Uniswap v2 on Arbitrum: A Practical Review for Crypto Traders in 2025

Dec, 2 2025

Dec, 2 2025

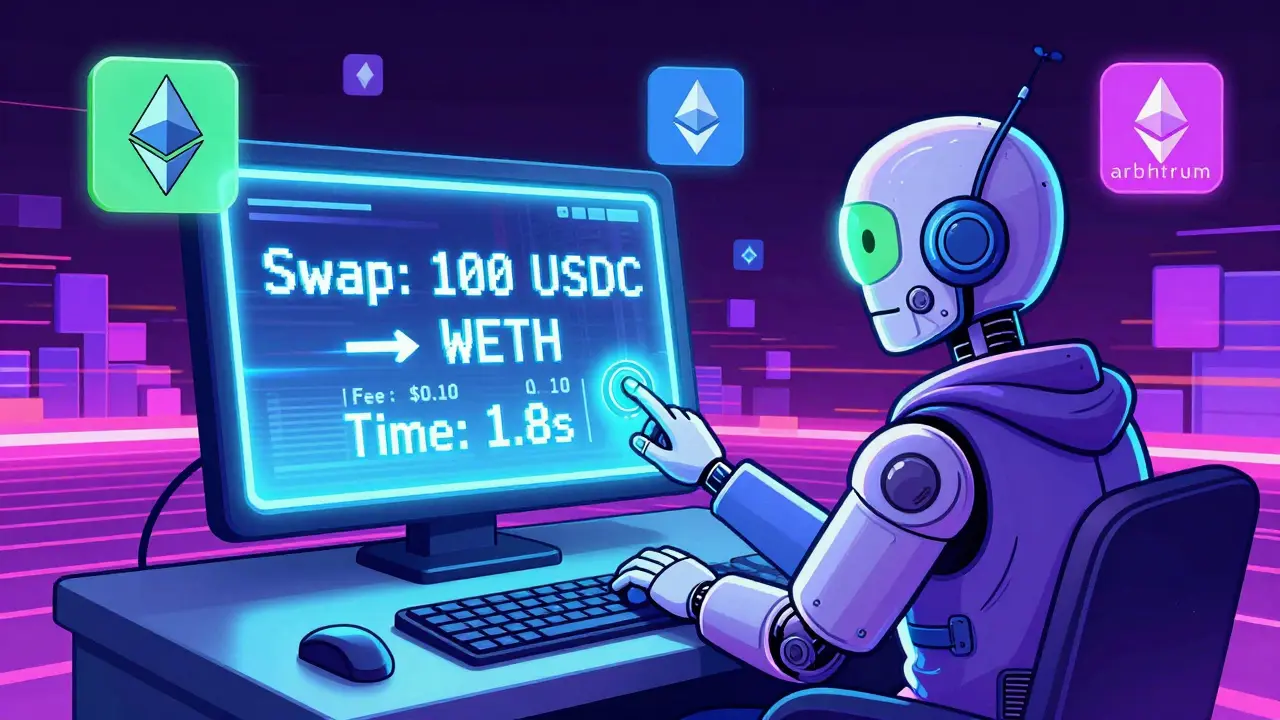

Uniswap v2 on Arbitrum isn’t a separate app. It’s not a new platform you download. It’s the same Uniswap you know - but running on Arbitrum, one of the fastest and cheapest Layer-2 networks for Ethereum. If you’ve ever paid $50 in gas to swap two tokens on Ethereum mainnet, you already know why this matters. On Arbitrum, that same swap costs less than 50 cents. And it finishes in under two seconds.

What Uniswap v2 on Arbitrum Actually Is

Uniswap v2 is the older version of the world’s most-used decentralized exchange. It launched in 2020 and uses a simple constant product market maker model: x * y = k. That means prices adjust automatically based on how much of each token is in the pool. No order books. No middlemen. Just code.

Arbitrum, launched in 2021, is a Layer-2 solution built to fix Ethereum’s slow speeds and high fees. It uses something called Optimistic Rollups. Think of it like bundling hundreds of transactions into one big one that gets posted to Ethereum. The result? Transactions are 10x faster and 90% cheaper.

Uniswap v2 on Arbitrum is just Uniswap v2 deployed on this faster chain. It doesn’t have the fancy concentrated liquidity of v3. But it’s simpler, more predictable, and still handles billions in daily volume. In 2025, over 40% of Uniswap’s total trading volume happens on Layer-2 networks - and Arbitrum takes the lion’s share.

Why It’s Better Than Uniswap on Ethereum Mainnet

Let’s say you want to swap 100 USDC for WETH. On Ethereum mainnet, you’d pay $15-$30 in gas during peak times. On Arbitrum? You’ll pay around $0.10. That’s not a small difference - it’s the difference between trading regularly and only trading when you’re desperate.

Speed matters too. On Ethereum, your transaction might sit in the mempool for 10-30 minutes if the network is congested. On Arbitrum, it’s confirmed in 2-5 seconds. No guessing. No refreshing. You click swap, you see your tokens in your wallet, and you move on.

And the liquidity? It’s deep. The WETH/USDC pool on Arbitrum holds over $1.2 billion as of August 2025. That’s more than most centralized exchanges. You can swap $50,000 in one go without moving the price more than 0.5%. That’s not possible on smaller DEXs.

How Fees Work (And Why They’re Hidden)

Uniswap v2 doesn’t show you the fee upfront. You just see the amount you’re swapping and the amount you’ll get. But behind the scenes, every trade has a 0.3% fee built in. That’s standard for most token pairs. Stablecoins like USDC/USDT? Those are 0.05%. Exotic tokens? Up to 1%.

On Arbitrum, that 0.3% fee still applies - but the gas cost is so low that you barely notice it. If you’re swapping $1,000, you pay $3 in trading fees. On Ethereum, you’d pay $3 + $20 in gas. On Arbitrum, you pay $3 + $0.10. That’s why traders who do small, frequent swaps - like arbitrageurs or yield farmers - prefer Arbitrum.

There’s one catch: Uniswap v2 doesn’t let you choose the fee tier. It’s locked in. That’s why v3 exists. But if you’re not trying to optimize every penny, v2’s simplicity is a feature, not a bug.

How to Use It (Step by Step)

Using Uniswap v2 on Arbitrum is almost identical to using it on Ethereum. Here’s how:

- Connect your wallet (MetaMask, WalletConnect, or Coinbase Wallet work best).

- In MetaMask, switch your network to Arbitrum One. If you don’t see it, add the network manually: Network Name: Arbitrum One, RPC URL: https://arb1.arbitrum.io/rpc, Chain ID: 42161.

- Go to app.uniswap.org. The interface will auto-detect Arbitrum.

- Click “Swap.” Enter the token you want to sell and the amount.

- Select the token you want to buy. The app will show you the rate and estimated fee.

- Click “Swap.” Confirm in your wallet. That’s it.

That’s it. No extra steps. No confusing menus. The interface is clean, responsive, and works even on older phones. You don’t need to learn anything new.

What You Can Trade

Uniswap v2 on Arbitrum supports every ERC-20 token that’s been bridged to Arbitrum. That includes:

- WETH (wrapped Ethereum)

- USDC, USDT, DAI (stablecoins)

- ARB (Arbitrum’s native token)

- WBTC (wrapped Bitcoin)

- DOGE, SHIB, PEPE (memecoins)

- Thousands of lesser-known tokens from DeFi projects

Want to trade a new token? Just search for it. If there’s a liquidity pool, you can swap. If not, you can’t - and that’s by design. No random tokens. No rug pulls (unless someone creates a pool and runs - but that’s true everywhere).

Uniswap doesn’t list tokens. The community does. Anyone can create a liquidity pool. That’s the power of open finance.

Security and Risks

Uniswap v2’s code has been audited, tested, and used for over 5 years. It’s one of the most battle-tested smart contracts in crypto. There are no backdoors. No admin keys. No CEO who can freeze your funds.

But here’s what you need to watch:

- Slippage: If you’re swapping a low-liquidity token, set your slippage to 1-2%. If it’s a meme coin with $50k in liquidity, go higher - 5-10%. Otherwise, you might get ripped off.

- Scam tokens: If a token has no website, no team, and 10 million holders, it’s probably a scam. Don’t trade it unless you’re gambling.

- Approval scams: Never approve a token for unlimited spending unless you trust the contract. Always check the address. Fake sites copy Uniswap’s design. Bookmark the real one: app.uniswap.org.

- Network delays: Arbitrum is fast, but not instant. If your transaction says “pending” for more than 10 minutes, check Arbitrum’s block explorer. It might be stuck.

There’s no insurance. No FDIC. If you lose your private key, your tokens are gone. That’s crypto. But the platform itself? It’s as secure as they come.

Uniswap v2 vs v3 on Arbitrum

Uniswap v3, launched in 2021, lets you concentrate your liquidity within custom price ranges. That means you can earn more fees with less capital. It’s great for professionals.

But v3 is complex. You need to understand price ranges, tick spacing, and impermanent loss. If you’re new, you’ll make mistakes. You’ll end up with your tokens stuck outside your desired range and earning nothing.

v2? You just deposit, and it works. No tuning. No monitoring. You get the same 0.3% fee, and your liquidity is always active. For most users - especially those doing occasional swaps - v2 is the better choice.

And here’s the kicker: v2 still handles more daily volume than v3 on Arbitrum. Why? Because simplicity wins.

Who Should Use It?

Uniswap v2 on Arbitrum is perfect for:

- Traders who swap tokens regularly and hate paying high gas fees

- People who want to avoid the complexity of v3

- Users who trade stablecoins or major tokens like ETH, WBTC, or ARB

- Anyone who values speed and reliability over advanced features

It’s not for you if:

- You’re trying to earn yield by providing liquidity - use v3 or a yield aggregator

- You’re trading obscure tokens with tiny pools - you’ll get bad prices

- You expect instant fiat on-ramps - you still need a centralized exchange to buy crypto with a credit card

What’s Next for Uniswap on Arbitrum?

Uniswap Labs has shifted focus to v3 and multi-chain expansion. That means v2 on Arbitrum won’t get new features. But it won’t die either. It’s too stable, too popular, and too cheap to shut down.

Arbitrum itself is evolving. The upcoming Stylus upgrade will let developers build smart contracts in Rust and C++, not just Solidity. That could bring in new projects - and more liquidity - to Uniswap’s pools.

Meanwhile, Arbitrum’s DAO is distributing more rewards to liquidity providers. In 2024, incentive programs boosted TVL on Arbitrum by $6 million per day on average. That trend is continuing.

So while Uniswap v2 might not be flashy, it’s not going anywhere. It’s the quiet workhorse of the Arbitrum ecosystem.

Final Verdict: Should You Use It?

Yes - if you’re trading on Ethereum, you’re paying too much. Uniswap v2 on Arbitrum is the easiest, cheapest, and most reliable way to swap tokens right now.

It’s not perfect. The interface doesn’t show you every detail. You can’t customize fees. You can’t earn yield. But for 90% of users, you don’t need those things. You just need to swap tokens quickly, safely, and cheaply.

And on those three things? Uniswap v2 on Arbitrum delivers better than almost any other exchange - centralized or decentralized.

If you’ve been waiting to try a DEX, this is the one to start with. No hype. No fluff. Just fast, cheap swaps.