Cryptocurrency: Practical Guides, Reviews, and Alerts

When exploring Cryptocurrency, digital assets secured by cryptography that enable peer‑to‑peer value transfer. Also known as crypto, it powers a fast‑growing ecosystem of services and innovations.

The crypto exchange, an online platform where users trade digital assets is the gateway for most traders. A reliable exchange demands strong security, low fees, and solid liquidity. Meanwhile, an airdrop, a free distribution of tokens to qualifying users offers a quick way to test new projects and earn rewards without investing capital. Blockchain regulation, government policies that shape how crypto services operate influences everything from exchange licensing to user privacy. Understanding these rules helps you stay compliant and avoid costly mistakes.

For deeper analysis, on‑chain analytics, the practice of extracting insights directly from blockchain data reveals market trends, transaction patterns, and potential security risks. Combining exchange reviews, airdrop guides, and regulatory updates gives you a 360° view of the crypto landscape. Below you’ll find curated articles that break down each topic with step‑by‑step instructions, real‑world examples, and actionable tips you can apply right away.

Governance attacks exploit token voting systems in DeFi, letting attackers buy control with flash loans to steal millions. Low participation and concentrated power make these attacks easy-and common.

MoreVietnamese traders access crypto exchanges through global platforms like Binance and Bybit, using VND deposits via e-wallets and bank transfers despite unclear regulations. Learn how they navigate KYC, taxes, and risks in 2026.

MoreStarting in 2026, 67 countries will automatically share your crypto transaction data with your home tax authority. Here's how CARF works, who it affects, and what you need to do now to stay compliant.

MoreIn 2026, the best crypto exchange depends on your goals. Coinbase is easiest for beginners, Kraken and Binance offer low fees for traders, and Gemini leads in security. Avoid platforms that lock your crypto. Choose based on control, safety, and features-not just volume.

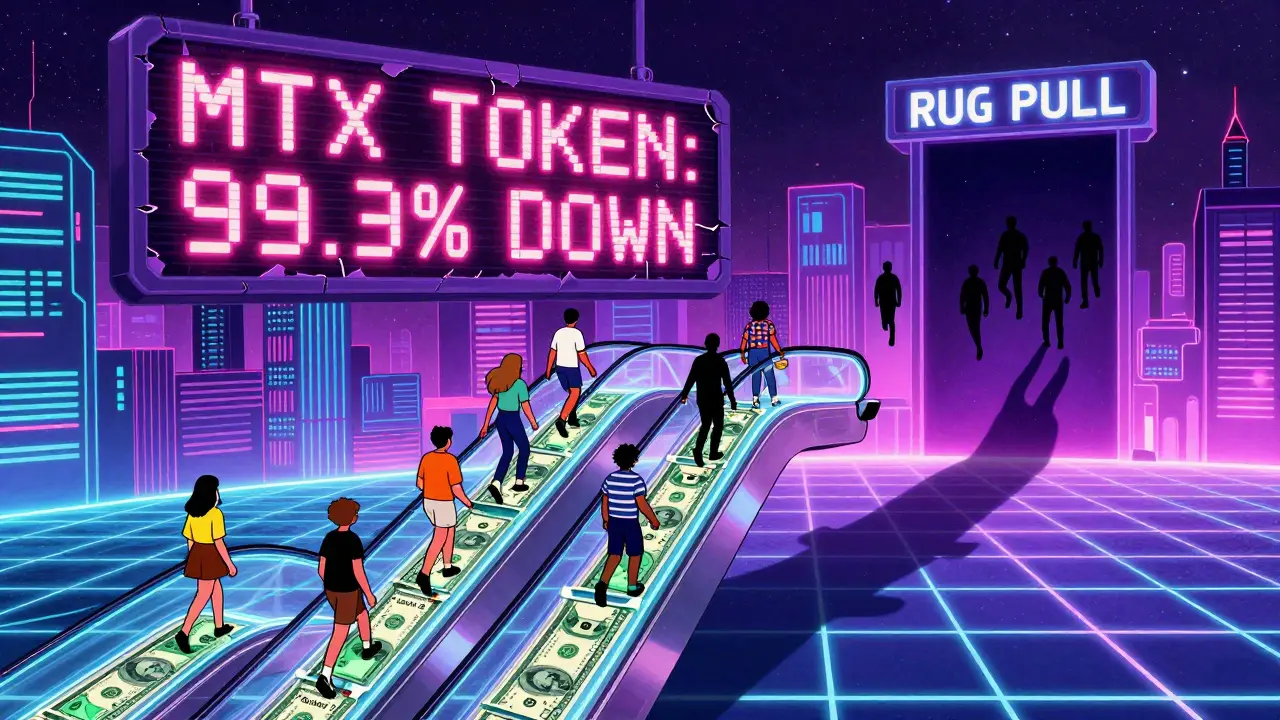

MoreMatrix Chain (MTC) was a failed crypto project built as a pyramid scheme on Binance Smart Chain. It promised high returns through a matrix system but vanished in 2025, leaving users with worthless tokens and no recourse.

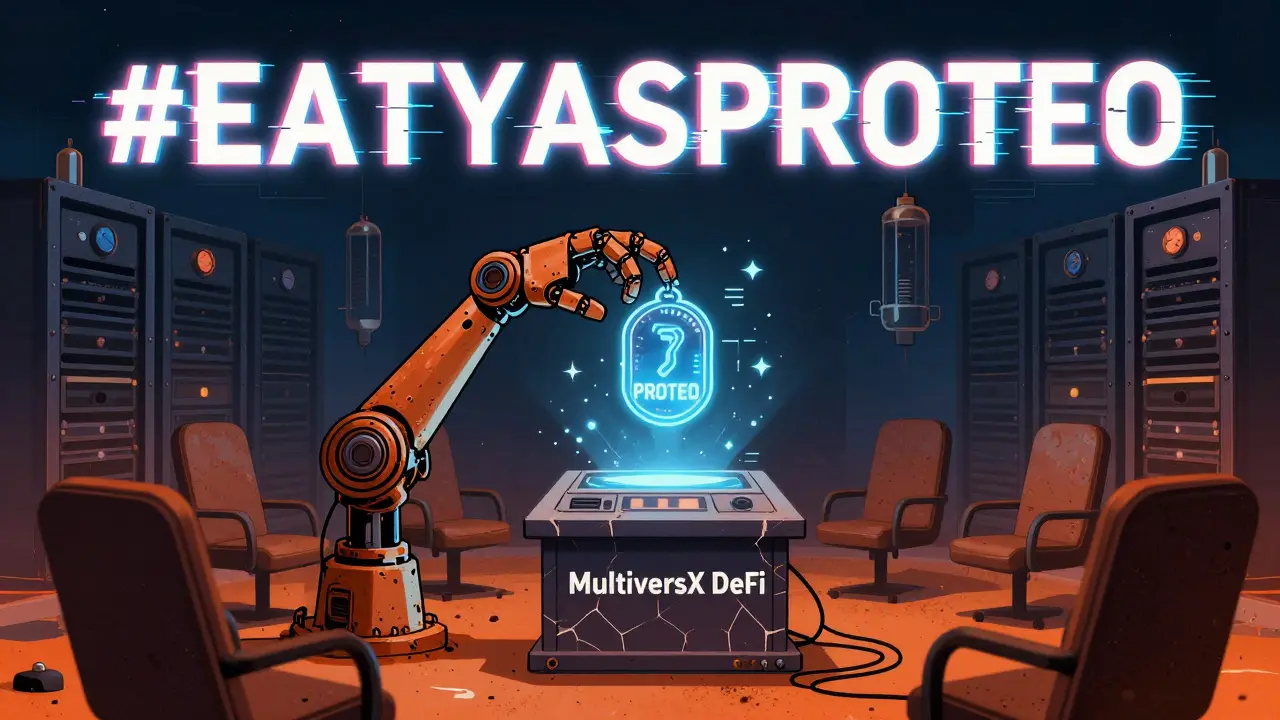

MoreProteo DeFi (PROTEO) is a nearly dead DeFi token on the MultiversX blockchain with a 99% price drop, zero community, and no liquidity. Learn why it failed and what to do instead.

MoreThe EU is banning Monero and Zcash by July 2027 under new anti-money laundering rules. Here’s what it means for holders, exchanges, and the future of privacy in crypto.

MoreNews drives cryptocurrency prices more than ever. Learn how sentiment analysis tools work, which platforms deliver real value, and how to avoid common traps that cost traders millions.

MoreBlock headers and block bodies work together to secure and store data in blockchain networks. The header links blocks cryptographically; the body holds transactions. Learn how they differ, why they matter, and how Bitcoin and Ethereum use them differently.

MoreThe RWA tokenization market hit $34.86 billion in October 2025, driven by institutional adoption of tokenized Treasuries, private credit, and gold. Growth is accelerating as regulation catches up and fractional ownership transforms access to traditional assets.

MoreNLexch offers some of the lowest crypto trading fees in 2026, but lacks transparency, security details, and regulatory compliance. Learn if it's worth the risk for active traders.

MoreTeam building activities improve blockchain development by building trust, reducing miscommunication, and speeding up collaboration. Learn which activities work best for dev teams and how to measure their real impact.

More