Uniswap Fees: What You Really Pay to Trade on the Leading DEX

When you swap tokens on Uniswap, a decentralized exchange built on Ethereum that lets you trade crypto without a middleman. It's one of the most used platforms in DeFi, but what you see as a "0% fee" isn't the full story. The real cost comes from gas fees, the price you pay to get your transaction processed on the Ethereum network, which can spike during busy times. You also face slippage, the difference between the price you expect and the price you actually get when trading large amounts, and sometimes hidden fees from token liquidity pools.

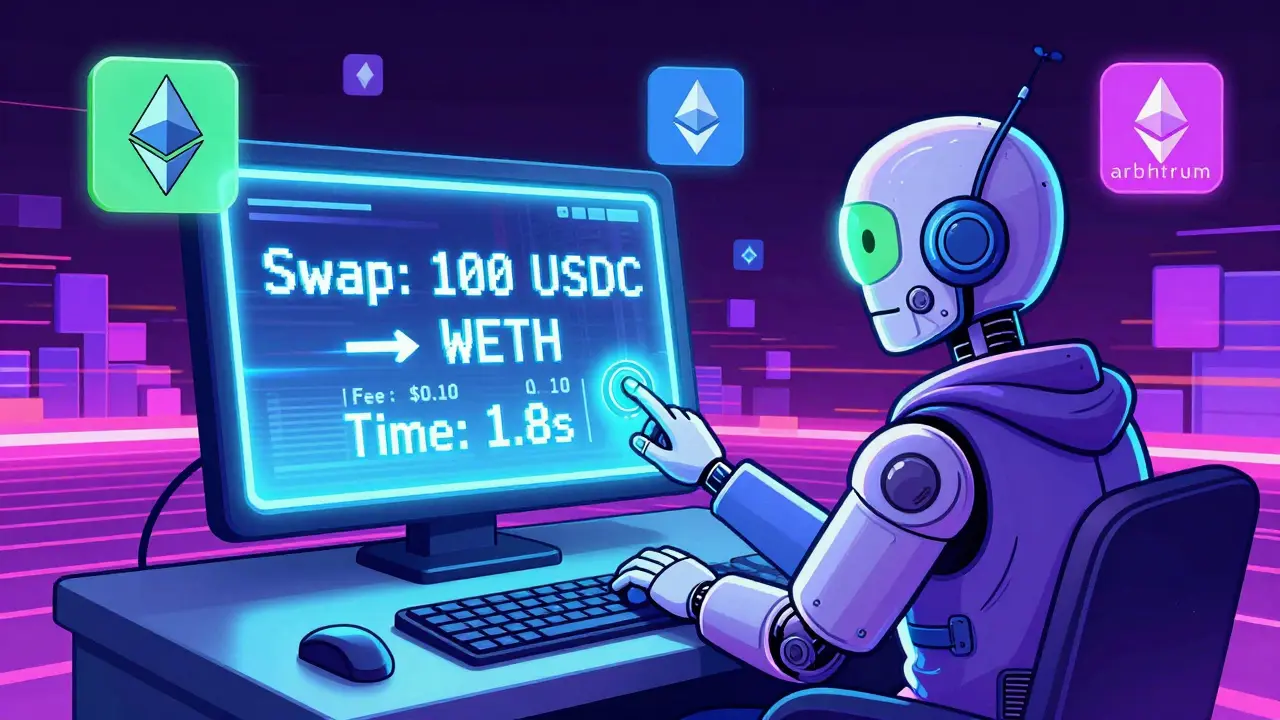

Uniswap V3 changed everything by letting liquidity providers set custom price ranges. That means traders get tighter spreads—but only if the market stays within those ranges. If it moves outside, your trade gets executed at a worse price, and you pay more in effective cost. On Ethereum, gas fees can range from $5 to over $50 depending on network congestion. On Layer 2s like Arbitrum or Polygon, you might pay under $0.10, but not all tokens are available there. The fee structure isn’t just about percentages—it’s about timing, network choice, and how big your trade is. A $100 swap might cost $2 in gas. A $10,000 swap could lose you $300 in slippage if the pool is shallow.

Most people think Uniswap is cheap because there’s no platform fee. But if you’re swapping meme coins with low liquidity, you’re basically paying a premium to the liquidity providers who take the risk. And if you’re using a wallet that doesn’t show you the real-time gas cost before you confirm, you’re flying blind. The posts below break down real cases: how someone paid $47 in gas to swap $200 worth of ETH, why a $500 trade on Uniswap V3 cost twice as much as expected, and how to use tools like DeFi Saver or 1inch to route trades through cheaper paths. You’ll also find guides on how to check pool depth before trading, how to estimate slippage, and which chains actually save you money when trading consistently. This isn’t theory—it’s what’s happening right now in wallets across the world.

Uniswap v2 on Arbitrum offers fast, low-cost crypto swaps with deep liquidity. Learn how it works, why it's better than Ethereum, and who should use it in 2025.

More