Crypto Trading on Arbitrum: How It Works and What You Need to Know

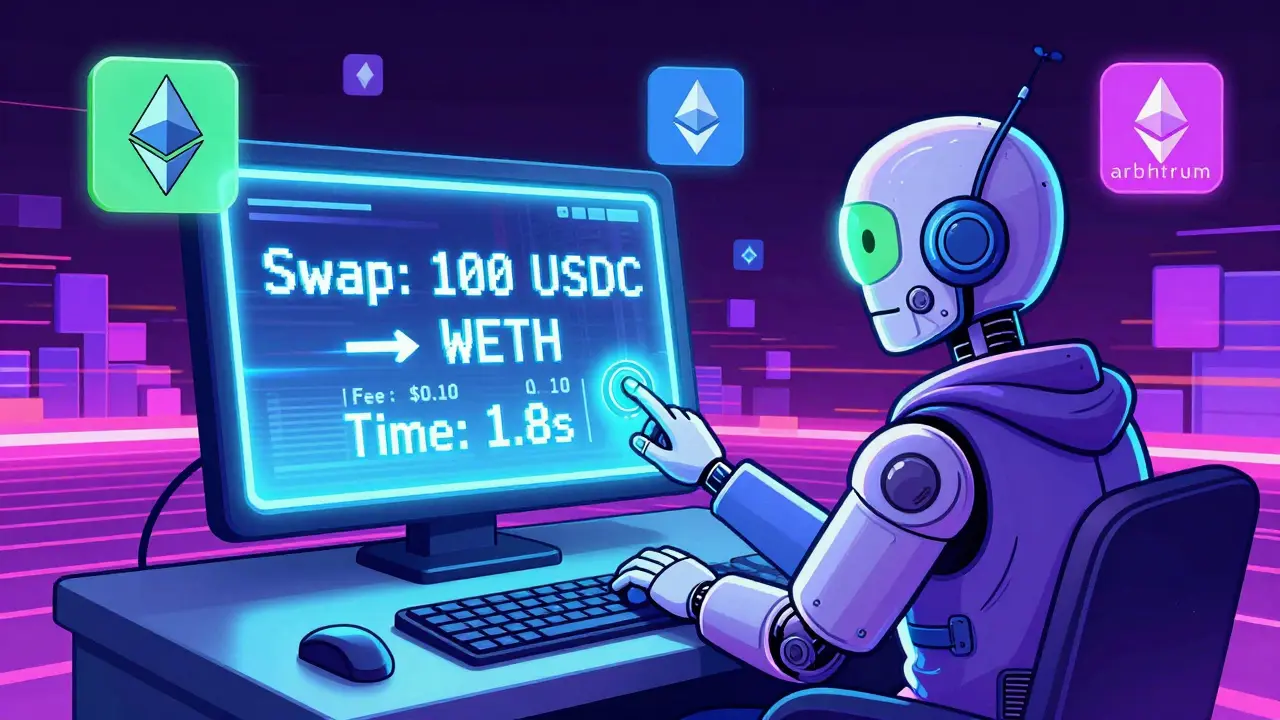

When you trade crypto on Arbitrum, a Layer 2 scaling solution built on Ethereum that lets you trade faster and cheaper. Also known as Arbitrum One, it’s not a separate blockchain—it’s a smarter way to use Ethereum without the high fees and slow speeds. Most traders use it because they’re tired of paying $50 in gas just to swap tokens on Ethereum. On Arbitrum, that same trade costs less than 10 cents—and finishes in under a second.

Arbitrum works by bundling hundreds of transactions off-chain, then posting one compressed proof back to Ethereum. This keeps the security of Ethereum while removing the congestion. It’s why DeFi trading, trading on decentralized finance platforms like Uniswap or GMX. Also known as on-chain trading, it exploded on Arbitrum. You’ll find most active DeFi apps now running here: lending protocols, perpetual futures, and even token swaps with near-zero slippage. The network doesn’t just handle volume—it handles complexity. Traders who use leveraged positions on GMX or stake on Arbitrum-based yield farms aren’t gambling on hype—they’re using a tool built for real trading.

But Arbitrum isn’t magic. It still runs on Ethereum’s base layer, so if Ethereum goes down, Arbitrum does too. And while fees are low, you still need ETH to pay for gas—even if it’s just $0.02 per trade. You also need to bridge your tokens from Ethereum to Arbitrum first. Many beginners get stuck here, sending tokens to the wrong network and losing them. That’s why most guides start with a bridge tutorial. And if you’re trading tokens like ARB or any new token listed only on Arbitrum, you’re already in a space where liquidity matters more than hype. The best trades here aren’t the ones with the biggest pumps—they’re the ones with the deepest order books and the most active users.

You’ll notice most posts here don’t talk about moonshots. They talk about what happens when things go wrong: frozen funds on exchanges that didn’t support Arbitrum properly, liquidations from leveraged trades that didn’t account for fee spikes, or airdrops that required you to interact with contracts on Arbitrum—but you were still on Ethereum. This collection doesn’t sell you a strategy. It shows you what actually works, what breaks, and who gets left behind when the network gets busy.

What you’ll find below isn’t a list of top coins to buy. It’s a record of real experiences: how traders avoided bank freezes by moving activity to Arbitrum, why some DeFi platforms failed on it, how liquidation engines behave differently here, and what happens when you forget to switch networks before trading. These aren’t theories. They’re stories from people who used Arbitrum—and lived to tell the tale.

Uniswap v2 on Arbitrum offers fast, low-cost crypto swaps with deep liquidity. Learn how it works, why it's better than Ethereum, and who should use it in 2025.

More