you pay your fair share, just like any business. No special treatment. No hidden subsidies.

What About Other Crypto Income? Staking, Trading, Spending

It’s not just mining. All crypto activity is taxed under the same rules.

- Staking rewards = taxed as income at 22%, same as mining.

- Trading crypto for other crypto = capital gain, taxed at 22% when you swap.

- Using Bitcoin to buy a laptop = taxable event. You’re selling crypto, so you owe capital gains on the difference between what you paid for it and its value at purchase time.

- Holding crypto = subject to annual wealth tax if your total crypto holdings exceed 1.7 million NOK (as of 2025). That’s about $160,000 USD.

Losses can be carried forward. If you lose money trading, you can use those losses to reduce your taxable gains in future years. That’s a relief, not a reward.

Is Norway Trying to Push Miners Out?

No. And here’s why that matters.

Norway doesn’t need to. Crypto mining makes up just 0.5% of its GDP and uses about 1% of its total electricity. That’s small. The country doesn’t see mining as a strategic industry-it’s just another business. And it’s regulated like one.

There’s no ban. No licensing requirement. No cap on hash rate. No environmental penalty. Miners can set up shop anywhere, as long as they pay taxes and follow standard business rules. The government even has a FinTech sandbox to test new financial tech-though crypto projects haven’t rushed into it. That’s not because of hostility. It’s because Norway’s system is already clear and predictable.

Compare that to countries like Kazakhstan or Russia, where rules change overnight. Or the U.S., where states fight over whether crypto is property or currency. Norway doesn’t play games. It just says: earn it, report it, pay it.

What Miners Actually Face Today

It’s not about tax incentives being removed. It’s about rising costs and falling rewards.

Bitcoin’s halving in 2024 cut block rewards in half. ASIC miners are more expensive. Electricity prices, while still low, have crept up slightly due to grid maintenance and climate-related strain on hydropower reservoirs. The cost of cooling in Arctic winters isn’t negligible either.

Miners who thought they’d profit forever are now realizing: it’s a business, not a lottery. Those who invested in efficient hardware, optimized cooling, and kept accurate records are still profitable. Those who bought cheap gear and hoped for tax breaks? They’re gone.

The real story isn’t policy change. It’s market correction.

Reporting Requirements and Deadlines

If you’re mining in Norway-or even just holding crypto as a resident-you must file a tax return by April 30 each year. For the 2025 return, you report your crypto holdings as of December 31, 2024. That includes every wallet, exchange, and cold storage device.

Skatteetaten doesn’t ask for transaction histories. But they do ask for the total value of each coin you held on that date. If you can’t prove your cost basis, they’ll assume you bought at the highest price in the year. That’s how they prevent underreporting.

Miners who keep spreadsheets with timestamps, NOK values, and receipts for equipment are fine. Those who guess? They risk penalties.

What This Means for Global Miners

Norway isn’t shutting down mining. It’s just not giving away free money.

Other countries are watching. Estonia, Sweden, and Canada are all reviewing their crypto tax models. Norway’s approach-simple, transparent, no special favors-is becoming a model for responsible regulation. It doesn’t attract hype. But it attracts long-term operators.

If you’re thinking of moving your mining operation to Norway, don’t expect a handout. Expect a spreadsheet. And a 22% tax bill.

But if you’re serious about running a clean, efficient, legal mining business? Norway still offers one of the most stable environments in the world. No gimmicks. No sudden bans. Just clear rules and cheap power.

The myth of tax incentives being removed? It’s just noise. The real story is simpler: Norway never gave them in the first place.

Did Norway remove tax incentives for crypto mining?

No. Norway never had tax incentives for crypto mining. The country has always taxed mining rewards as regular income at a flat 22% rate. There were no special deductions, credits, or exemptions to remove. The idea that incentives were removed is a misconception based on confusion between low electricity costs and tax policy.

How is crypto mining taxed in Norway today?

Mining rewards are taxed as income at a flat rate of 22%. You pay tax on the Norwegian Krone (NOK) value of the coins when you receive them. You can deduct legitimate business expenses like electricity, hardware depreciation (30% per year), and software. Staking rewards are taxed the same way.

Why did crypto mining grow in Norway if there were no tax breaks?

Because of cheap, renewable electricity. Over 98% of Norway’s power comes from hydropower, making electricity among the cheapest in Europe. Miners came for low energy costs, not tax breaks. The country’s stable grid and clean energy made it attractive for energy-intensive operations.

Are there any limits on how much crypto mining you can do in Norway?

No. There are no legal limits on hash rate, number of miners, or electricity usage. As long as you report your income, pay taxes, and follow standard business rules, you can operate at any scale. The government doesn’t restrict mining-it just requires transparency.

What happens if I don’t report my crypto mining income in Norway?

The Norwegian Tax Administration can impose penalties of up to 40% of the unpaid tax, plus interest. They cross-check data from exchanges, blockchain analytics firms, and bank transfers. If you can’t prove your cost basis, they’ll assume you bought at the highest market price during the year, leading to higher taxes. Filing accurately avoids fines and audits.

Is crypto mining still profitable in Norway in 2025?

It depends. For operators with efficient hardware, low-cost power, and good cooling systems, yes. After the Bitcoin halving in 2024, rewards dropped by half, so profitability is tighter. Miners using older ASICs or paying higher electricity rates are struggling. The key is efficiency, not tax breaks.

Do I need to register my mining business in Norway?

Not specifically for mining. But if you’re operating as a business (not just a hobby), you must register with the Brønnøysund Register Centre and get a Norwegian organization number. This lets you claim business deductions and issue invoices. Hobby miners still report income but don’t need formal registration.

How does Norway’s crypto tax system compare to the U.S. or EU?

Norway is simpler. The U.S. taxes mining as income but has complex state-level rules and no national wealth tax. The EU varies by country-some tax staking as income, others as capital gains. Norway applies one flat 22% rate to mining and staking, with clear rules on depreciation and reporting. It’s less flexible but far more predictable.

Can I use crypto losses to reduce my tax bill in Norway?

Yes. Capital losses from selling or trading crypto can be used to offset capital gains in the same year. Any unused losses can be carried forward indefinitely to reduce future gains. This applies to mining too-if you sell mined coins at a loss, you can use that to lower your overall tax burden.

What’s the future of crypto mining in Norway?

It will continue, but only for professional operators. As rewards shrink and hardware costs rise, hobby miners are leaving. The country’s stable tax system, clean energy, and rule of law make it a reliable base for serious mining businesses. Expect consolidation, not expansion. Norway won’t chase hype-it will support efficiency.