Meshswap Crypto Exchange Review: Is This DeFi Platform Still Worth It in 2025?

Dec, 10 2025

Dec, 10 2025

MESH Staking Return Calculator

Estimate potential returns from staking MESH tokens on Meshswap based on current market conditions. Note: Staking rewards are extremely low and often not worth the gas fees.

Estimated Returns

Current Market ConditionsCalculate your potential returns from staking MESH tokens on Meshswap

Enter values to see if staking is profitable

When you hear "crypto exchange," you probably think of Binance, Coinbase, or even Uniswap. But what about Meshswap? It’s not on most people’s radar anymore - and for good reason. Launched as a DeFi hub on Polygon, Meshswap promised a self-sustaining economy powered by its native token, MESH. But today, that dream looks more like a ghost town.

What Is Meshswap, Really?

Meshswap isn’t just another DEX. It was built to be a full DeFi ecosystem: swap tokens, lend, farm with leverage, and stake - all on Polygon. The idea was simple: reward users with MESH tokens for using the platform, and let those same token holders vote on how the system evolves. No private sale. No insider dumps. Everyone had to earn their MESH by providing liquidity. That’s rare in crypto, and it sounded fair. But fairness doesn’t mean success.The MESH Token: A Collapse in Plain Sight

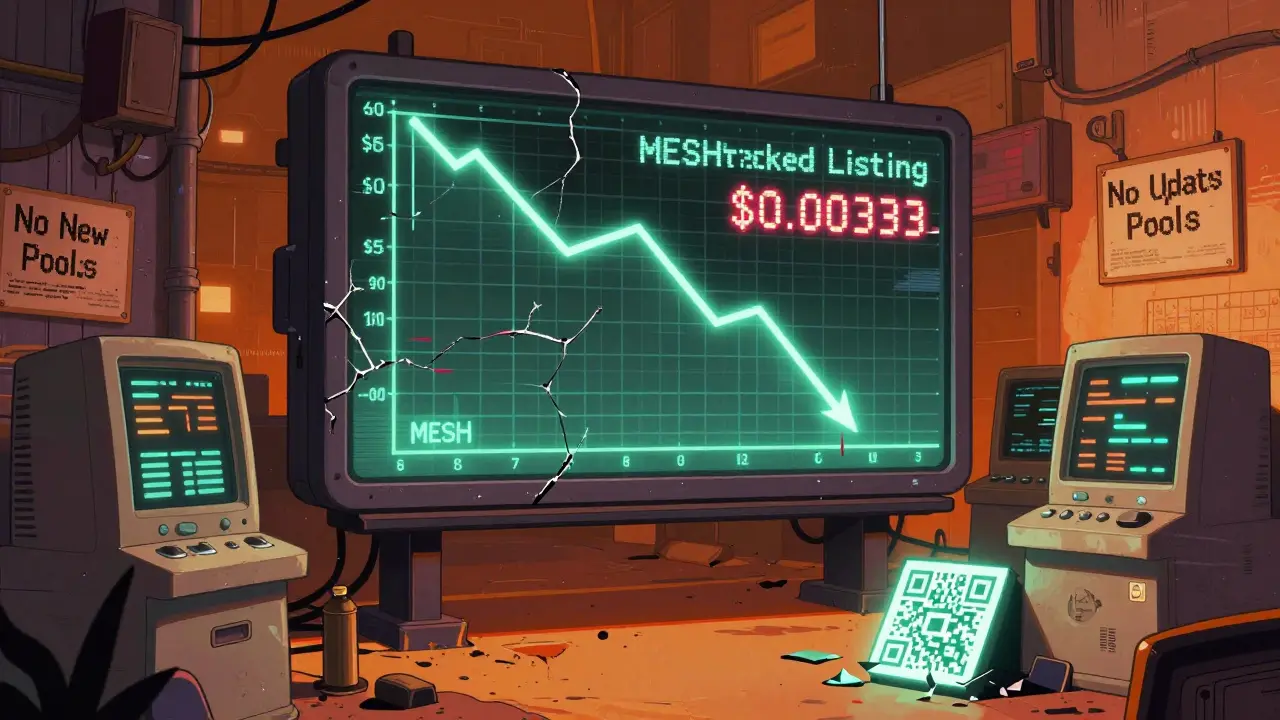

The MESH token was the heartbeat of the whole system. At its peak in June 2022, it hit $5.01. Today? It’s trading around $0.0033. That’s a 99.9% drop. That’s not a correction. That’s a collapse. The total supply is 122.94 million MESH, but only about 71 million are circulating. Sounds healthy? Not when the 24-hour trading volume is under $1,500. That’s less than what a single whale might move on Uniswap. The MESH/USDC.E pair makes up just over half of that volume - and even that’s barely moving. Why does this matter? Because the whole economic model depends on activity. More trades = more fees = more MESH rewards. But with no users, the rewards dried up. And when rewards stop, people leave. And when people leave, the token drops further. It’s a death spiral.How MESH Was Supposed to Work - And Why It Didn’t

Meshswap’s tokenomics were clever on paper. Here’s how it was meant to function:- You provide liquidity → earn MESH rewards

- You stake MESH → earn more MESH from inflation

- You vote on proposals → control how rewards are distributed

- You pay to create new farming pools → MESH gets burned → scarcity increases

Trading on Meshswap: Slow, Quiet, and Untracked

You can still trade MESH on Meshswap’s own DEX. The two main pairs are MESH/USDC.E and MESH/WPOL. But here’s the kicker: CoinMarketCap labels Meshswap as an “Untracked Listing.” That’s not a technical glitch. That’s a red flag. CoinMarketCap only lists exchanges that meet strict criteria for transparency and volume reliability. If they don’t track you, it means your data doesn’t meet the bar. Either the volume is fake, or it’s too low to matter. In this case, it’s the latter. Compare that to Uniswap, which processes billions in daily volume. Or even Symbiosis.finance, which swaps tokens in under a minute. Meshswap? It doesn’t even rank among the fastest DeFi platforms. Speed matters when gas fees are low and users expect instant trades. Meshswap doesn’t deliver on that.

What Do the Predictions Say?

Crypto analysts are divided - but mostly pessimistic. - WalletInvestor thinks MESH might hit $0.0013 by end of 2025. That’s a 40% gain. But it’s still 99.6% below its peak.Where’s the Team? The Updates? The Community?

Here’s what’s missing: any sign of active development. No GitHub commits in months. No Twitter updates. No Medium posts. No Discord activity worth mentioning. No press releases. No roadmap changes. Nothing. In crypto, silence is death. Projects that stop communicating lose trust fast. And without trust, even the best code is worthless. Compare this to Uniswap or Aave - they post weekly updates, share governance results, and respond to community feedback. Meshswap? Radio silence.Is Meshswap Safe?

No public audit reports are available. No security disclosures. No bug bounty program listed. That’s a huge red flag for any DeFi platform. If you’re locking up your funds in a smart contract, you need to know it’s been tested. Polygon is secure. But Meshswap’s code? Unknown. That’s like buying a car with no inspection report - it might run, but you have no idea if the brakes work.

Who Is This For?

Honestly? No one. If you’re looking for a high-yield DeFi platform in 2025, Meshswap is not it. The yields are negligible. The liquidity is thin. The token is dying. The team is gone. It’s not a scam - there’s no evidence of fraud. But it’s not a functioning project either. It’s a relic.What Are the Alternatives?

If you want to trade on Polygon, here are better options:- QuickSwap: Higher volume, active development, solid UI.

- Uniswap (Polygon): The gold standard. Reliable, audited, widely used.

- SushiSwap: Strong community, governance, and liquidity incentives.

- Curve Finance: Best for stablecoin swaps with low slippage.

The Bottom Line

Meshswap was a bold experiment. It had a fair launch, a unique tokenomics model, and a clear vision. But vision without execution is just a dream. Today, Meshswap is a cautionary tale. A project that started with promise but faded into obscurity because no one was left to use it - and no one was left to build it. Don’t invest in MESH. Don’t stake your tokens. Don’t even bother swapping. If you’re looking for DeFi on Polygon, go where the liquidity is. Go where the updates are. Go where the community still talks. Meshswap? It’s not dead - it’s just forgotten.Is Meshswap still operational in 2025?

Yes, technically. The smart contracts are still live, and you can still swap MESH on its DEX. But there’s almost no trading volume, no new features, no team updates, and no community activity. It’s a shell of its former self.

Can I still earn rewards by staking MESH?

You can still stake MESH, but the rewards are nearly worthless. With daily trading volume under $1,500, the inflation payouts have shrunk to fractions of a cent. The cost to stake (gas fees, time, risk) far outweighs any return.

Why did MESH crash so hard?

MESH crashed because the entire ecosystem depended on user activity to drive demand. When trading volume dropped, rewards dried up. Users left. More users left. The token lost its utility, and without utility, it lost all value. The fair launch didn’t save it - the lack of ongoing development did.

Is Meshswap safe to use?

No public audit reports exist for Meshswap’s smart contracts. While Polygon is secure, the protocol’s code has never been independently verified. Without transparency, there’s no way to know if your funds are at risk of exploits or rug pulls. Avoid it unless you’re willing to lose your money for the sake of experimentation.

Should I buy MESH as a long-term investment?

Not unless you’re gambling. Even the most optimistic price forecasts show MESH staying under $0.002 in 2026 - a fraction of its original value. There’s no fundamental reason to believe it will recover. No team, no users, no innovation. It’s a dead asset.

What happened to the Meshswap team?

No one knows. The team vanished. Their social media accounts went silent after 2023. There are no GitHub commits, no Discord announcements, no press releases. In crypto, this is called a “dead project.” It’s not officially shut down - it’s just abandoned.

Can I withdraw my MESH from Meshswap?

Yes, you can withdraw your MESH tokens at any time. But there’s no guarantee you’ll find buyers. With such low volume, you may have to sell at a steep discount - or wait weeks for a trade to fill. Liquidity is extremely thin.

Are there any positive signs for Meshswap?

No. There are no recent updates, no community growth, no new partnerships, and no development activity. Even in a bull market, MESH hasn’t recovered. That’s not a sign of potential - it’s a sign of failure.