Arbitrum DEX: What It Is and Why It Matters for Crypto Traders

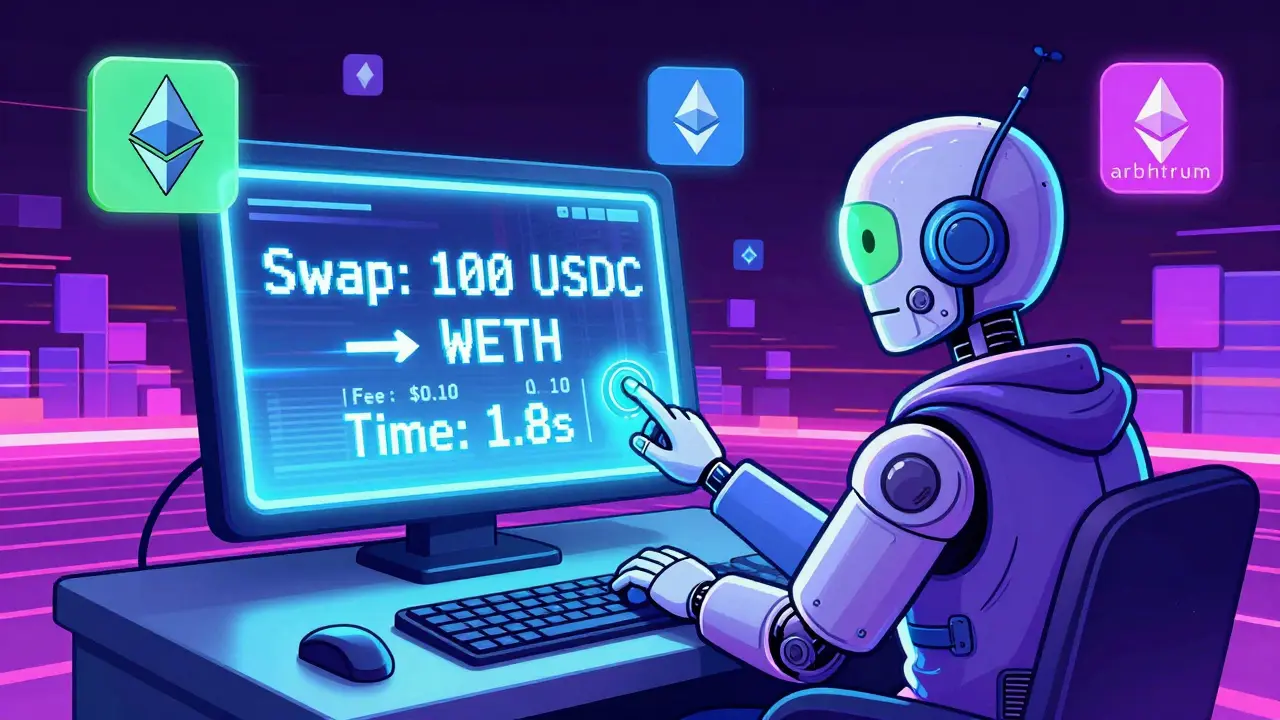

When you trade crypto on a Arbitrum DEX, a decentralized exchange built on Arbitrum, a Layer 2 scaling solution for Ethereum. Also known as Arbitrum One, it lets users swap tokens without relying on banks or middlemen—just code, wallets, and crypto. Unlike older exchanges that feel slow and expensive, Arbitrum DEX runs on a system that handles hundreds of transactions per second while keeping fees under a dollar. It’s not a new blockchain—it’s a smarter layer on top of Ethereum, fixing its biggest problems: high gas fees and sluggish speed.

Arbitrum DEX isn’t just about speed. It’s built for people who trade often—whether you’re swapping ETH for USDC, farming yield, or testing new tokens. Behind the scenes, it uses Layer 2 blockchain, a technology that processes transactions off the main Ethereum chain to reduce congestion and then bundles them back in a way that’s secure and verifiable. This means you get the safety of Ethereum’s network without the cost. It also connects to tools like MetaMask and WalletConnect, so you don’t need to learn anything new. If you’ve used Uniswap or SushiSwap before, you’ll feel right at home—just faster and cheaper.

What makes Arbitrum DEX stand out isn’t just the tech—it’s who’s using it. Traders are moving away from centralized exchanges because they’re tired of frozen funds, sudden delistings, and opaque rules. With Arbitrum DEX, you hold your keys, you control your trades, and you’re not at the mercy of a company’s policy change. It’s also where new tokens launch—not because they’re hype-driven, but because the infrastructure supports real volume. Projects like GMX, ZyberSwap, and Aerodrome built their entire user base here because they needed low-cost, high-throughput trading. And when you look at the data, Arbitrum DEX handles more daily volume than most Layer 1 blockchains.

But it’s not perfect. Some tokens on Arbitrum DEX are risky. You’ll find meme coins with no liquidity, fake projects, and scams that look real. That’s why knowing how to check token contracts, track trading volume, and spot rug pulls matters more here than anywhere else. You’re not protected by a customer service team—you’re on your own. That’s the trade-off for freedom. And if you’ve ever lost money on a bad trade because the network was clogged or fees spiked, Arbitrum DEX is the fix you’ve been waiting for.

What you’ll find in this collection isn’t just theory. These posts show you what’s actually happening on Arbitrum DEX right now: how traders are using it to avoid bank freezes, how liquidation engines behave under pressure, why some airdrops fail even on fast chains, and how digital signatures keep everything secure. You’ll see real examples—like how a $4 billion capital flight happened on crypto networks, or how a dead token like POUPE still tricks people into thinking it’s alive. This isn’t about hype. It’s about what works, what breaks, and how to stay safe while you trade.

Uniswap v2 on Arbitrum offers fast, low-cost crypto swaps with deep liquidity. Learn how it works, why it's better than Ethereum, and who should use it in 2025.

More