Uniswap v2 Arbitrum: What It Is, How It Works, and Why It Matters

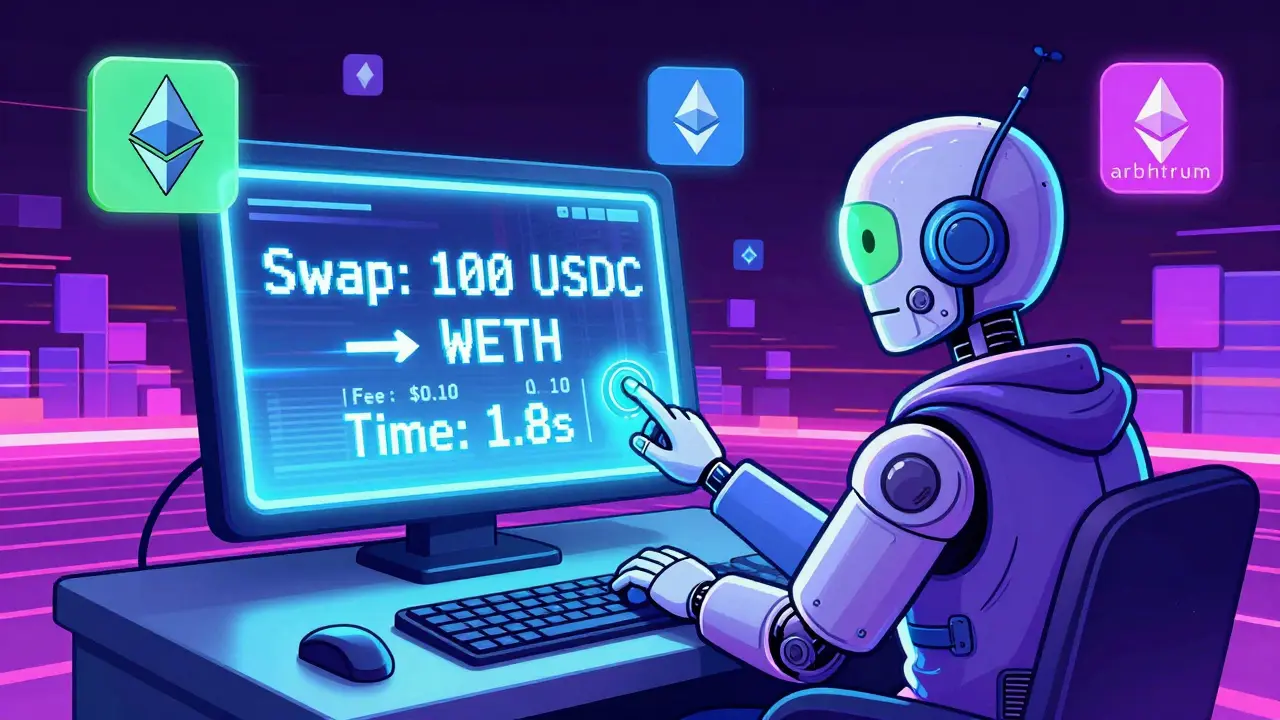

When you trade crypto on Uniswap v2 Arbitrum, a version of the popular decentralized exchange running on the Arbitrum layer-2 network. Also known as Uniswap on Arbitrum, it lets you swap tokens without a middleman—while paying a fraction of the gas fees you’d pay on Ethereum’s main chain. This isn’t just a faster version of Uniswap. It’s a smarter one. Built to solve Ethereum’s congestion and high costs, Uniswap v2 Arbitrum combines the open, trustless trading of Uniswap with the speed and affordability of Arbitrum’s rollup technology.

Arbitrum itself is a layer-2 scaling solution, a system that processes transactions off the main Ethereum blockchain but still secures them using Ethereum’s security. Also known as rollup, it batches hundreds of trades into one single transaction on Ethereum, slashing costs and speeding things up. That’s why trades on Uniswap v2 Arbitrum often cost less than $0.10, even during busy times. Meanwhile, DeFi, the ecosystem of open financial apps built on blockchain. Also known as decentralized finance, it relies on protocols like this to function without banks or brokers. Without Arbitrum, many DeFi users would be priced out of simple swaps. With it, everyday traders can move in and out of tokens like USDC, WETH, or new tokens from small projects without worrying about $50 gas fees.

Uniswap v2 on Arbitrum doesn’t have all the bells and whistles of Uniswap v3—no concentrated liquidity or price ranges—but it’s simpler, more stable, and still the go-to for most users. You’ll find the same familiar interface, the same token listings, and the same open access. But now, you can actually afford to use it. That’s why so many DeFi apps, from lending platforms to yield aggregators, have moved their liquidity here. It’s not about hype. It’s about utility.

What you’ll find in the posts below isn’t just theory. These are real stories: how people lost money because they didn’t understand how liquidations work on layer-2, why some tokens vanished after being listed here, how gasless transactions became possible with account abstraction, and why exchanges like DeepBook Protocol are now building on Arbitrum too. You’ll see how regulatory pressure affects trading, how airdrops get snatched up by bots, and why some projects thrive here while others die quietly. This isn’t a beginner’s guide to Uniswap. It’s a practical look at what happens when real people use it under real conditions—on a network that makes it possible to trade without going broke.

Uniswap v2 on Arbitrum offers fast, low-cost crypto swaps with deep liquidity. Learn how it works, why it's better than Ethereum, and who should use it in 2025.

More