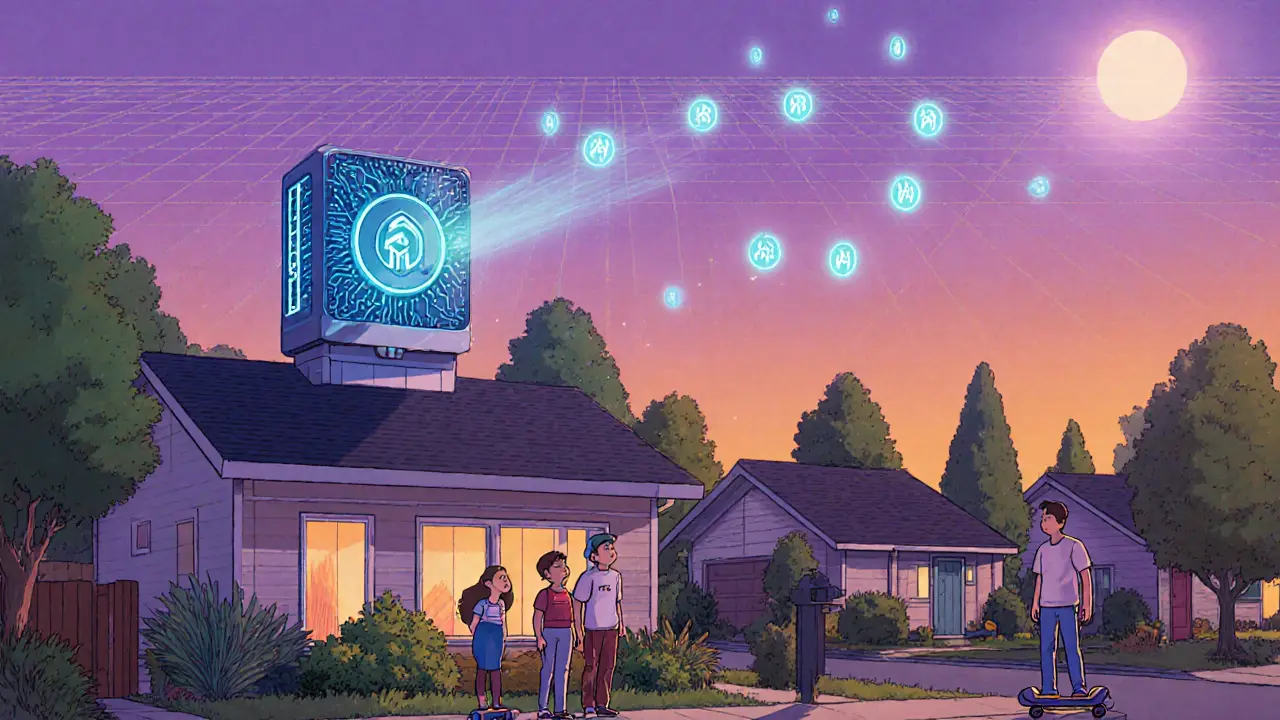

DePIN – Decentralized Physical Infrastructure Networks

When talking about DePIN, a framework that merges real‑world assets with blockchain governance to create open, shared infrastructure networks. Also known as Decentralized Physical Infrastructure, it lets anyone own, operate, or profit from things like wireless towers, storage facilities, or renewable energy stations, all coordinated by smart contracts.

One key piece of the puzzle is decentralized physical infrastructure, which refers to the actual hardware‑level assets—sensors, routers, solar panels—that are pooled together in a trust‑less pool. These assets are measured by on‑chain metrics such as uptime, coverage area, or data throughput. By turning physical performance into verifiable blockchain data, operators can earn token incentives that reward real‑world contribution instead of just speculative trading.

How Networks Stay Connected

Connecting dozens of independent nodes across the globe needs a reliable way to move value and data between blockchains. Blockchain bridges, whether trusted or trustless, act as the highways that let DePIN participants swap tokens, share proofs of coverage, and settle payments without a single central gatekeeper. Trustless bridges use multi‑sig or zk‑rollup designs to lock assets on one chain and mint equivalents on another, preserving security while cutting fees.

But bridges alone don’t give you insight into how the network is really performing. That’s where on‑chain data mining comes in. By extracting transaction logs, event emissions, and token flow records, analysts can build dashboards that show hotspot coverage, node reliability, and revenue distribution. This data feeds back into the token incentive model, creating a feedback loop: better performance → higher rewards → more hardware investment.

Another crucial component is the governance layer that decides how rewards are split, how new assets are added, and how disputes are resolved. Smart‑contract based voting, often weighted by stake or proof‑of‑service, lets token holders shape network policy without a boardroom. The result is a self‑optimizing system that can adapt to regulatory changes, market demand, or emerging technologies like edge computing.

All these pieces—hardware assets, token incentives, cross‑chain bridges, and data mining—combine to form a living ecosystem. They enable projects to launch free‑air‑drop campaigns, run airdrop‑style promotions, or experiment with novel tokenomics. That’s why you’ll see articles on airdrops, exchange reviews, and regulatory updates all showing up under the DePIN tag: they each touch on a facet of how decentralized infrastructure is built, funded, or regulated.

Below you’ll find a curated set of posts that dive deeper into each of these areas, from practical guides on claiming airdrops to detailed reviews of crypto exchanges that support DePIN tokens. Use them to sharpen your strategy, spot new opportunities, and stay ahead of the fast‑moving world of decentralized physical infrastructure.

Discover what DePIN means in crypto, how it tokenizes real‑world infrastructure, and why it matters for investors and everyday users alike.

More